Prepaid Rent On The Balance Sheet - Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of.

Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company.

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using.

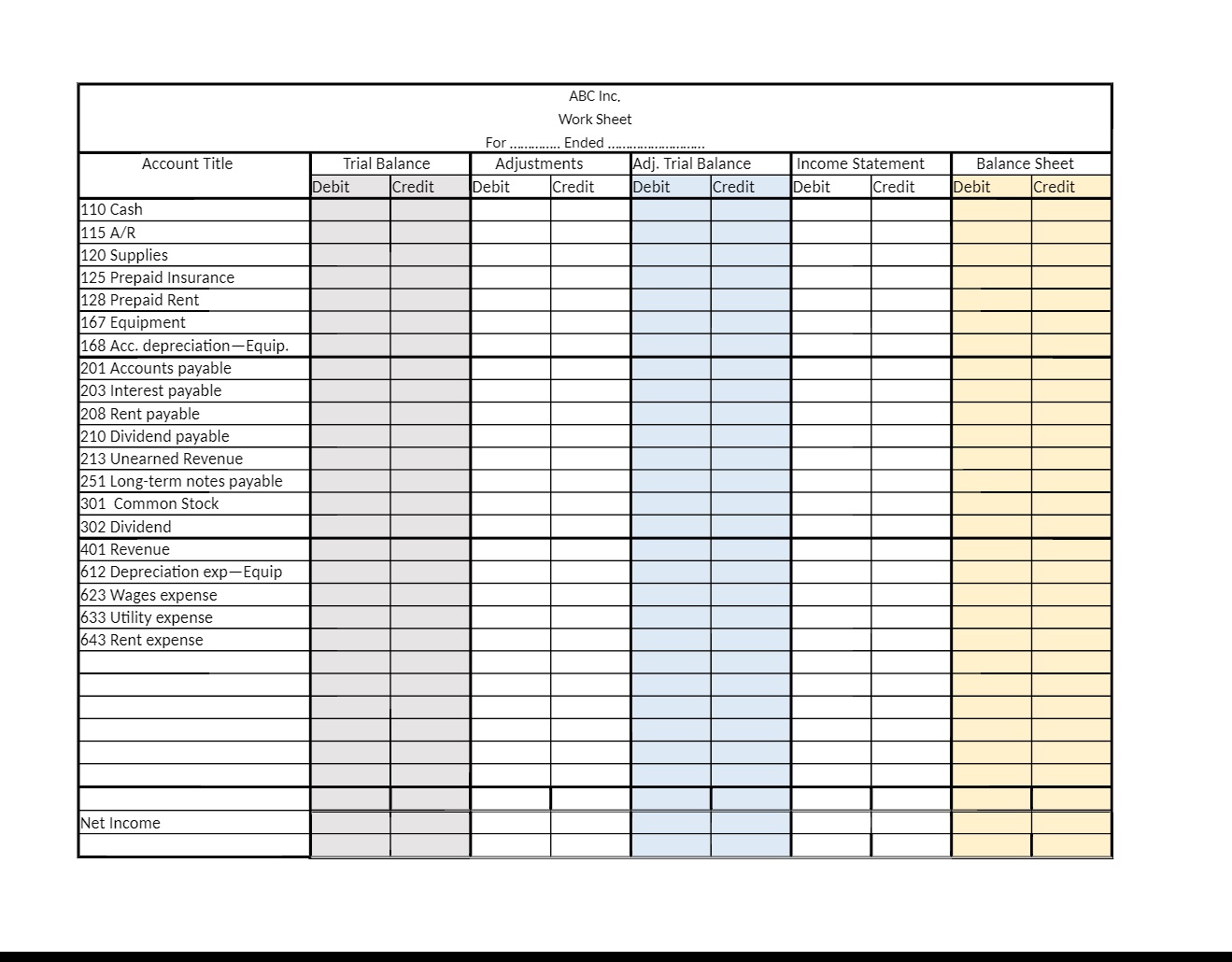

Where Is Prepaid Rent On The Balance Sheet LiveWell

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit.

