Where Does Prepaid Rent Go On A Balance Sheet - Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. What it does simply trades one asset. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using.

Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company.

What it does simply trades one asset. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company.

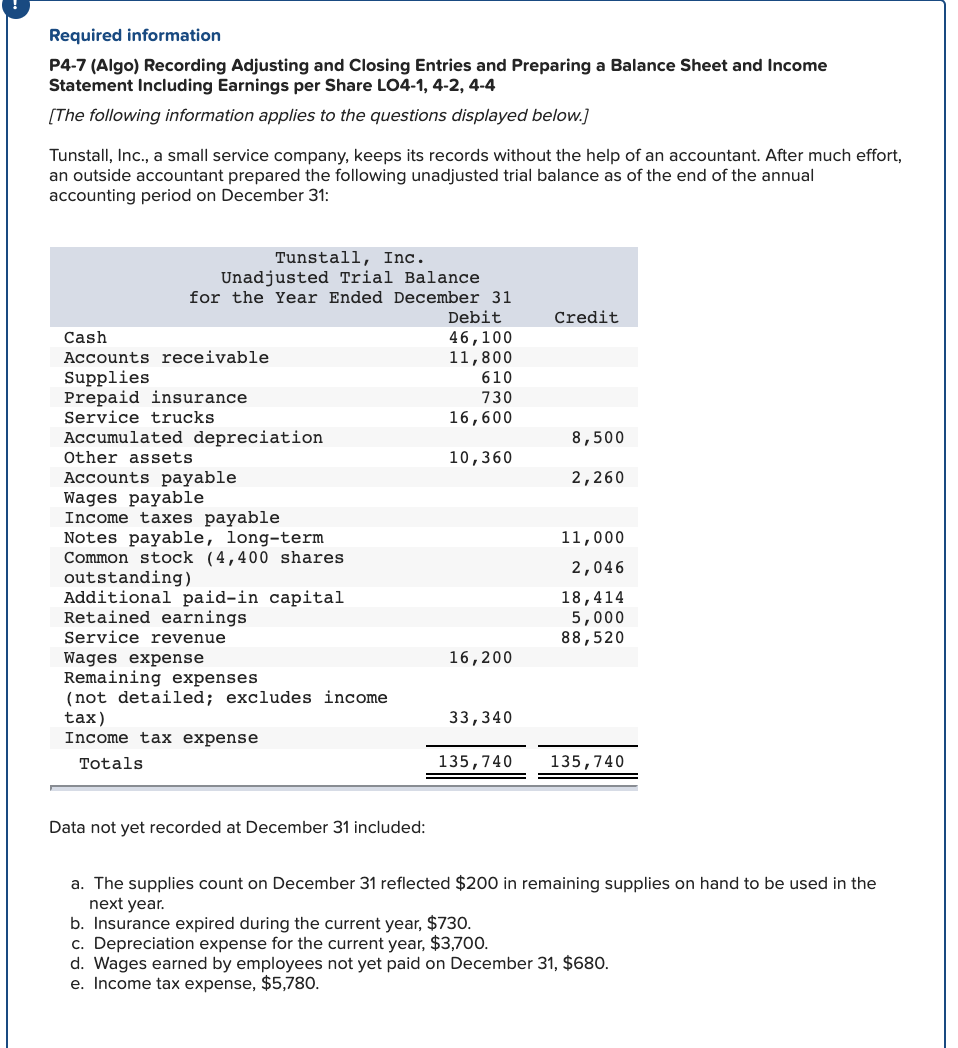

Solved Please help complete balance sheet. Prepaid insurance

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. What it does simply trades one asset. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Accurate accounting for prepaid assets begins with recognizing these payments.

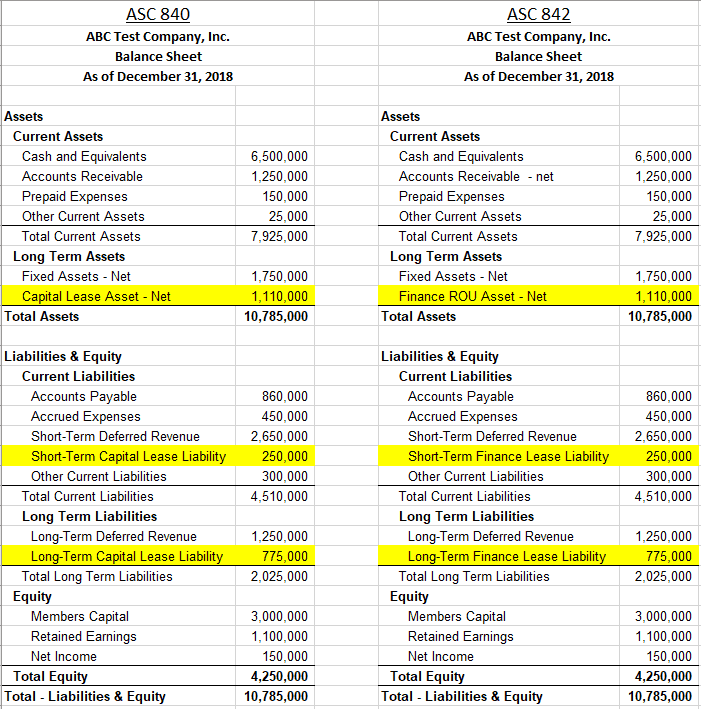

ASC 842 Balance Sheet Guide with Examples Visual Lease

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the.

