Trademark In Balance Sheet - The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. It is classified as an intangible asset as. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The trademark is an intangible asset that can be capitalized on your balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to.

Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. It is classified as an intangible asset as. The trademark is an intangible asset that can be capitalized on your balance sheet. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet.

The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The trademark is an intangible asset that can be capitalized on your balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. It is classified as an intangible asset as.

30 xG® and xMax® are registered trademarks of xG Technology, Inc

The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. The trademark is an intangible asset that can be capitalized on your balance sheet. The cost of register or acquire.

Answered Cash Accounts Receivable Allowance for… bartleby

The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. It is.

PPT Brands… PowerPoint Presentation, free download ID2825483

It is classified as an intangible asset as. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. The cost of register or acquire a trademark is capitalized as an.

balance sheet and trademark not format PDF

The trademark is an intangible asset that can be capitalized on your balance sheet. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. It is classified as an intangible asset as. The cost of register or acquire a trademark is capitalized as an asset in the company balance.

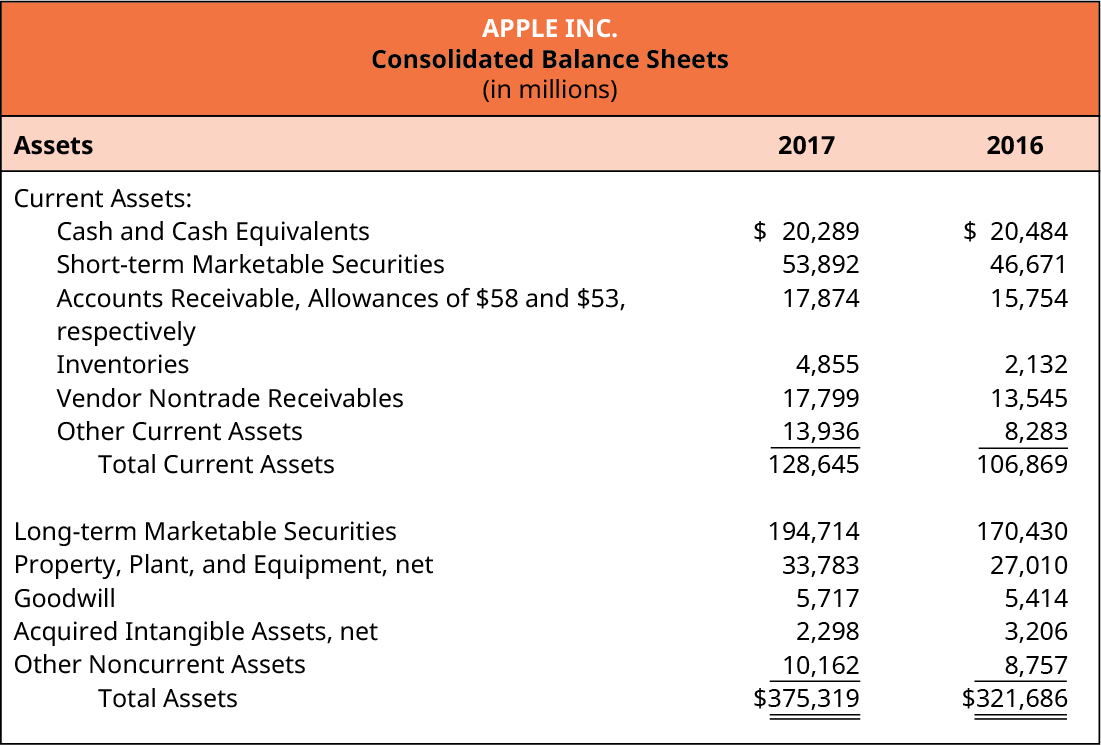

3.6 Tangible v Intangible Assets Financial and Managerial Accounting

The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The trademark is an intangible asset that can be capitalized on your balance sheet. It is classified as an intangible asset as. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly.

How to make a balance sheet presentation for the company

The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. It is classified as an intangible asset as. The trademark is an intangible asset that can be capitalized on your balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly.

