Sheet Bank - A bank's balance sheet provides a snapshot of its financial position at a specific time. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. It consists of assets, representing what the bank owns, and.

A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. A bank's balance sheet provides a snapshot of its financial position at a specific time. It consists of assets, representing what the bank owns, and. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets.

It consists of assets, representing what the bank owns, and. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. A bank's balance sheet provides a snapshot of its financial position at a specific time.

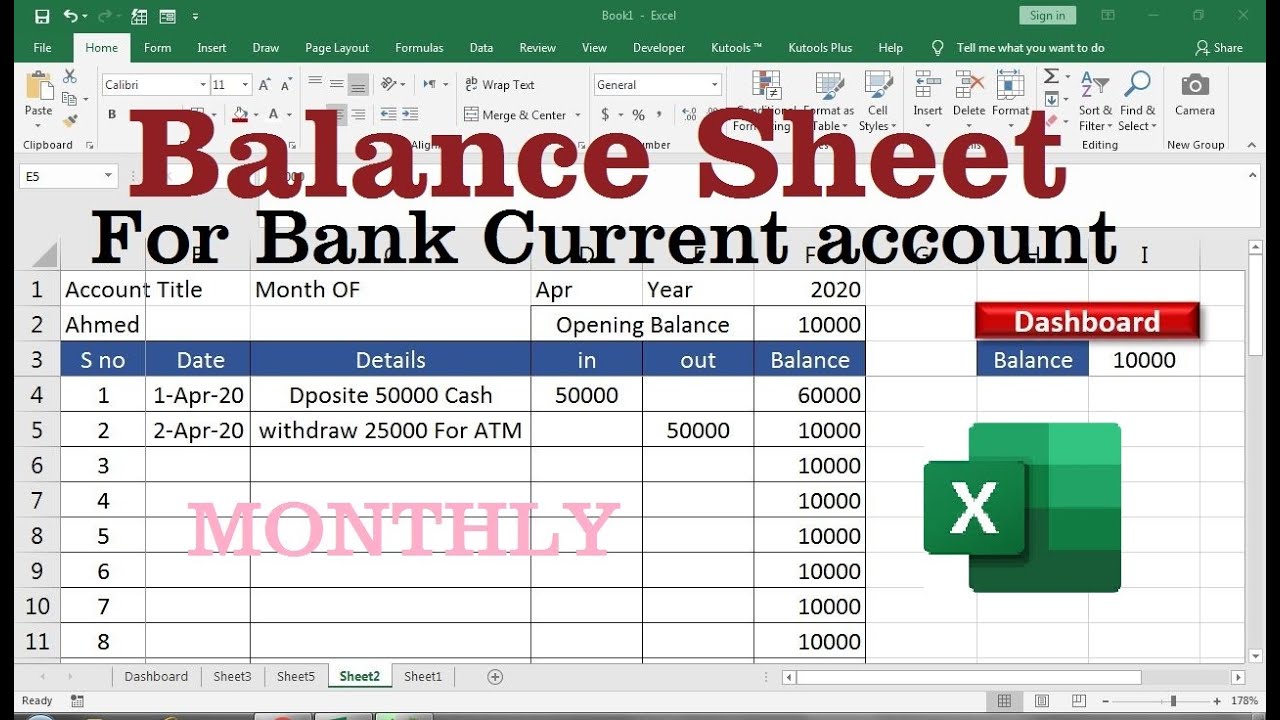

bank balance sheet explanation YouTube

A bank's balance sheet provides a snapshot of its financial position at a specific time. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. It consists of assets, representing what the bank owns,.