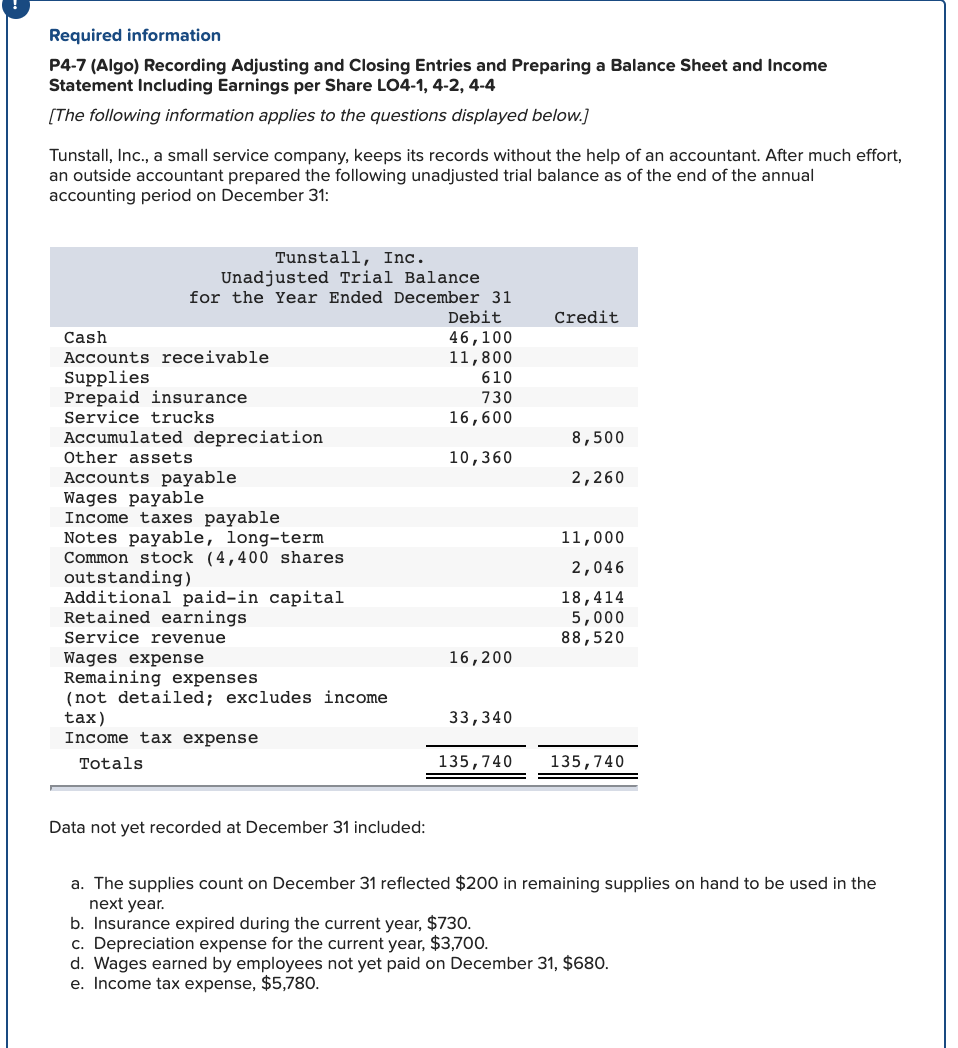

Free Prepaid Expense Schedule Excel Template Web Prepayments And

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the.

Prepaid Expenses In Balance Sheet Analysis Template Ipsas 20 Financial

Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a.

