What Is Retained Earnings On Balance Sheet - Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

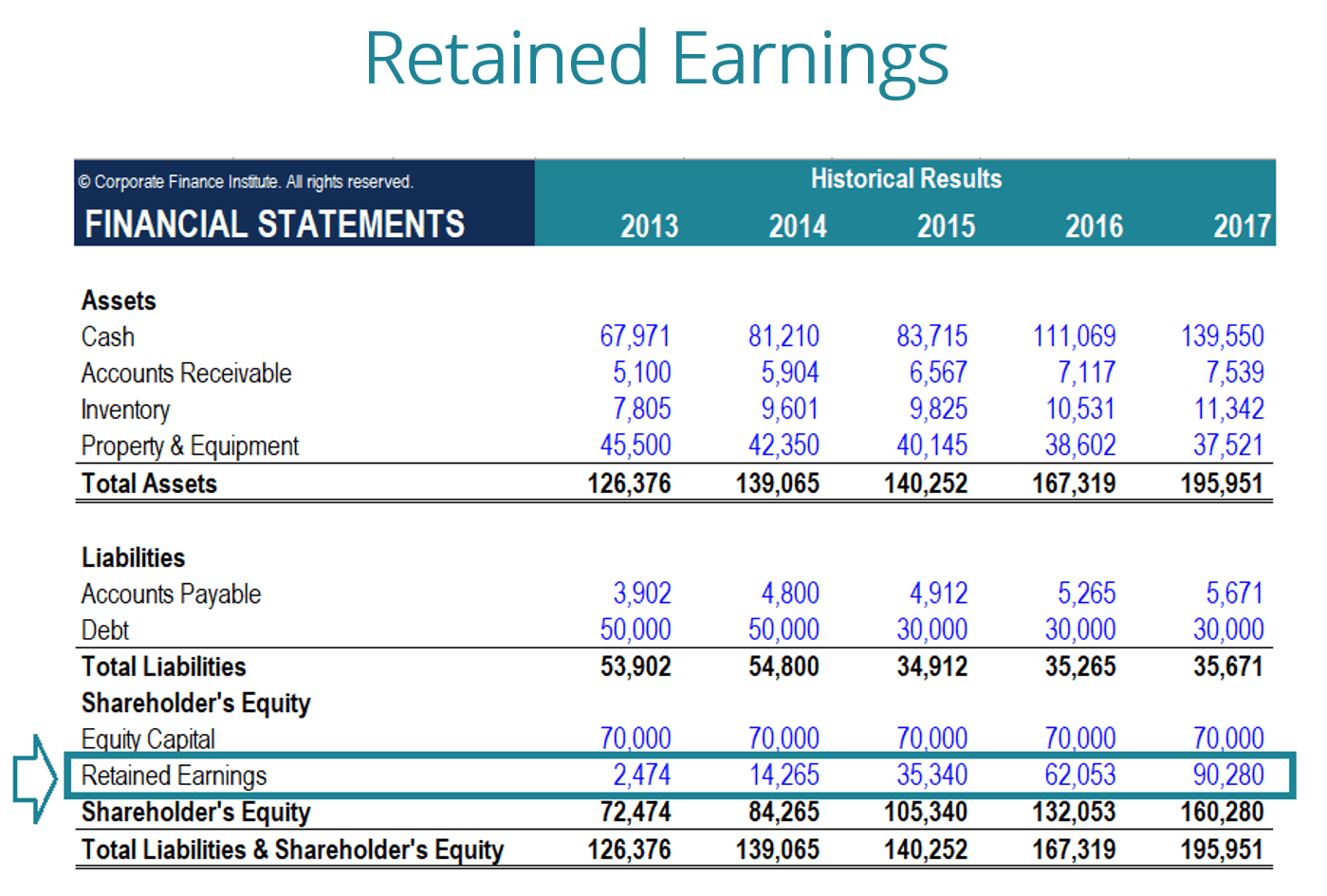

What are Retained Earnings? Guide, Formula, and Examples

Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

Retained Earnings What Are They, and How Do You Calculate Them?