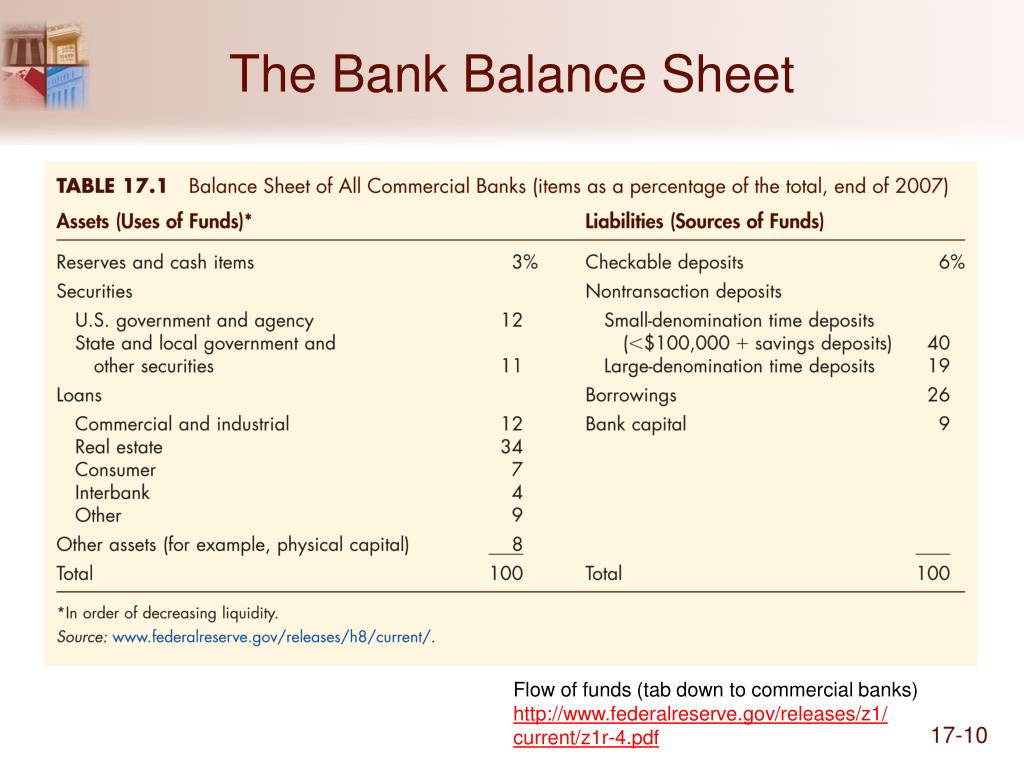

PPT Chapter 17 PowerPoint Presentation ID74190

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand.

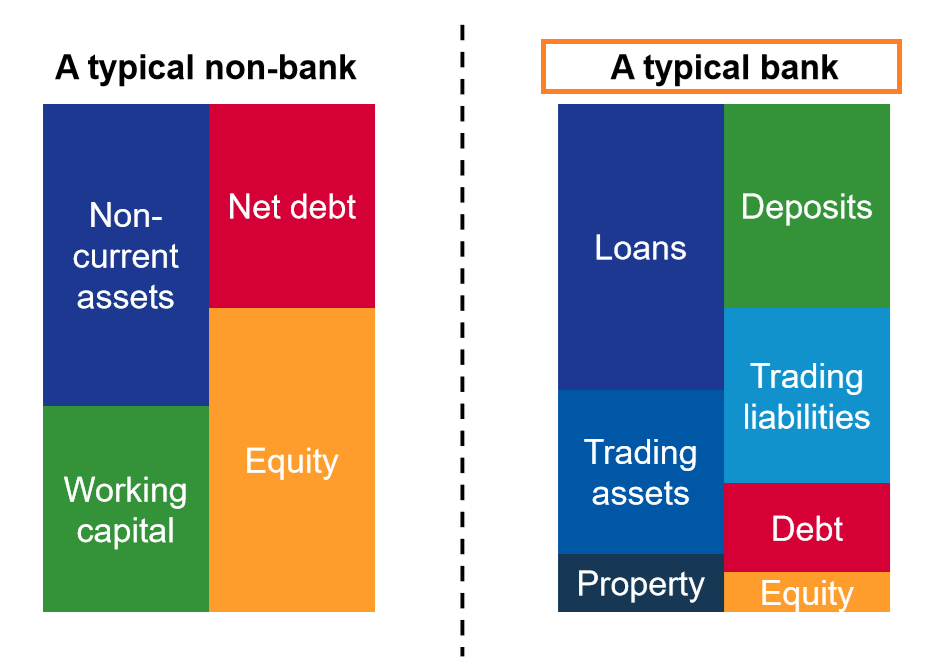

How Does A Bank S Balance Sheet Work at Ruth Sapp blog

Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank's balance sheet provides a snapshot of its financial position at a specific time. Balance sheets act as a source document for different stakeholders like.

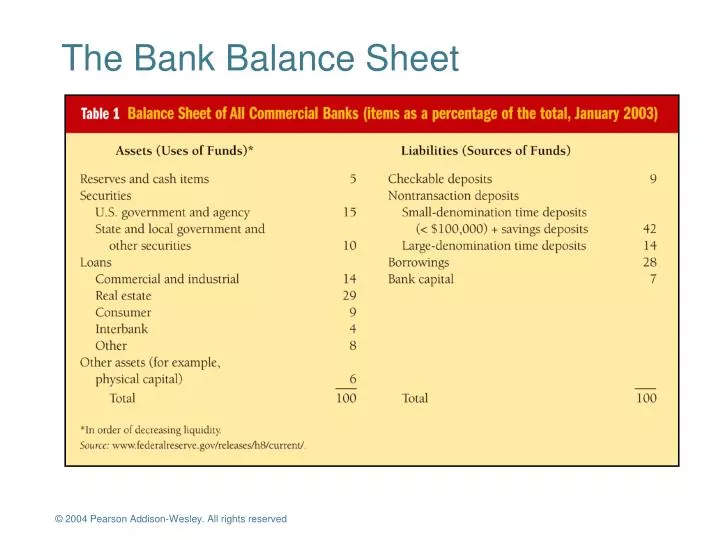

PPT The Bank Balance Sheet PowerPoint Presentation, free download

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance lending. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. A.

