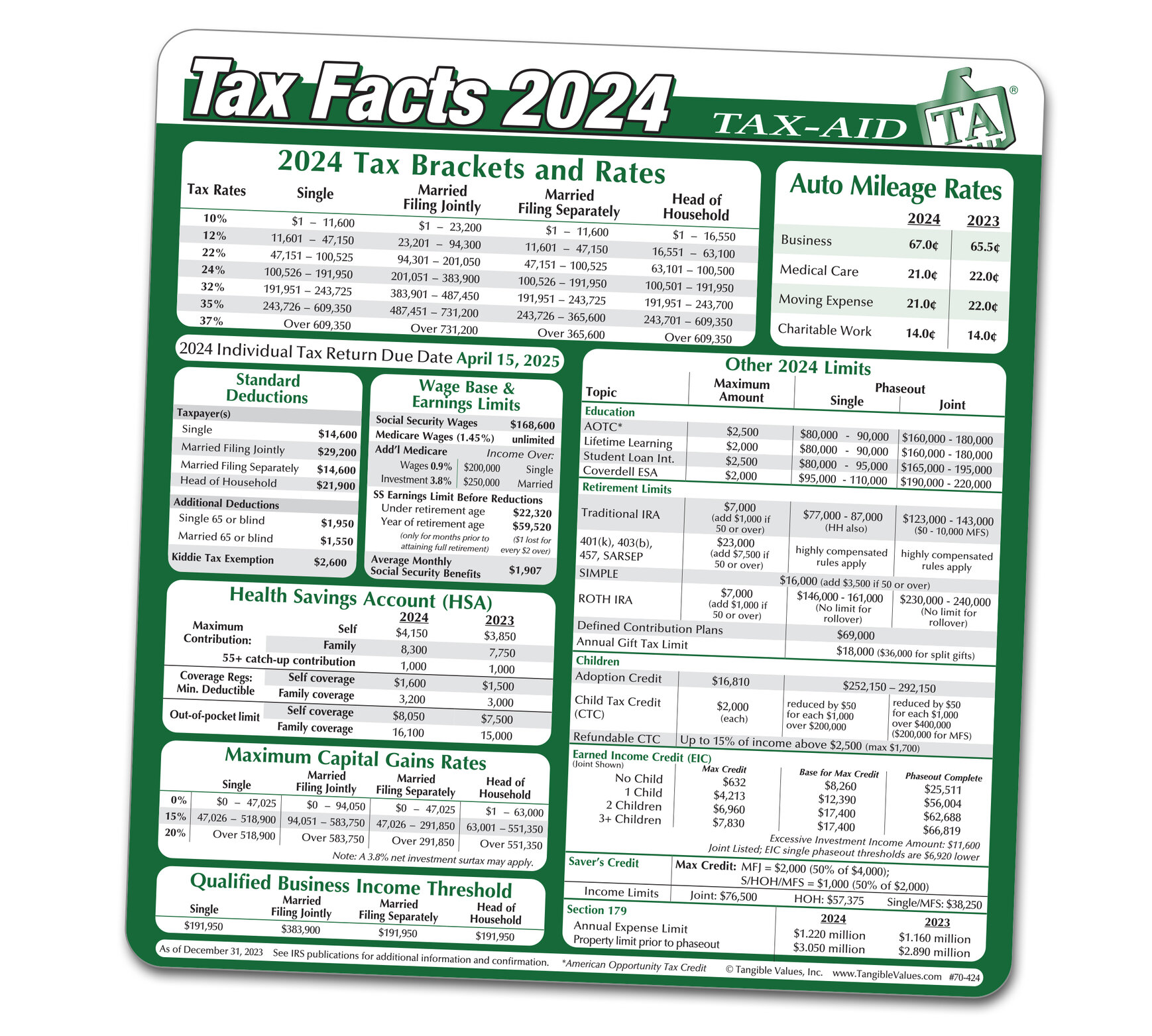

Tax Cheat Sheet 2024 - Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024.

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1).

Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1).

Our 2024 Tax Reference Sheet is Now Available TFO Family Office Partners

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. In 2024, the income.

