What Is A Liability On A Balance Sheet - Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two. This is a list of. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What is the definition of liabilities? Liabilities are the obligations belonging to a particular company that must be settled over.

Liabilities are the obligations belonging to a particular company that must be settled over. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. This is a list of. What is the definition of liabilities? Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. T he assets and liabilities are separated into two.

Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are the obligations belonging to a particular company that must be settled over. This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. T he assets and liabilities are separated into two. What is the definition of liabilities?

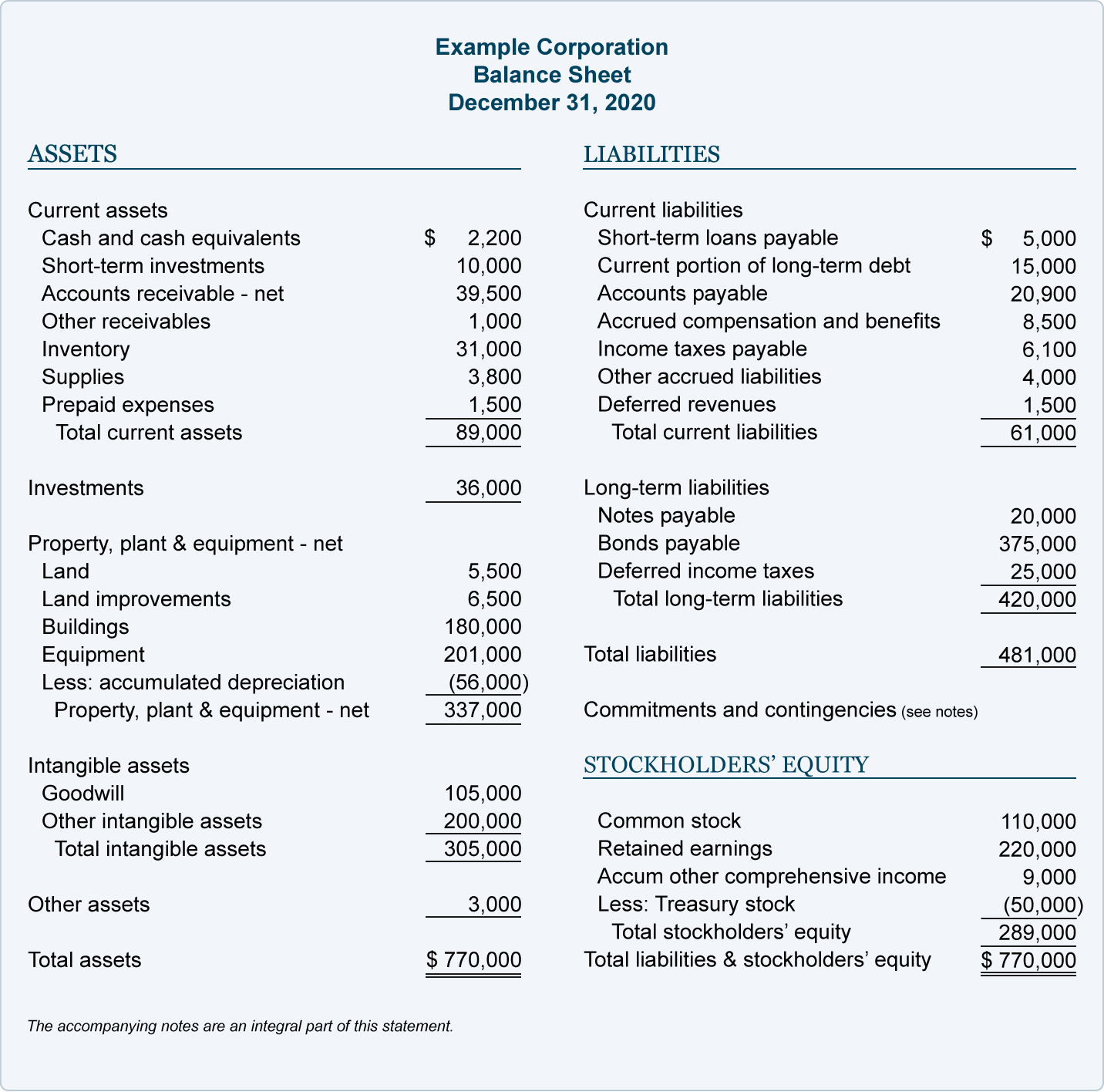

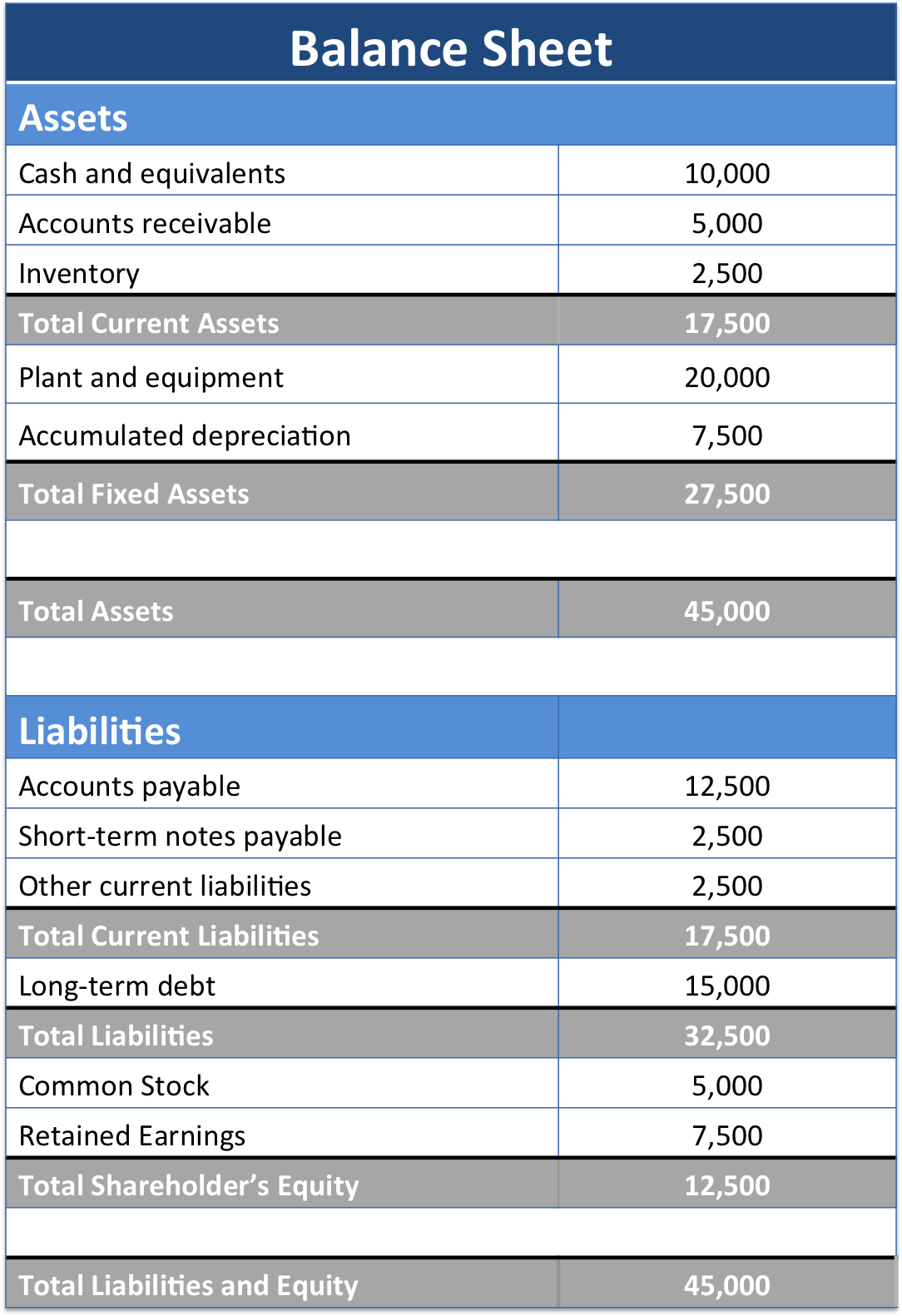

Liabilities Side of Balance Sheet

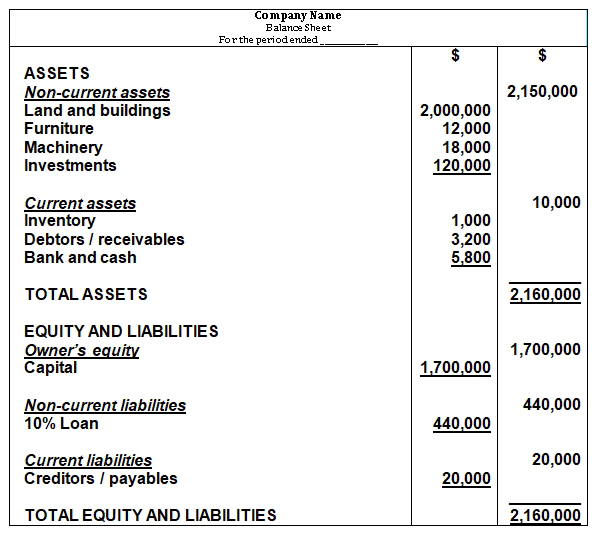

Most businesses will organize the liabilities on their balance sheet under two separate headings: This is a list of. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. T he assets and liabilities are separated into two. Liabilities are settled over time through the transfer of economic benefits including.