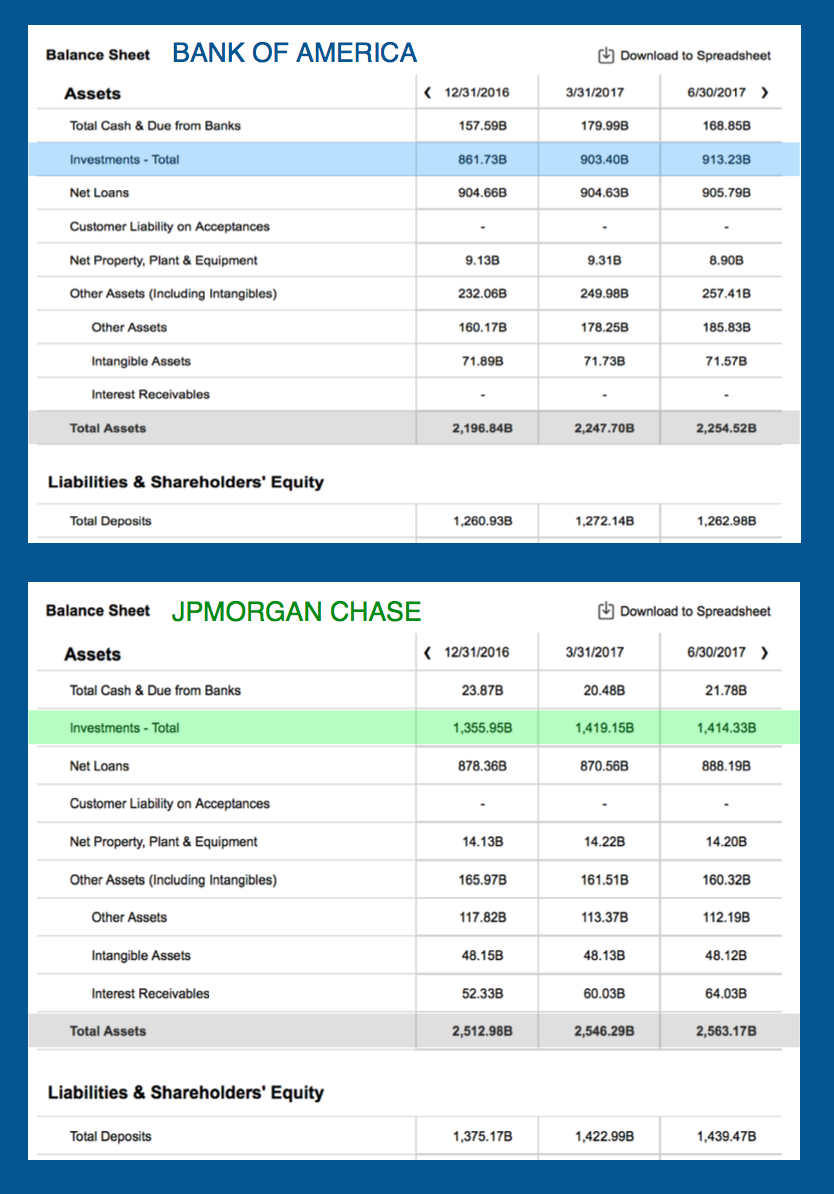

How Bank Of America And Chase Use Their Balance Sheets

A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of.

EXCEL BASIC SHEET 4 BANK ACCOUNT SHEET YouTube

A bank's balance sheet provides a snapshot of its financial position at a specific time. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Balance sheets.

Free printable money balance sheet, Download Free printable money

It consists of assets, representing what the bank owns, and. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze.

Bank Statement Administrative Report Management Excel Template And

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Balance sheets act as a source document for different stakeholders like investors and creditors to analyze and understand the. A bank balance sheet is a key way to draw conclusions regarding a bank’s business and the resources used to be able to finance.

Banks Balance Sheet Complete Guide on Banks Balance Sheet

Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. It consists of assets, representing what the bank owns, and. Instead, several unique characteristics are included in a bank's balance sheet and.

[Economics] What is Understanding Balance sheet of a Commercial Bank

Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the.

A Bank Balance Sheet Is A Key Way To Draw Conclusions Regarding A Bank’s Business And The Resources Used To Be Able To Finance Lending.

It consists of assets, representing what the bank owns, and. Relationship balances include owned consumer checking, savings, money market, and certificate of deposit including retirement and maxsafe®. Bank balance sheets are an accounting of a bank’s liabilities and assets and can be one of the trickiest parts of learning. Instead, several unique characteristics are included in a bank's balance sheet and income statement that help investors.

Balance Sheets Act As A Source Document For Different Stakeholders Like Investors And Creditors To Analyze And Understand The.

A bank’s balance sheet, which sums up the financial balances, is prepared and tailored to reflect the mandate put in place by a bank’s. Banks use much more leverage than other businesses and earn a spread between the interest income they generate on their assets. A bank's balance sheet provides a snapshot of its financial position at a specific time.

![[Economics] What is Understanding Balance sheet of a Commercial Bank](https://d77da31580fbc8944c00-52b01ccbcfe56047120eec75d9cb2cbd.ssl.cf6.rackcdn.com/d41d2102-4f84-4785-90c3-817a96d6ad2b/balance-sheet-of-a-company-vs-balance-sheet-of-bank---teachoo.jpg)