Why Prepaid Expenses Appear in the Current Asset Section of the Balance

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company.

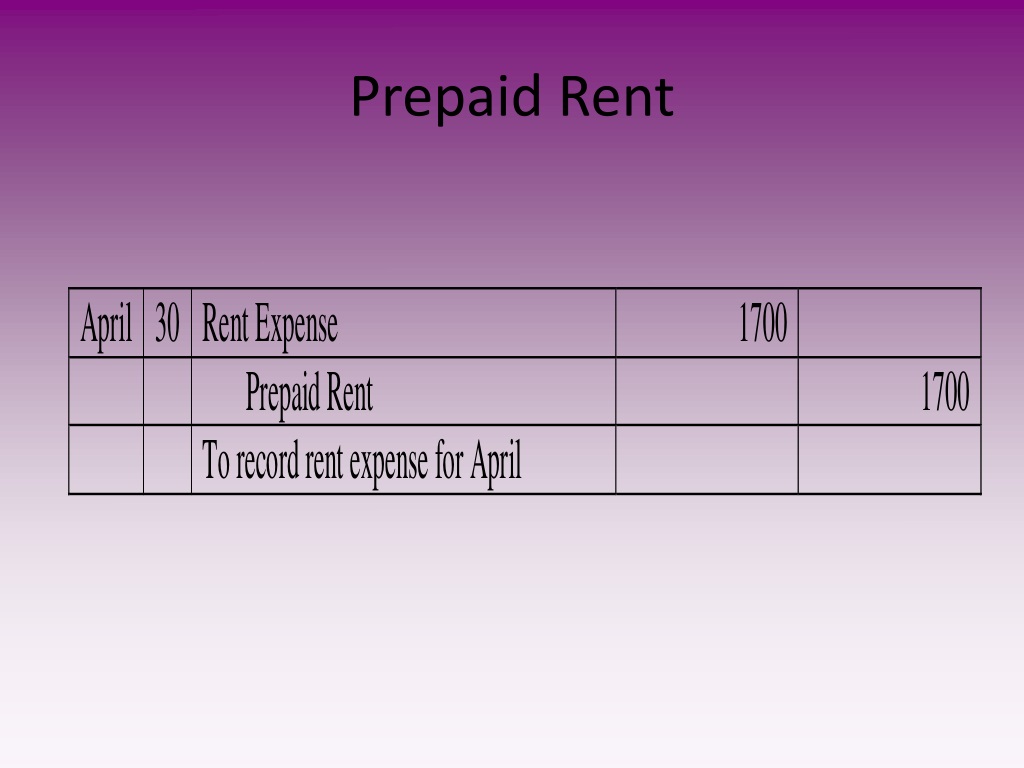

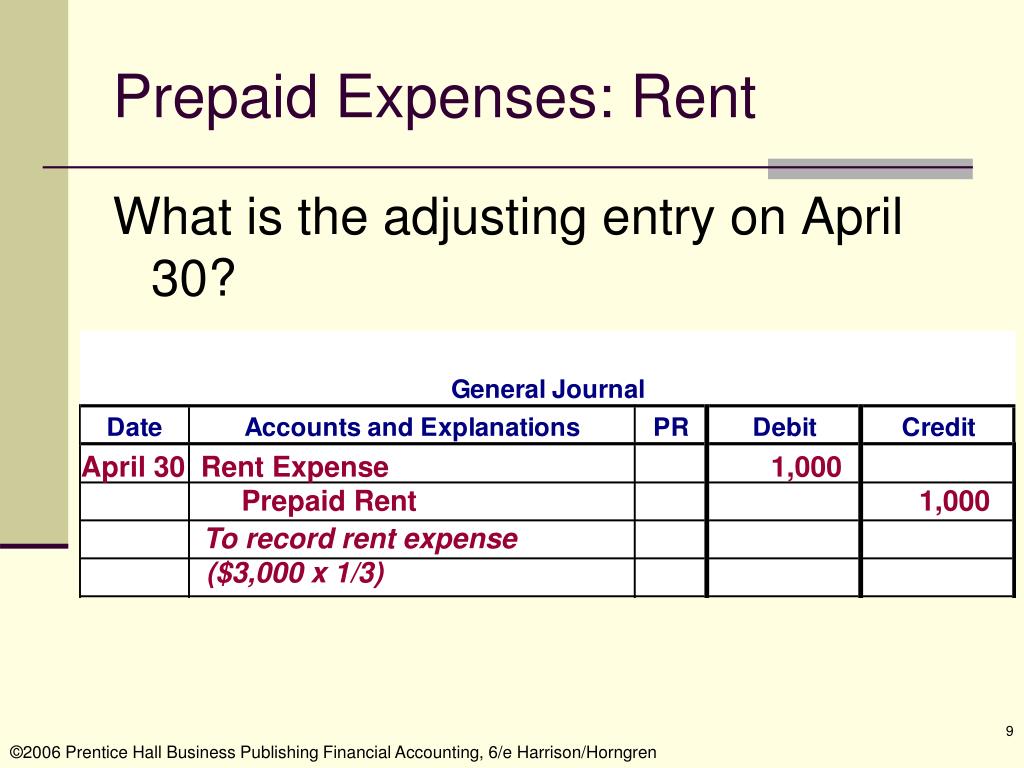

PPT Understanding Adjustments and Prepaid Expenses in Accounting

What it does simply trades one asset. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Likewise, as an advance payment, prepaid rent doesn’t affect the.

