What Is Accounts Payable On A Balance Sheet - When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit.

Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching.

Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit.

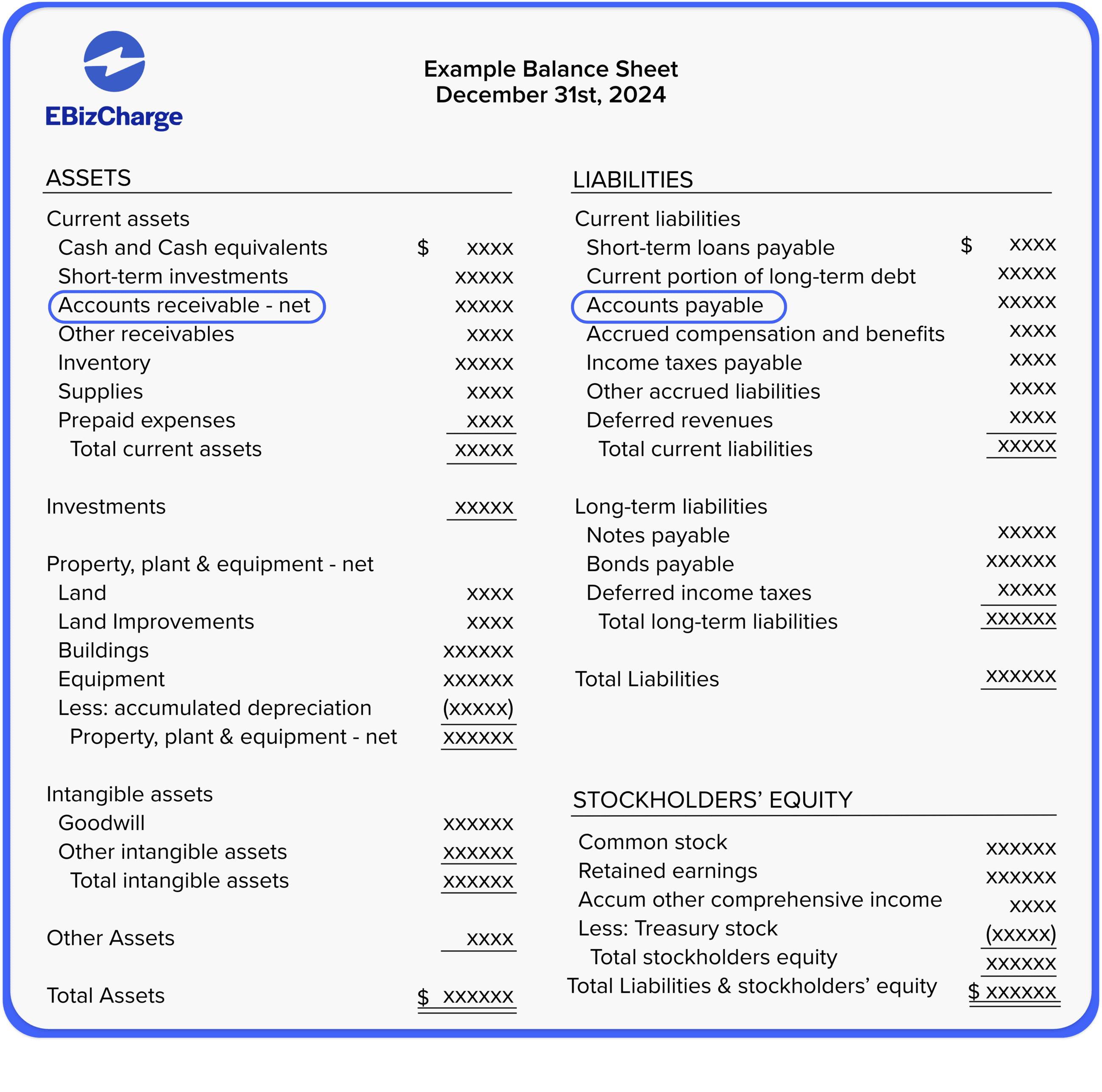

Accounts Receivable vs Accounts Payable

Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. When a.

What are Accounts Receivable and Accounts Payable?

Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable.