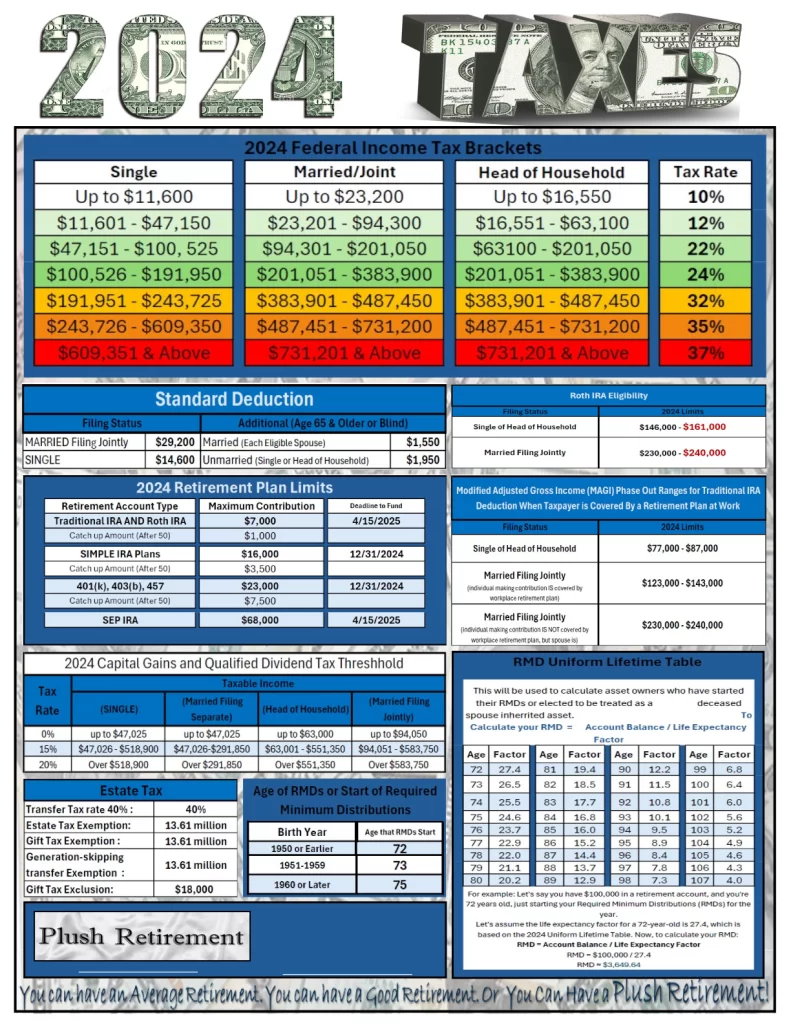

2024 Taxes Cheat Sheet & Historic Tax Rates Plush Retirement

Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as.