What Is The Basic Accounting Equation Explain With Suitable Example

What it does simply trades one asset. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a.

PPT Accrual Accounting and the Financial Statements Chapter 3

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. What it does simply trades one asset. Prepaid rent, often classified as a current asset on the.

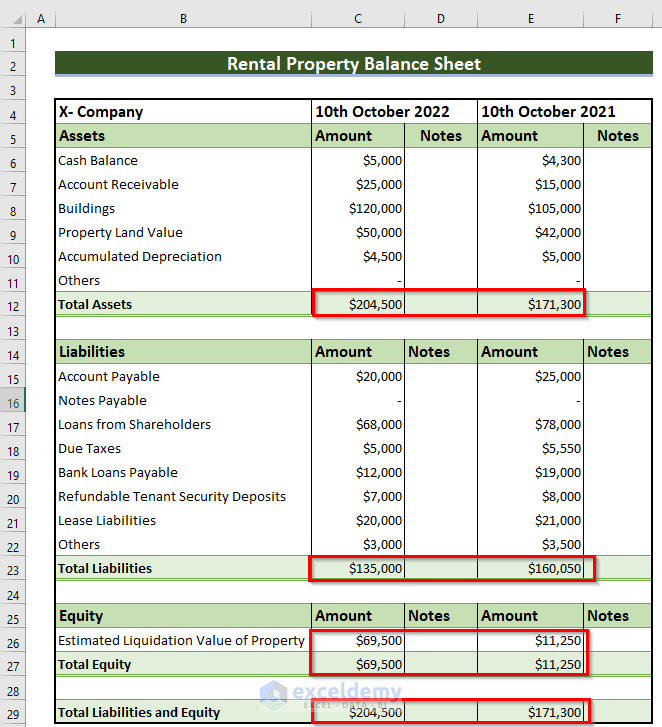

Rental Property Balance Sheet in Excel 2 Methods (Free Template)

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a.

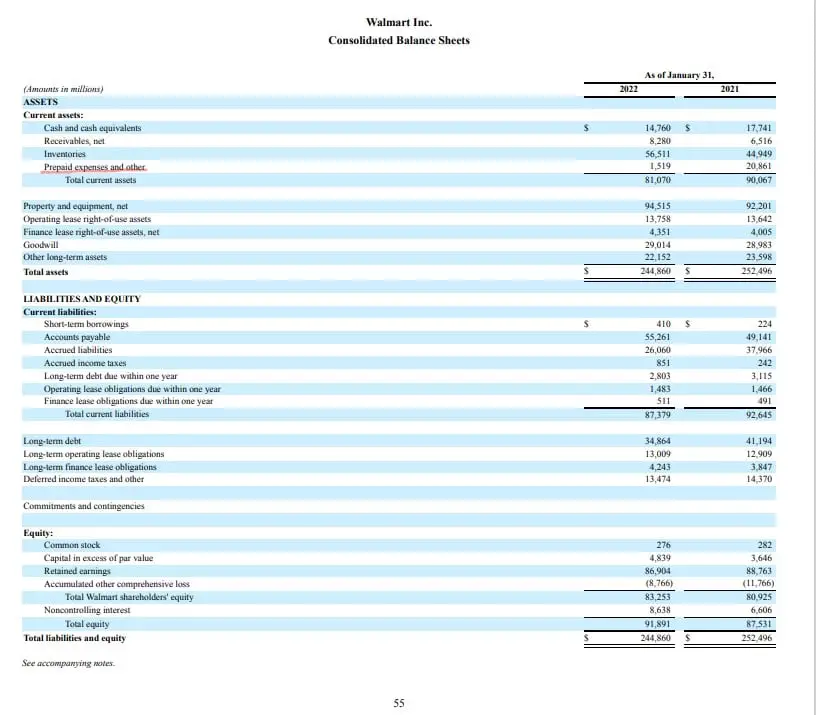

Prepaid Expenses on Balance Sheet Quant RL

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What.

bucketsery Blog

What it does simply trades one asset. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Likewise, as an advance payment, prepaid rent doesn’t affect the.

Prepaid Rent, Often Classified As A Current Asset On The Balance Sheet, Represents A Future Economic Benefit For A Company.

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Likewise, as an advance payment, prepaid rent doesn’t affect the total assets on the balance sheet. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. What it does simply trades one asset.