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

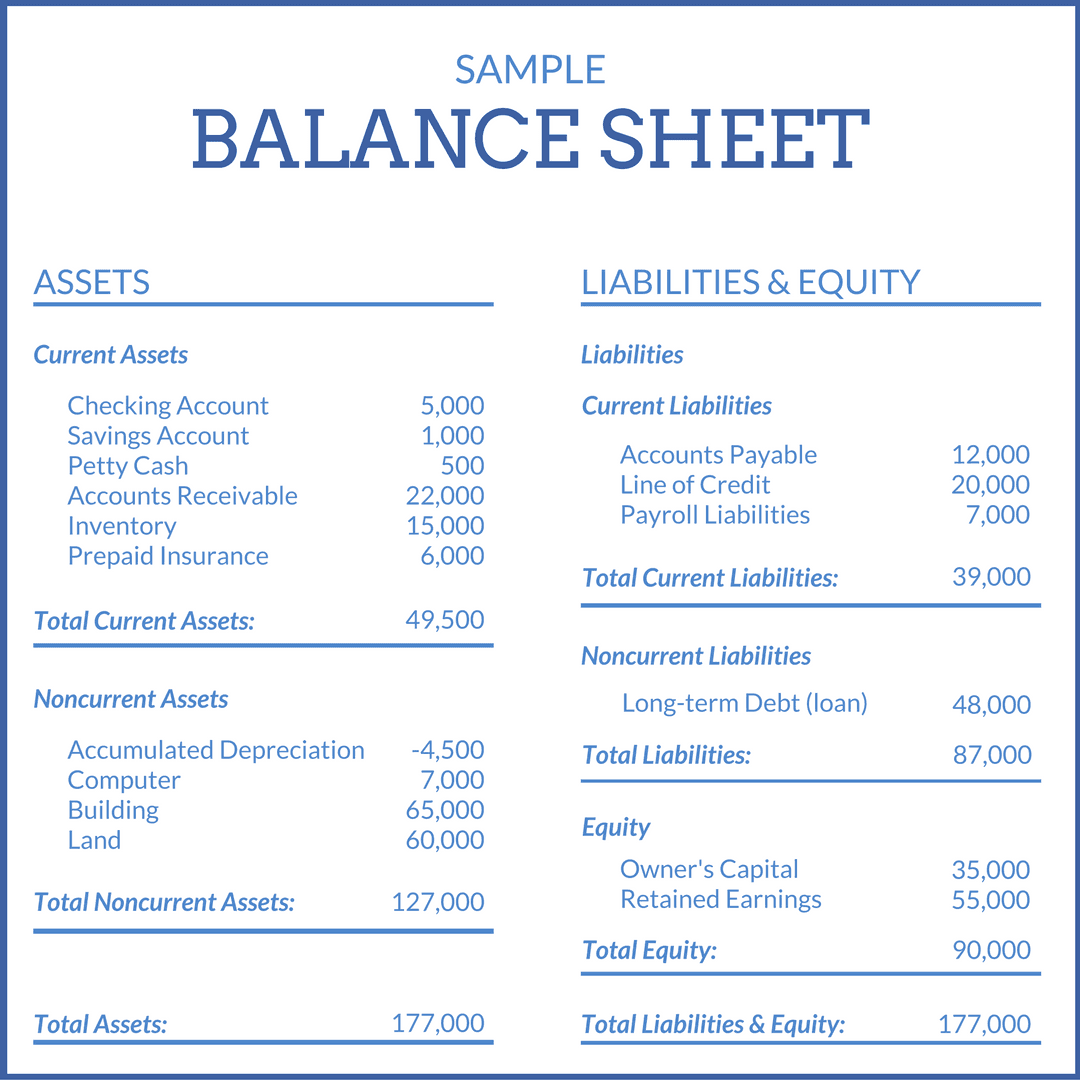

How to Find Retained Earnings on Your Balance Sheet A Quick and Easy

Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