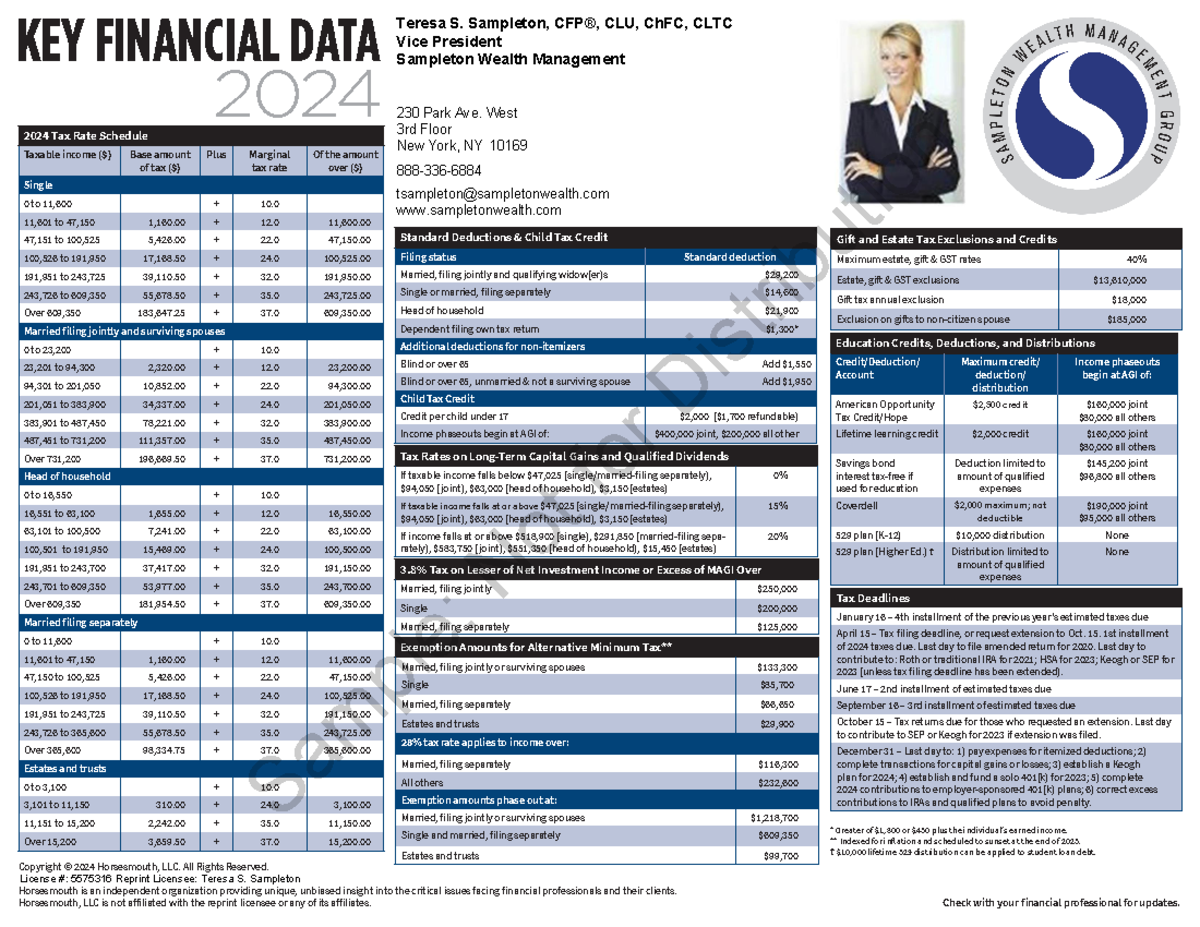

2024 cheat sheet tax codes KEY FINANCIAL DATA 2024 2024 Tax Rate

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. Up.

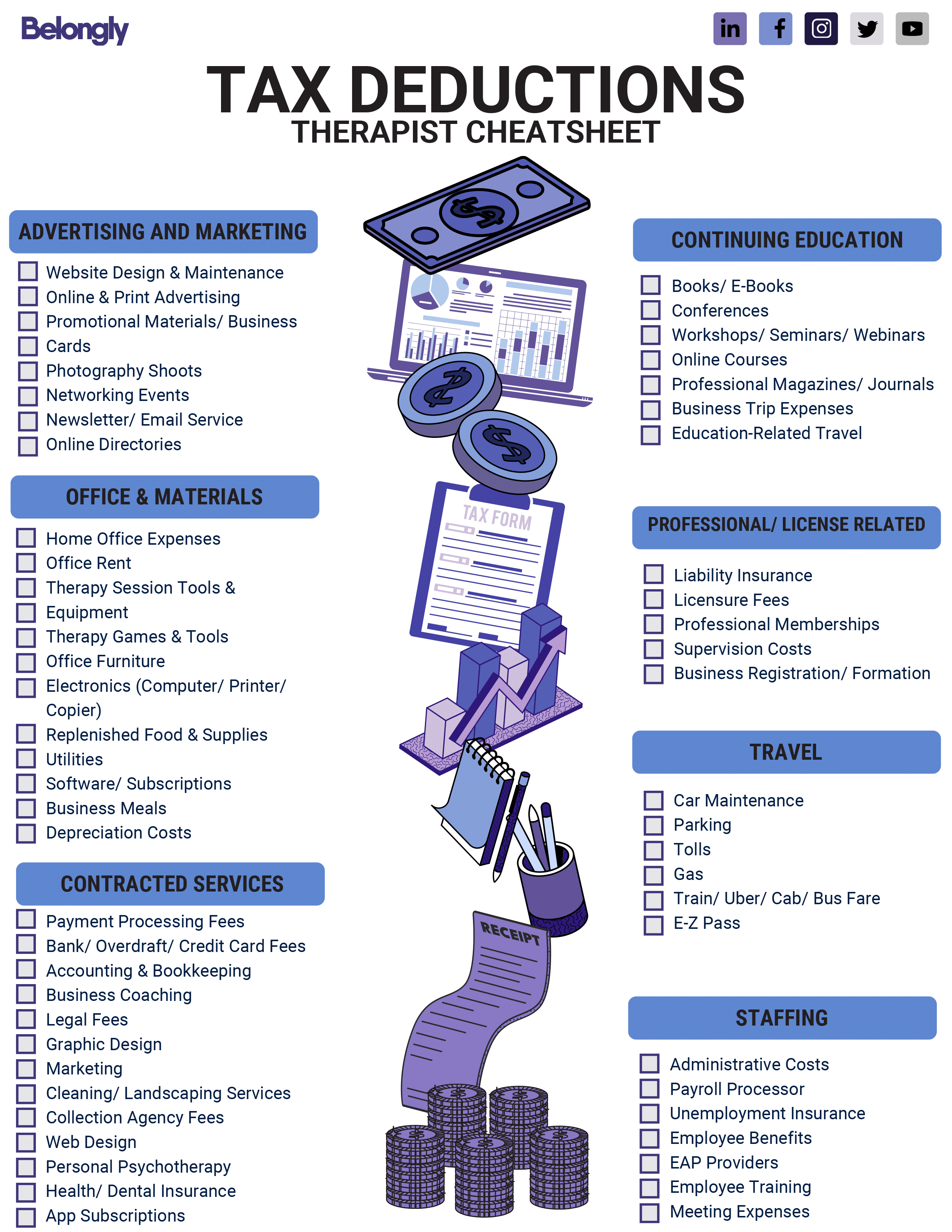

Tax Deduction Cheat Sheet 2024 Allyn Giacinta

In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social.