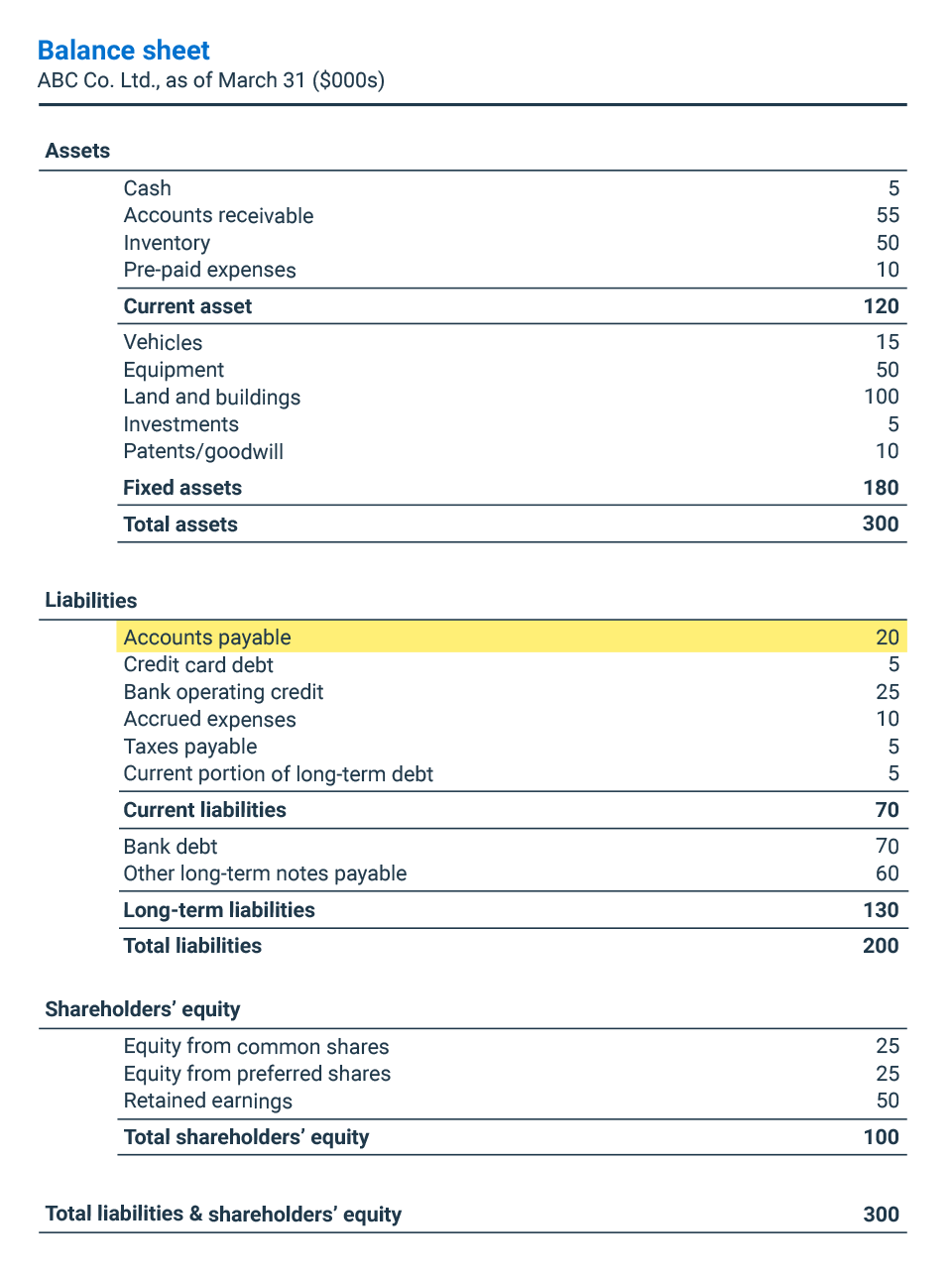

What are accounts payable? BDC.ca

When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable.

What is accounts receivable? Definition and examples

When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit..

Accounts Payable (AP) What They Are and How to Interpret Pareto Labs

Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back.

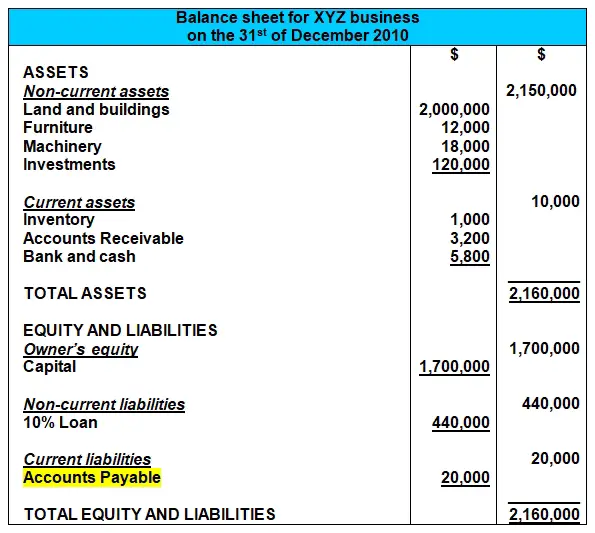

How Do You Calculate Accounts Payable On A Balance Sheet at Sara Gosman

Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching..

Balance sheet example track assets and liabilities

Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payable.

Bills Payable in Balance Sheet Double Entry Bookkeeping

Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. When a.

How to Read & Prepare a Balance Sheet QuickBooks

Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back.

What is accounts payable? Definition and examples

Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. When a company purchases goods and services from a supplier or creditor on credit that needs to be paid back quickly. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching. Accounts payable.

When A Company Purchases Goods And Services From A Supplier Or Creditor On Credit That Needs To Be Paid Back Quickly.

Accounts payableis a current liability recognized on the balance sheet to measure the unpaid bills owed to suppliers and. Accounts payable are the amounts owed by a business to its vendors or creditors for goods or services purchased on credit. Accounts payable affects both the balance sheet, as a current liability, and the income statement, through the matching.