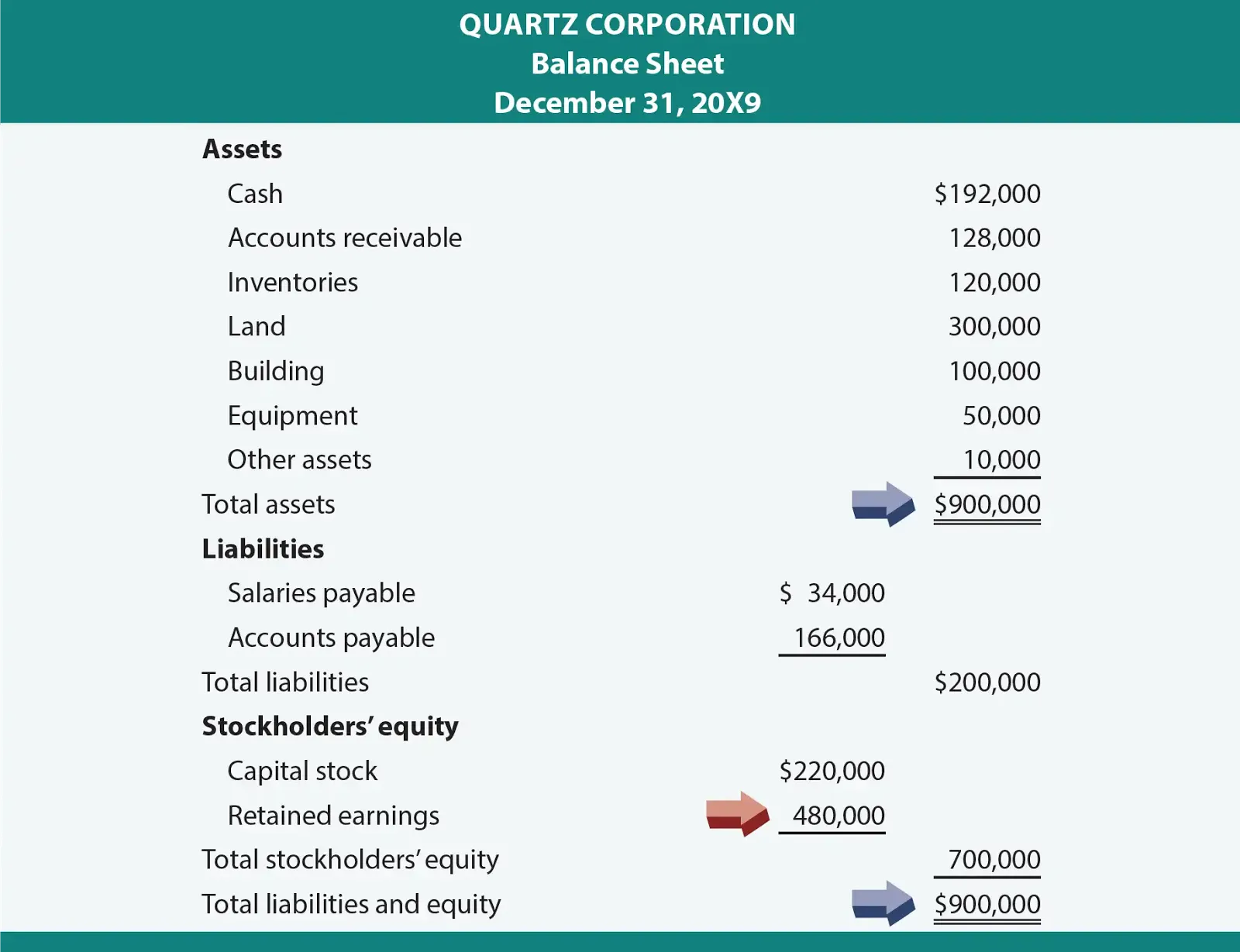

Retained Earnings Definition, Formula, and Example

Retained earnings are the profits of a business entity that have not been disbursed to the shareholders. The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.

