Where Does Deferred Revenue Go On A Balance Sheet - Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or.

Deferred Revenue Debit or Credit and its Flow Through the Financials

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue is.

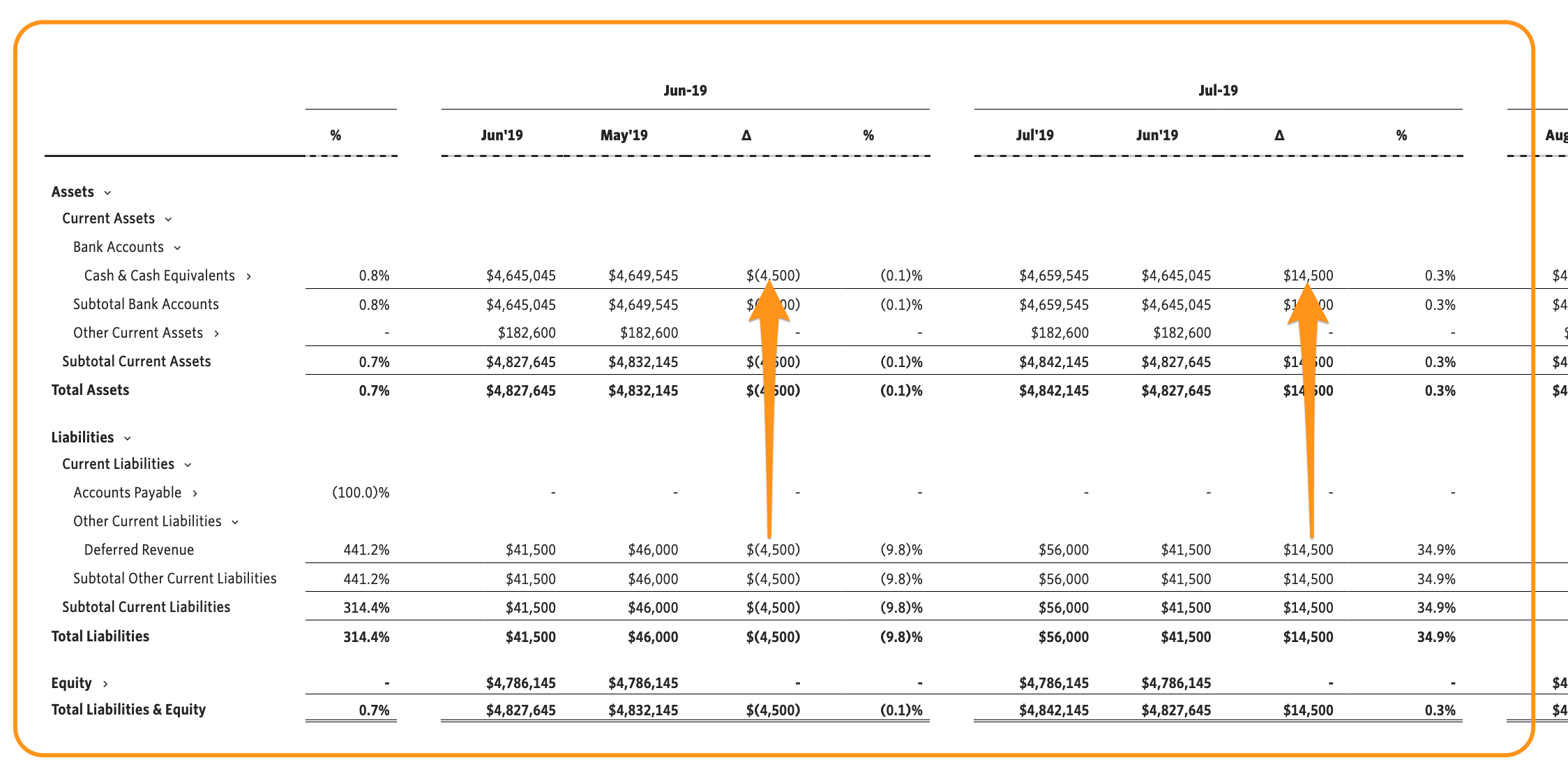

Simple Deferred Revenue with Jirav Pro

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver.