How to Understand Your Balance Sheet A Beginner's Guide 2025

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities are settled over time through the transfer of economic benefits including.

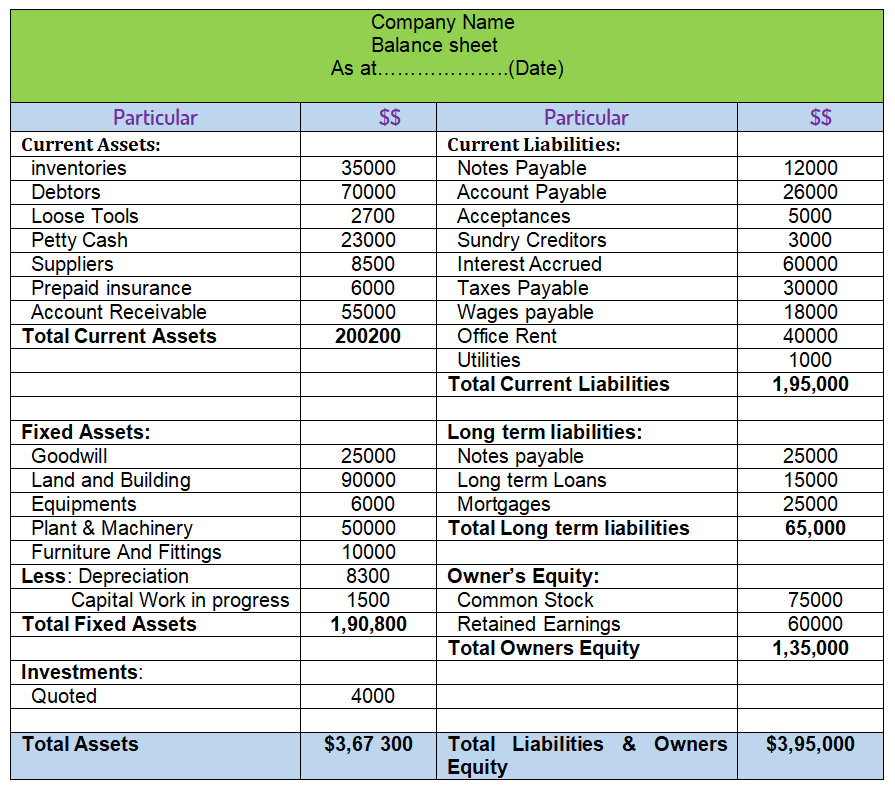

Balance Sheet Format Explained (With Examples) Googlesir

This is a list of. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities are the obligations belonging to a particular company that must be settled over. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Most businesses will organize the.