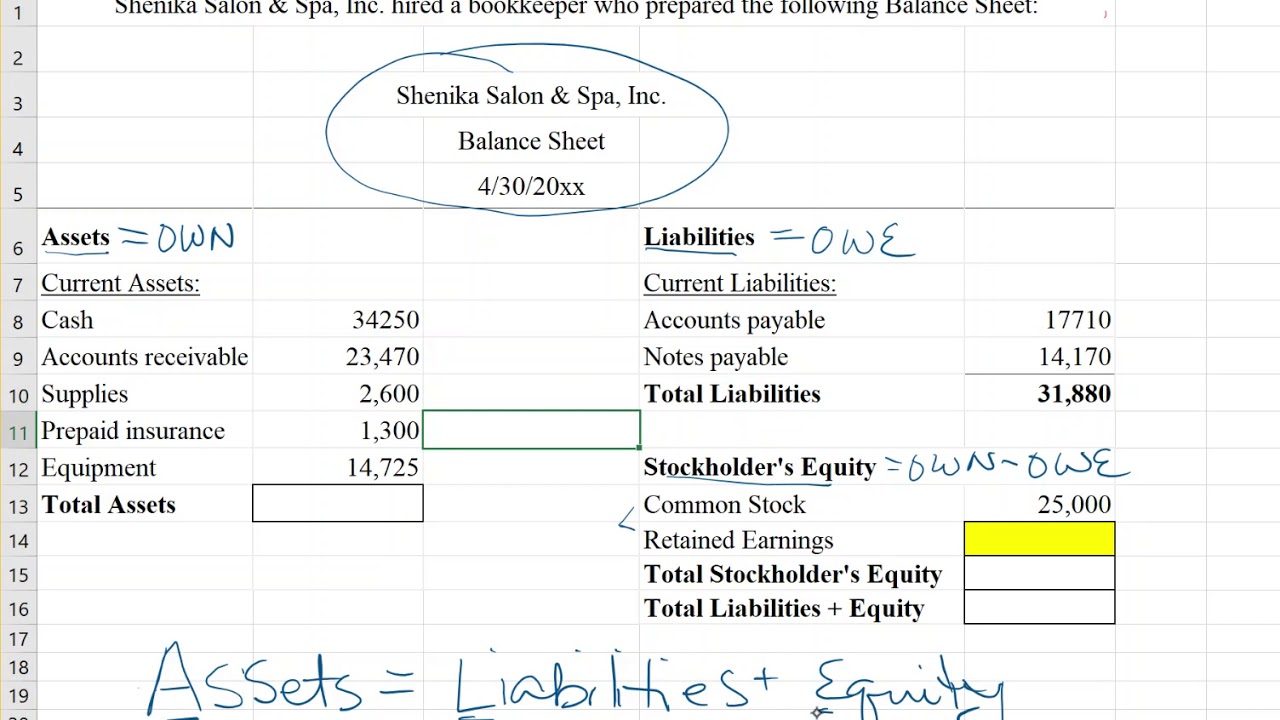

Complete a Balance Sheet by solving for Retained Earnings YouTube

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

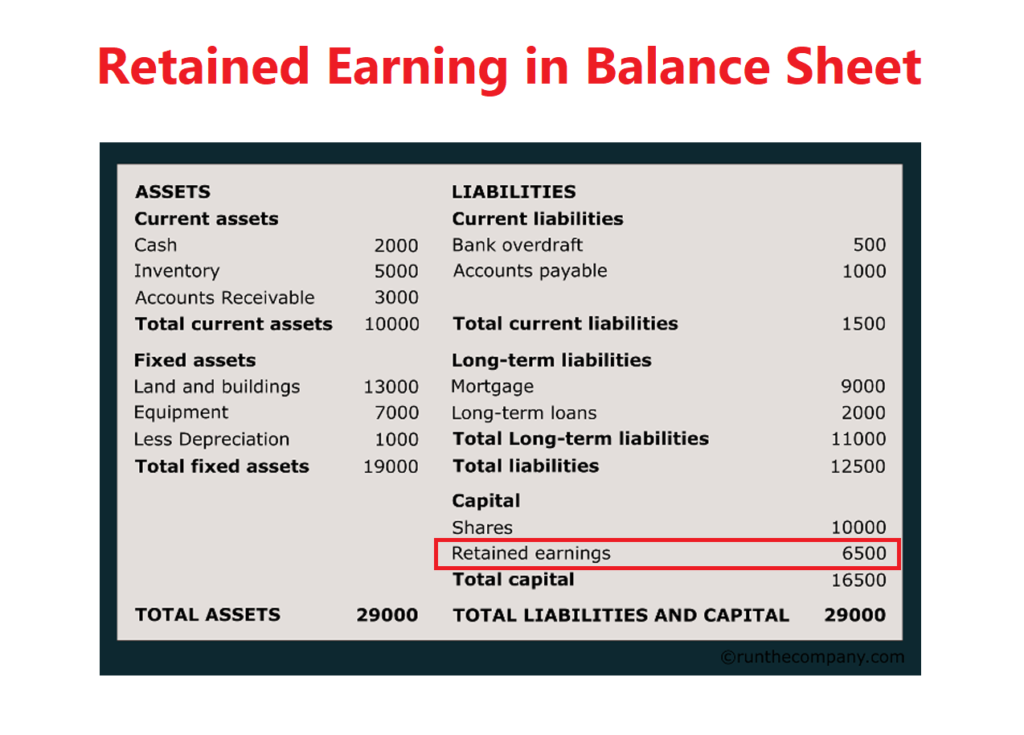

Looking Good Retained Earnings Formula In Balance Sheet Difference

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

How Are Earnings Calculated