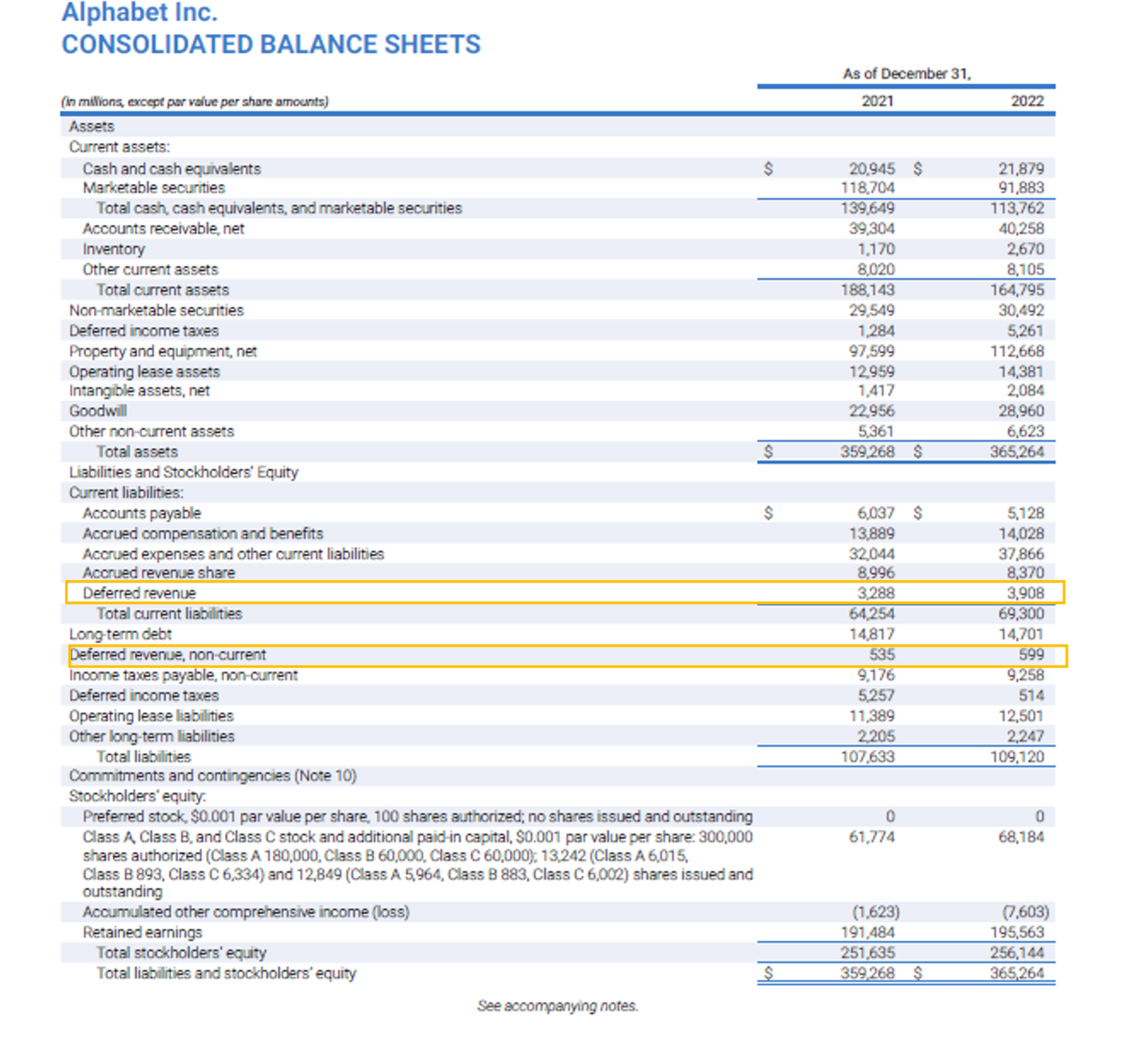

Deferred Revenue You can have it but not yet earned it skillfine

Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is.