Create a Balance Sheet Format for Trading Company in Excel

The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. It is.

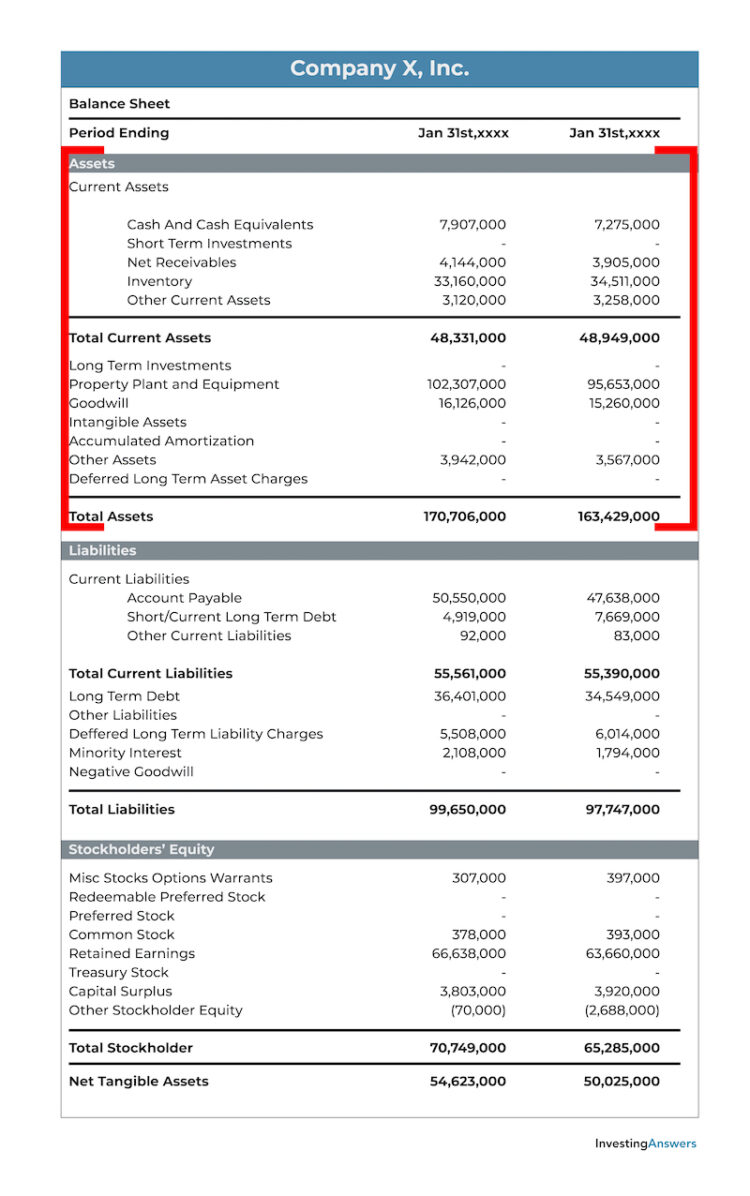

Asset Examples & Definition InvestingAnswers

The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. It is.

Beginner's Guide To Understanding Your Balance Sheet (1) Elements Of

The trademark is an intangible asset that can be capitalized on your balance sheet. It is classified as an intangible asset as. The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for.

Should trademarks be included on the balance sheet? AccountingCoach

The cost of register or acquire a trademark is capitalized as an asset in the company balance sheet. The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The trademark is an intangible asset that can be capitalized on your balance sheet. It is classified as an intangible asset.

The Cost Of Register Or Acquire A Trademark Is Capitalized As An Asset In The Company Balance Sheet.

The value of a trademark is closely tied to brand recognition and consumer loyalty, making it a critical asset for businesses. The trademark is an intangible asset that can be capitalized on your balance sheet. Initially, trademarks are recorded on the balance sheet at their acquisition cost, which includes all expenses directly attributable to. It is classified as an intangible asset as.