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

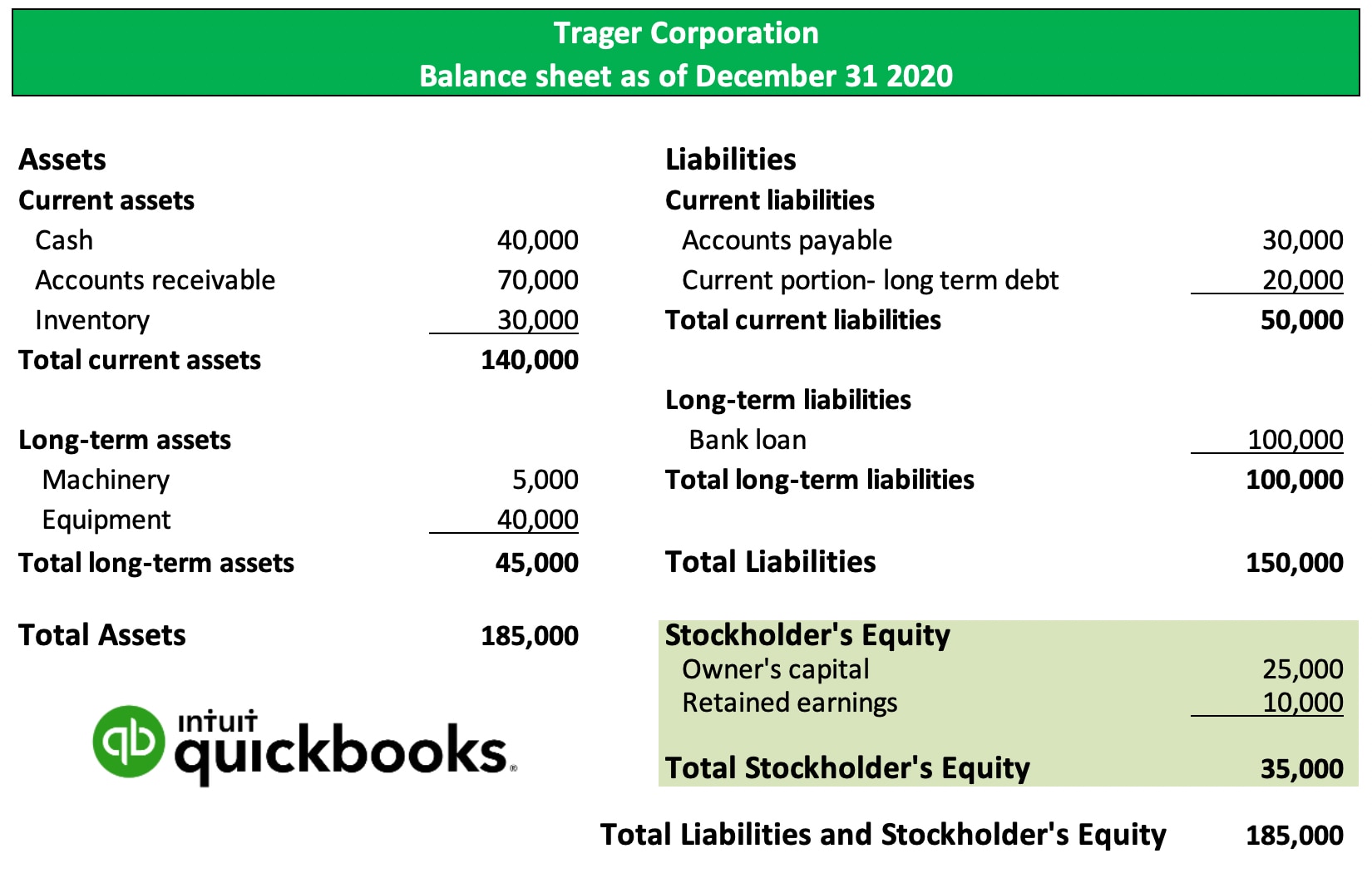

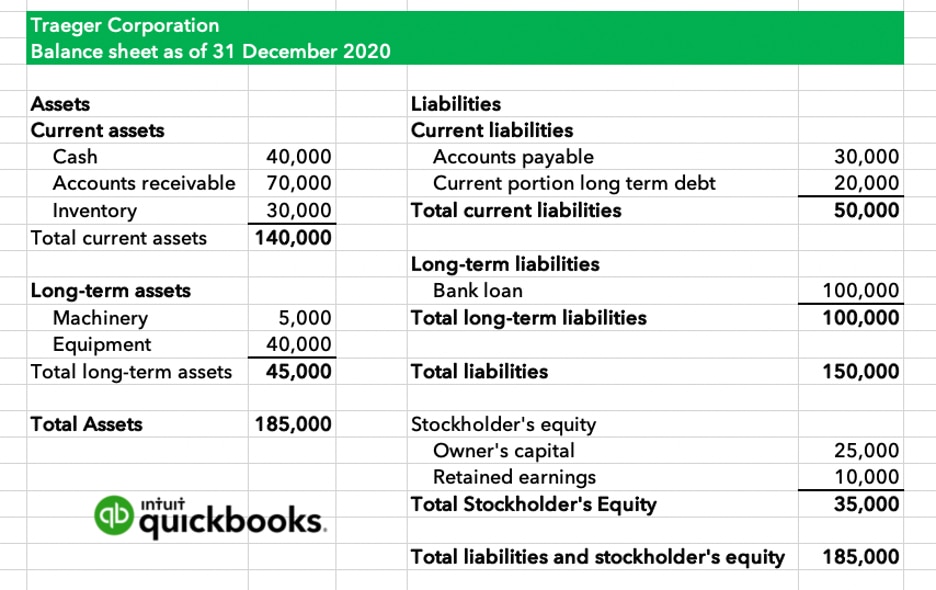

What are retained earnings? QuickBooks Australia

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

Retained Earnings Explained Definition, Formula, & Examples

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds. Retained earnings are the profits of a business entity that have not been disbursed to the shareholders.

Retained Earnings Are The Profits Of A Business Entity That Have Not Been Disbursed To The Shareholders.

The retained earnings on the balance sheet refer to the cumulative profits kept by a corporation, as opposed to the proceeds.