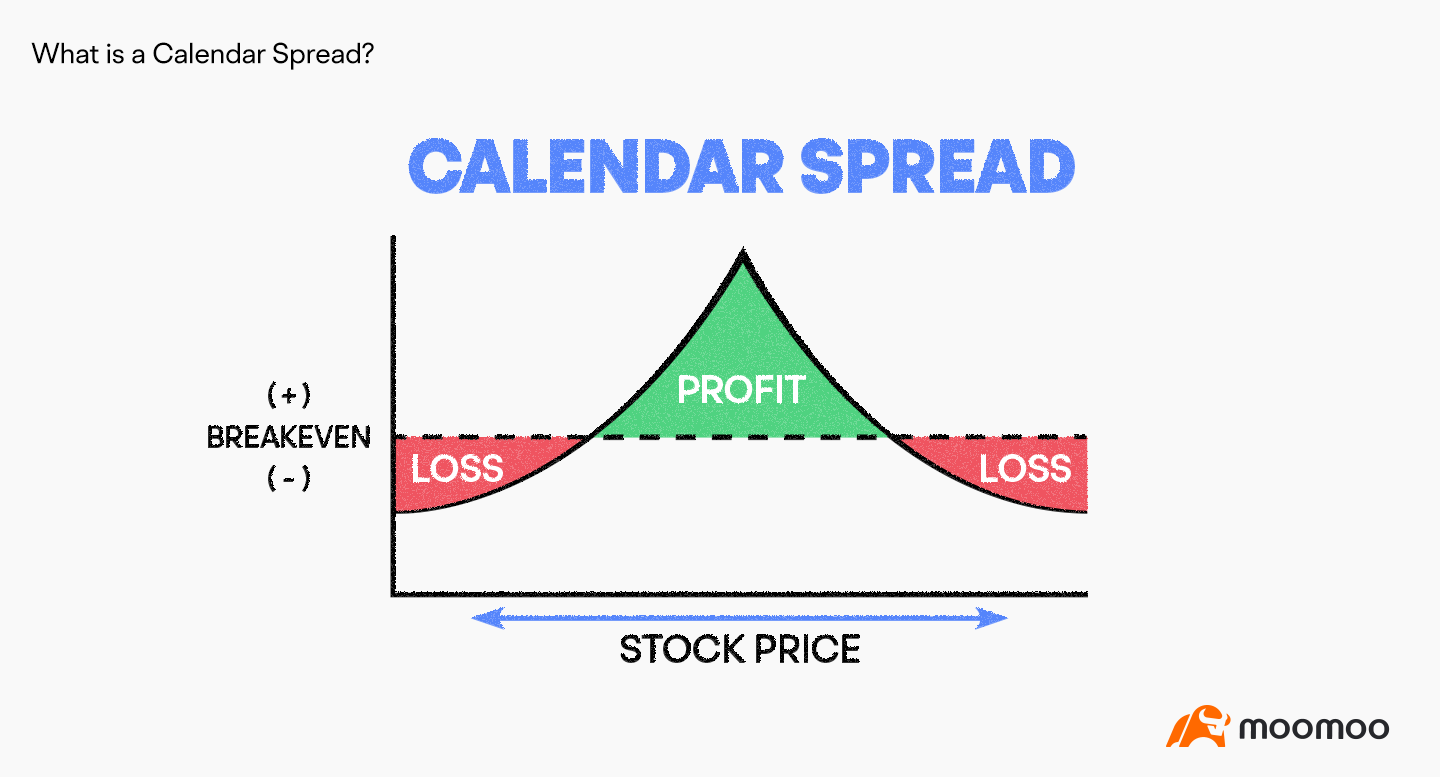

Short Calendar Spread - Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade.

Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

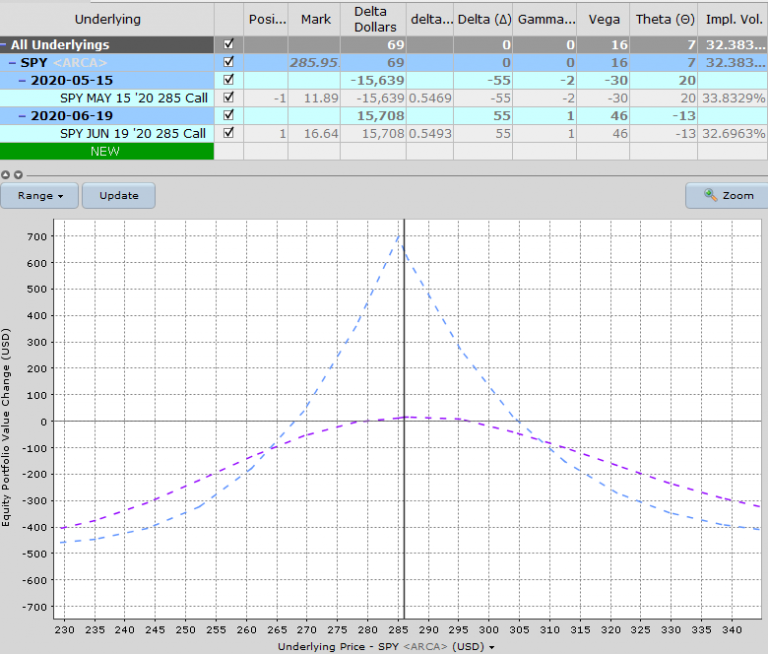

Pin on Double Calendar Spreads and Adjustments

The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

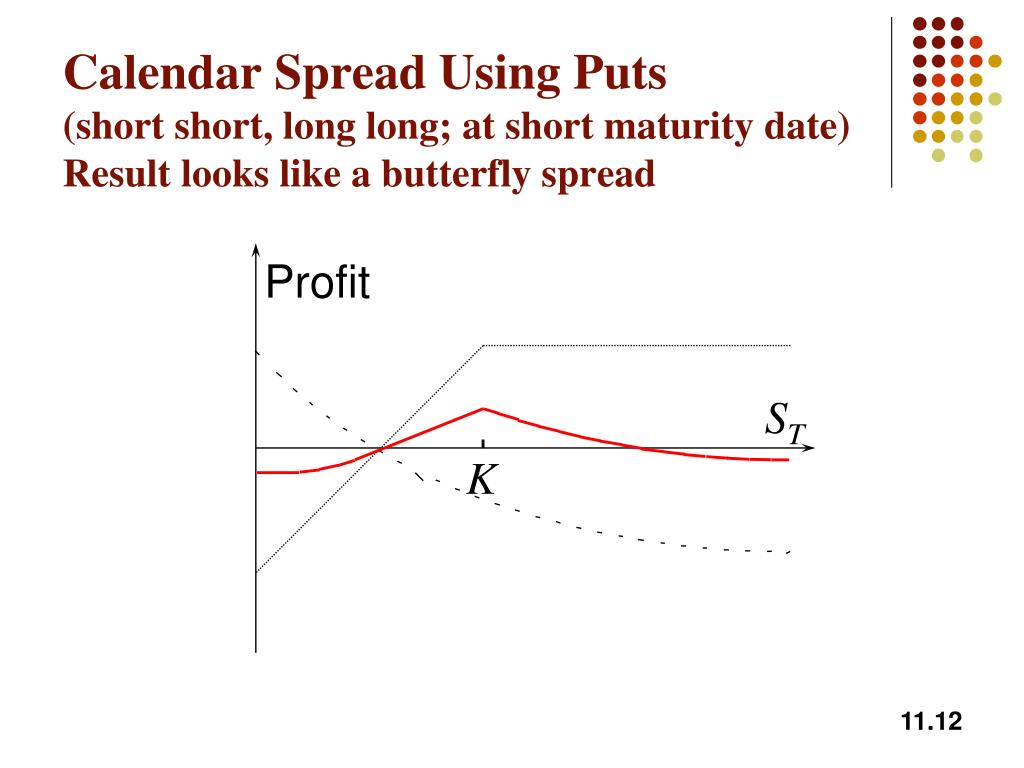

PPT Trading Strategies Involving Options PowerPoint Presentation

The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

What Is A Calendar Spread Option Strategy Mab Millicent

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

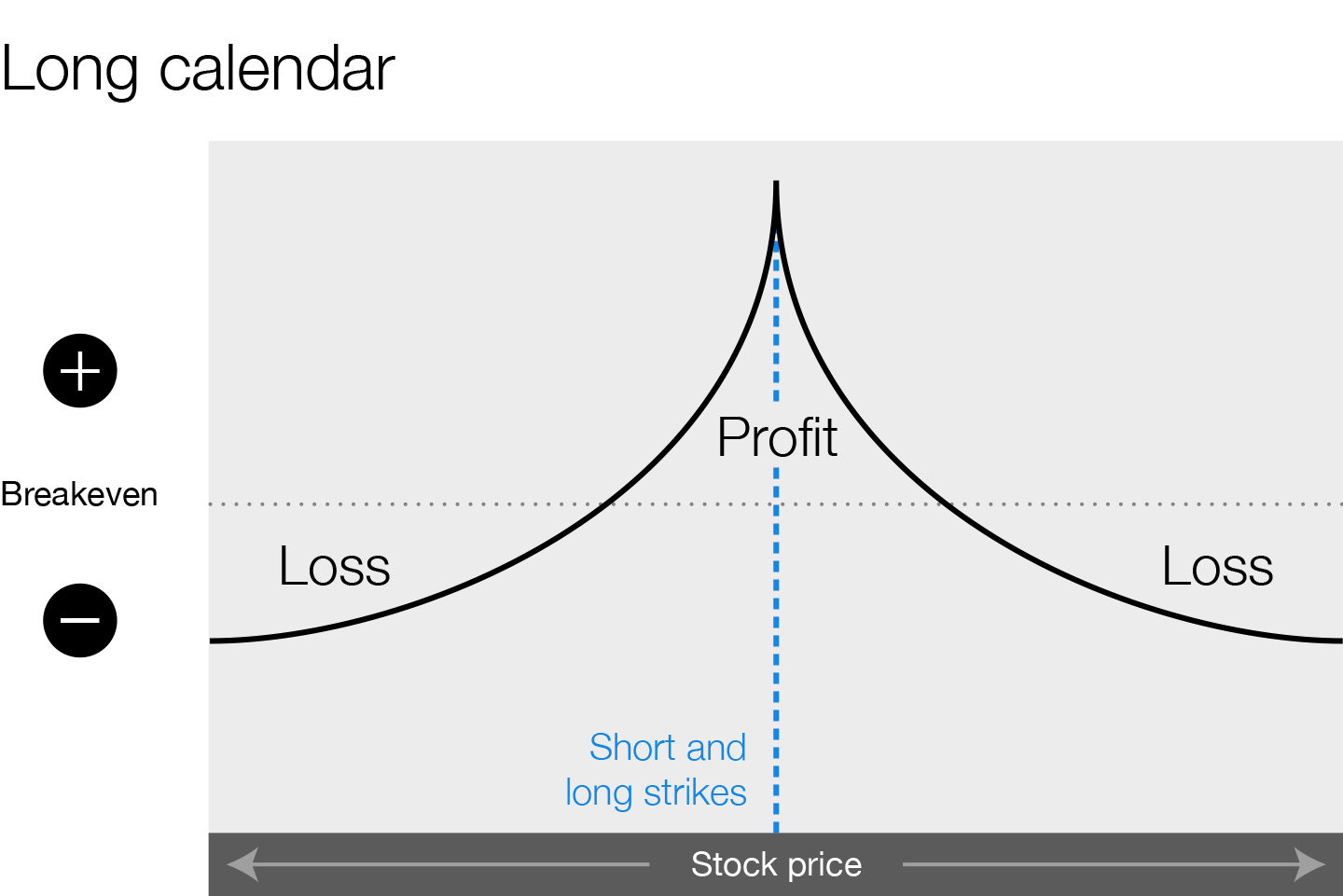

Calendar Spreads 101 Everything You Need To Know

The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Spread Options Strategy Definedge Securities Shelf

Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Spreads Option Trading Strategies Beginner's Guide to the

The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Calendar Spreads in Futures and Options Trading Explained

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. Selling an option contract you don’t yet own creates a “short” position.

Everything You Need to Know about Calendar Spreads

Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement. The typical calendar spread trade. Selling an option contract you don’t yet own creates a “short” position.

Calendar Call Spread Option Strategy Heida Kristan

Selling an option contract you don’t yet own creates a “short” position. The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

Selling An Option Contract You Don’t Yet Own Creates A “Short” Position.

The typical calendar spread trade. Learn how to use a short calendar call spread to profit from a volatile market when you are unsure of the direction of price movement.

:max_bytes(150000):strip_icc()/calendarspread.asp_final-6628bf3928bd4717bde925a70b28ac8c.png)