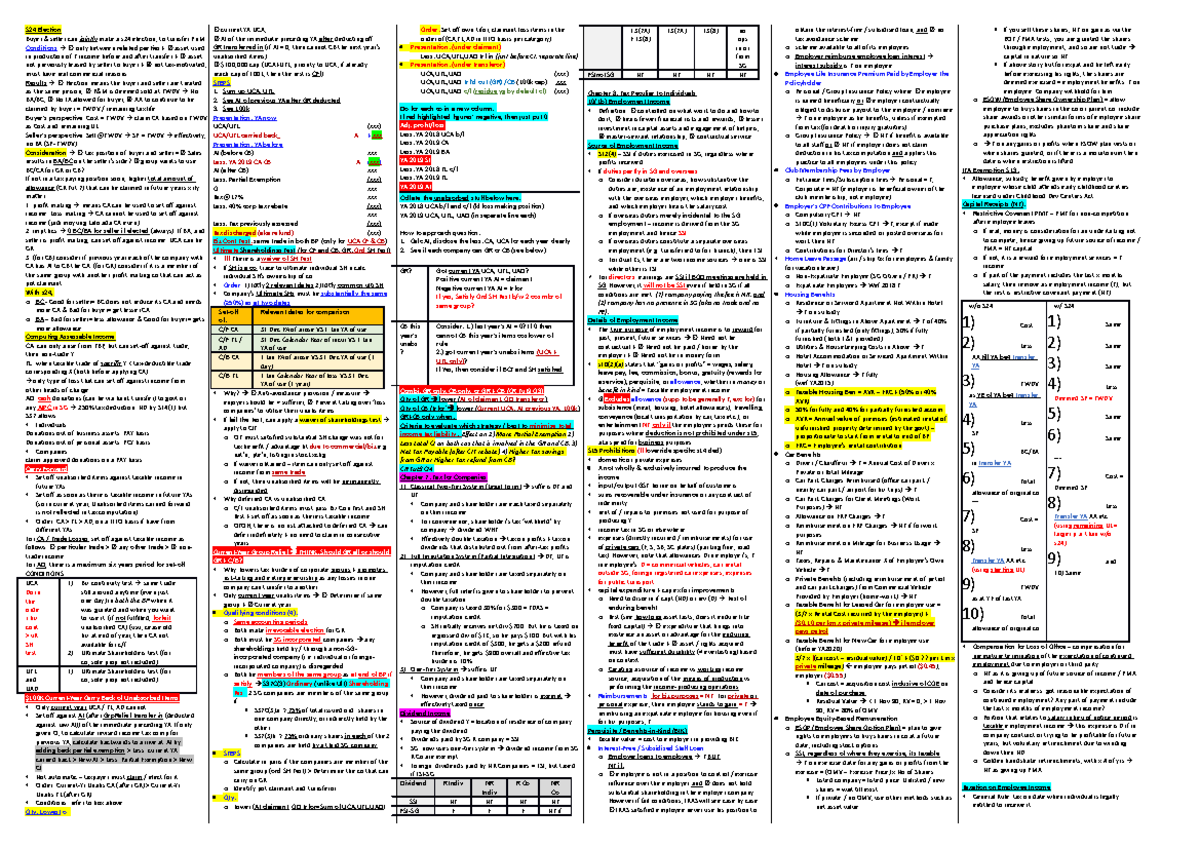

Tax Return Cheat Sheet

Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows.

2024 Inova Payroll Tax Cheat Sheet Inova Payroll

In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social.

2024 Individual Tax Rate Threshold “Cheat Sheet” Ultimate Estate

In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2.

2024 Tax Facts Mouse Pad Item 70424

In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals.

Free Taxes 2024 Templates For Google Sheets And Microsoft Excel

This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. In 2024, the income.

2024 Tax Planning Quick Reference Guide Clarus Wealth

Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. Tax rates for married individuals filing joint returns, heads of households, unmarried individuals, married individuals filing separate. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024. In 2024, the income.

Tax Rates For Married Individuals Filing Joint Returns, Heads Of Households, Unmarried Individuals, Married Individuals Filing Separate.

In 2024, the income limits for every tax bracket and all filers will be adjusted for inflation and will be as follows (table 1). Up to 85% of benefits are taxable provisional income = adjusted gross income + nontaxable income + 1/2 social security benefits. This quick reference guide provides tax brackets and key deductions, credits, and retirement plan contribution limits for 2024.