What Is The Difference Between Fiscal And Calendar Year - To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: Should your accounting period be aligned with the regular calendar year, or should you define your own. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Fiscal year vs calendar year:

Fiscal year vs calendar year: Should your accounting period be aligned with the regular calendar year, or should you define your own. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time:

The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Should your accounting period be aligned with the regular calendar year, or should you define your own. Fiscal year vs calendar year: To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time:

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

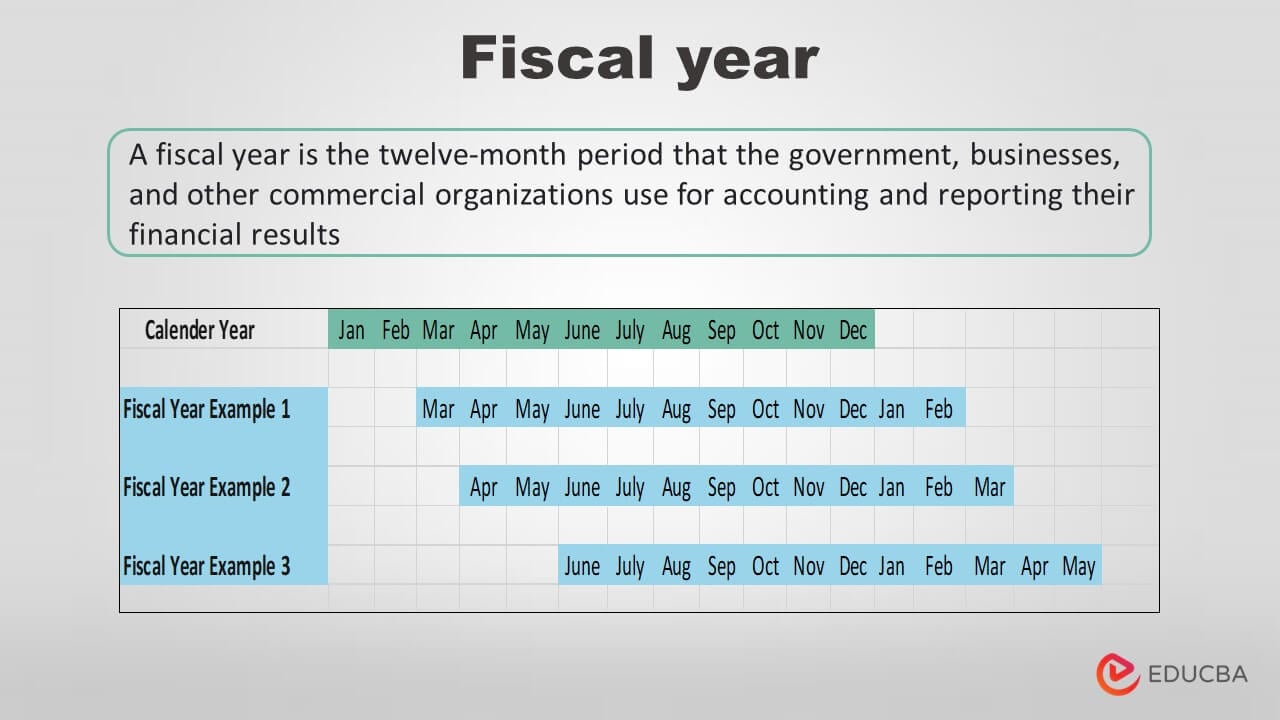

The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Should your accounting period be aligned with the regular calendar year, or should you define your own. To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: Fiscal year.

Fiscal Year vs Calendar Year Top 8 Differences You Must Know!

Fiscal year vs calendar year: To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Should your accounting period be aligned with the regular calendar year, or should you.

Fiscal Year End Vs Calendar Year End Megan May

Should your accounting period be aligned with the regular calendar year, or should you define your own. Fiscal year vs calendar year: To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end.

Difference Of Fiscal Year And Calendar Year Alisa Belicia

Should your accounting period be aligned with the regular calendar year, or should you define your own. To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Fiscal year.

Difference Between Fiscal And Calendar Year

Fiscal year vs calendar year: Should your accounting period be aligned with the regular calendar year, or should you define your own. To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end.

What is a Fiscal year? Benefits, IRS Guidelines, & Examples

To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Fiscal year vs calendar year: Should your accounting period be aligned with the regular calendar year, or should you.

What is the difference between Calendar and Fiscal Year? YouTube

The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: Should your accounting period be aligned with the regular calendar year, or should you define your own. Fiscal year.

What Is The Difference Between Fiscal Year And Calendar Year Fae Mikaela

The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: Should your accounting period be aligned with the regular calendar year, or should you define your own. Fiscal year.

What is the Difference Between Fiscal Year and Calendar Year

To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: Should your accounting period be aligned with the regular calendar year, or should you define your own. The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Fiscal year.

Fiscal Year vs Calendar Year Top Differences You Must Know! YouTube

The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the. Should your accounting period be aligned with the regular calendar year, or should you define your own. Fiscal year vs calendar year: To understand government budgeting, you need to distinguish between two fundamental ways of.

Should Your Accounting Period Be Aligned With The Regular Calendar Year, Or Should You Define Your Own.

Fiscal year vs calendar year: To understand government budgeting, you need to distinguish between two fundamental ways of organizing financial time: The critical difference between a fiscal year and a calendar year is that the former can start on any day and end precisely on the.