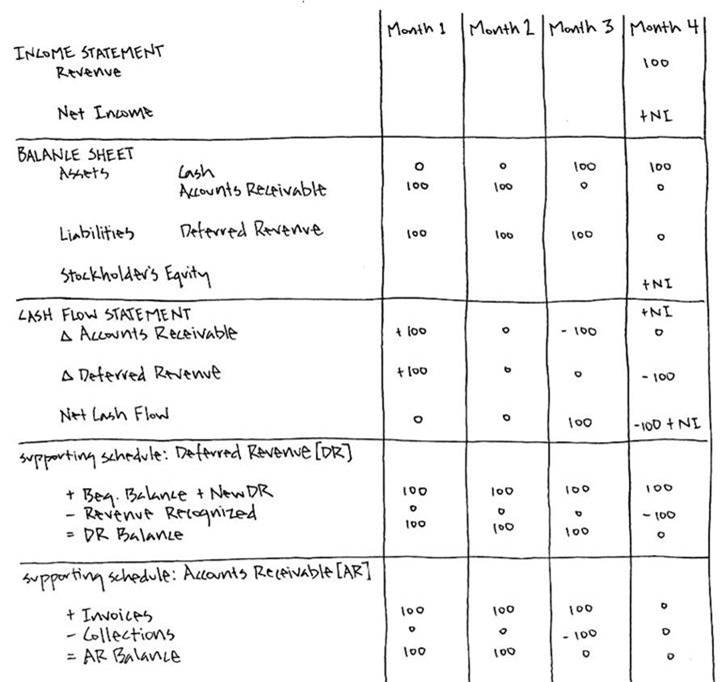

Deferred Revenue A Simple Model

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is.

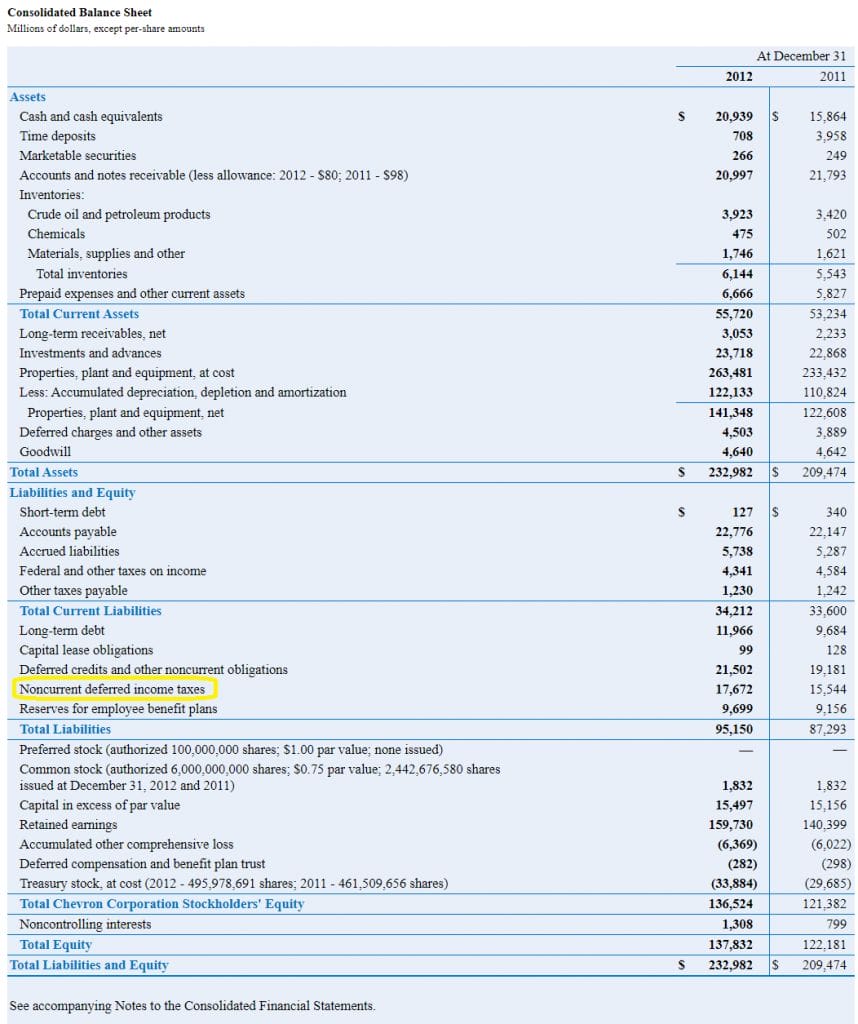

Deferred Tax Liabilities Explained (with RealLife Example in a

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or..

Deferred Revenue Accounting, Definition, Example

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue.

What Is Deferred Revenue? Complete Guide Pareto Labs

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or..

What is Deferred Revenue? The Ultimate Guide (2022)

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver.

Deferred Revenue AwesomeFinTech Blog

Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver.

What Is Unearned Revenue? QuickBooks Global

Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears as a liability on the balance sheet because it represents an obligation to deliver goods or. Deferred revenue is.

Deferred Revenue Appears As A Liability On The Balance Sheet Because It Represents An Obligation To Deliver Goods Or.

Deferred revenue is recorded as a liability on the balance sheet, since the company has an unmet obligation to the customer until. Deferred revenue is recorded on the balance sheet as a liability because it represents a future obligation to deliver products or. Deferred revenue appears on the balance sheet as a liability, reflecting obligations to deliver goods or services.