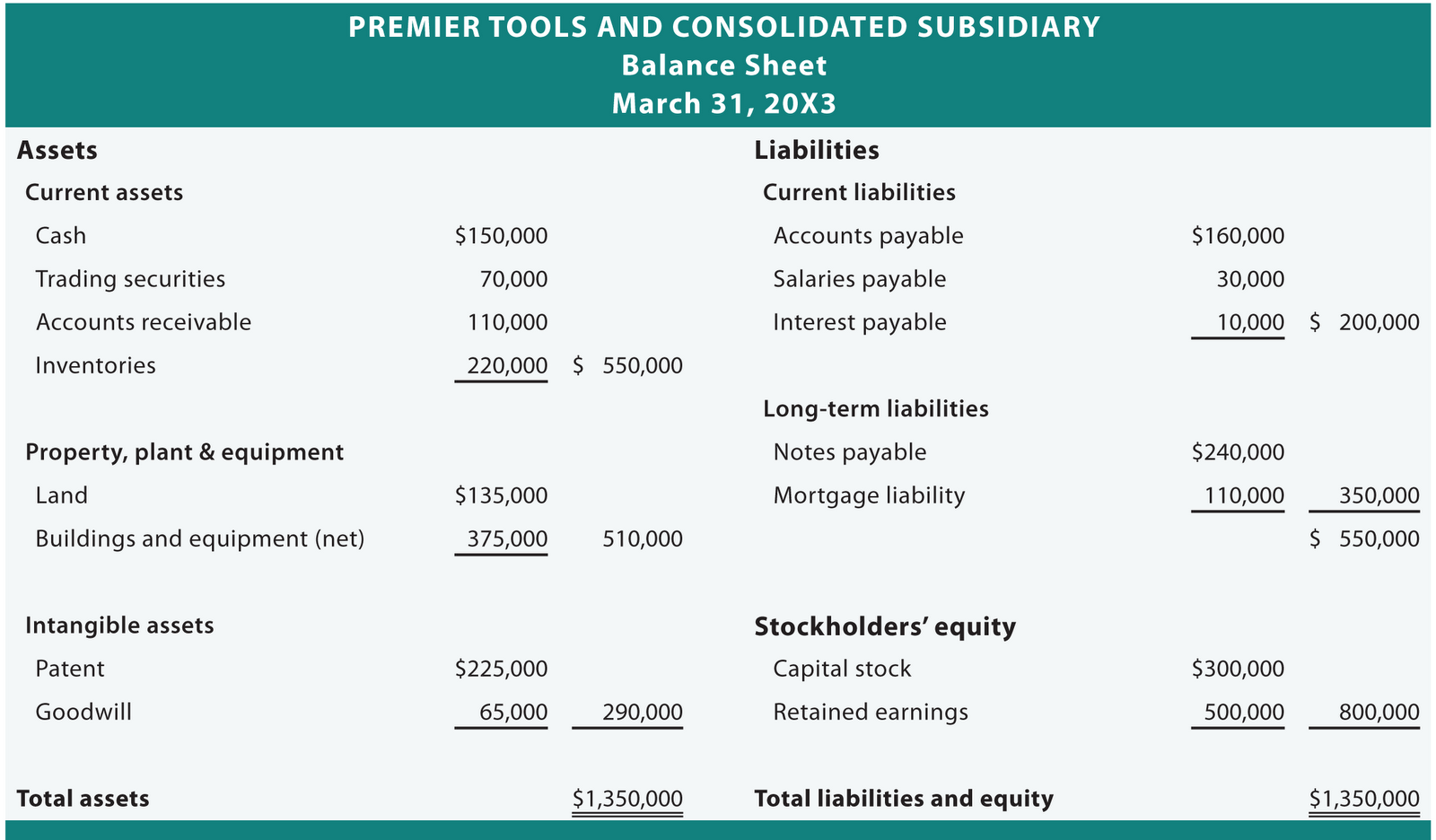

Balance sheet definition and meaning Market Business News

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. What is the definition of liabilities? T he assets and liabilities are separated into two. Liabilities are the obligations belonging to a particular company that must be settled over.

The Balance Sheet

What is the definition of liabilities? This is a list of. Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity.

How To Balance The Balance Sheet

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Liabilities are the obligations belonging to a particular company that must be settled over. On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities are settled over time through the transfer of economic benefits including.

Balance Sheets 101 Understanding Assets, Liabilities and Equity HBS

What is the definition of liabilities? Liabilities are the obligations belonging to a particular company that must be settled over. Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. T he assets and liabilities are separated into two.

Balance Sheet Explained Structure, Assets, Liabilities with Examples

On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. This is a list of.

Company Balance Liabilities Financial Statements Excel Template And

Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities are the obligations belonging to a particular company that must be settled over. T he assets and liabilities are separated into two. This.

Balance sheet example track assets and liabilities

This is a list of. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities are the obligations belonging to a particular company that must be settled over. Most businesses will organize the liabilities on their balance sheet under two separate headings: Liabilities and equity make up the right side of the balance.

T He Assets And Liabilities Are Separated Into Two.

What is the definition of liabilities? Most businesses will organize the liabilities on their balance sheet under two separate headings: On the right side, the balance sheet outlines the company’s liabilities and shareholders’ equity. Liabilities and equity make up the right side of the balance sheet and cover the financial side of the company.

This Is A List Of.

Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Liabilities are the obligations belonging to a particular company that must be settled over.