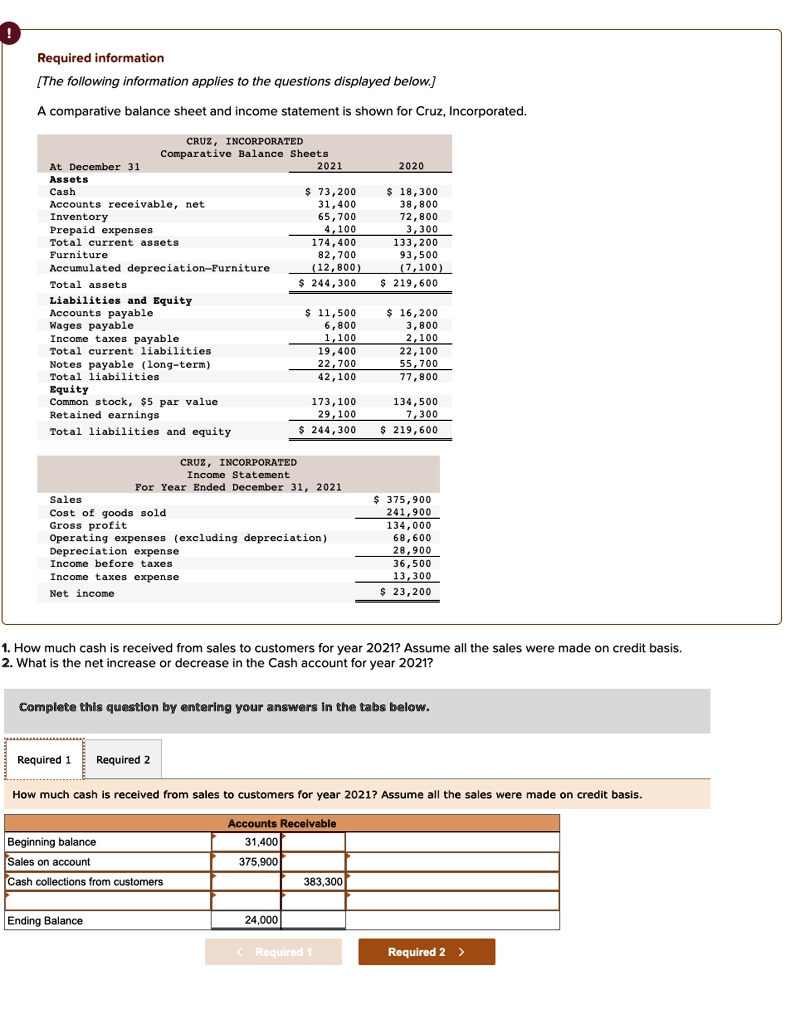

2011 Financial Discussion

Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the.

Prepaid Assets on Balance Sheet Quant RL

Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the.

Solved Please help complete balance sheet. Prepaid insurance

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the.

Is Prepaid Rent an Asset? Financial

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as.

balance sheet as of dec 31 2004 sep 30 2005 current assets cash 9093634

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company.

bucketsery Blog

Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company.

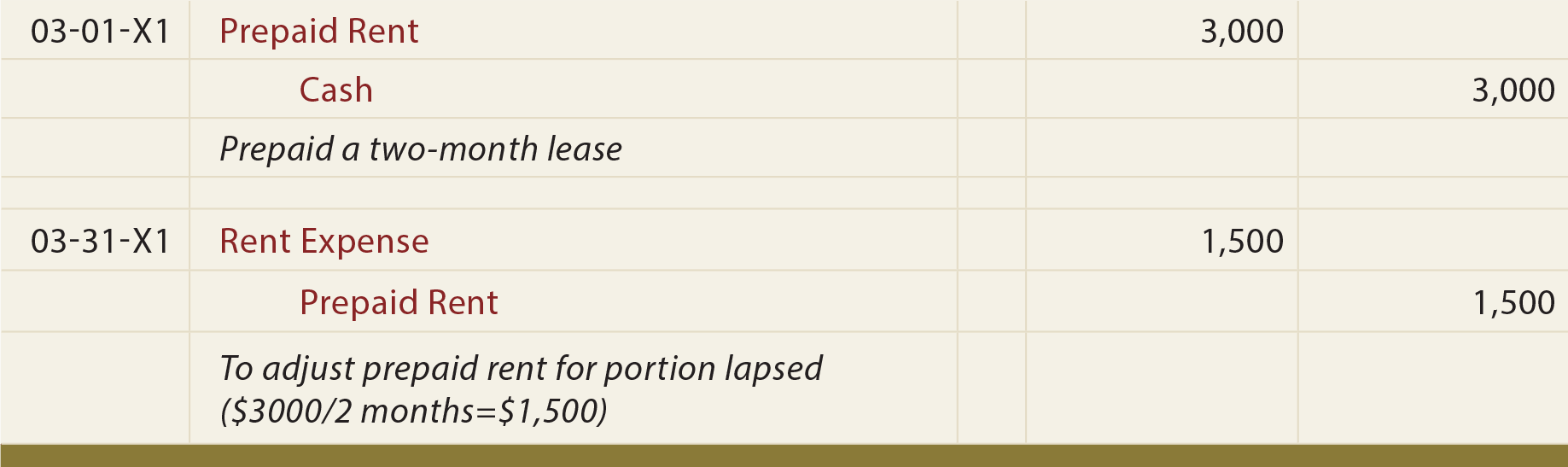

RENT PAID IN ADVANCE JOURNAL ENTRIES WITH EXAMPLES Luxity

In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using. Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as.

In Short, Store A Prepaid Rent Payment On The Balance Sheet As An Asset Until The Month When The Company Is Actually Using.

Prepaid rent, often classified as a current asset on the balance sheet, represents a future economic benefit for a company. Prepaid rent, essentially a payment made for rent before the rental period has occurred, is recorded as an asset on the. Accurate accounting for prepaid assets begins with recognizing these payments as assets on the balance sheet at the time of.