Payroll Liabilities On Balance Sheet - Payroll liabilities are amounts an employer owes to employees, government agencies, or other. Why is the reconciliation of payroll liabilities so important?. What should you know about your liabilities, specially accrued liabilities? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Net pay and withholding liabilities. Payroll withholdings include required and voluntary deductions authorized by each employee. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a.

Why is the reconciliation of payroll liabilities so important?. Net pay and withholding liabilities. Payroll liabilities are amounts an employer owes to employees, government agencies, or other. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Payroll withholdings include required and voluntary deductions authorized by each employee. What should you know about your liabilities, specially accrued liabilities? Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a.

Net pay and withholding liabilities. Payroll liabilities are amounts an employer owes to employees, government agencies, or other. Why is the reconciliation of payroll liabilities so important?. What should you know about your liabilities, specially accrued liabilities? Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Payroll withholdings include required and voluntary deductions authorized by each employee.

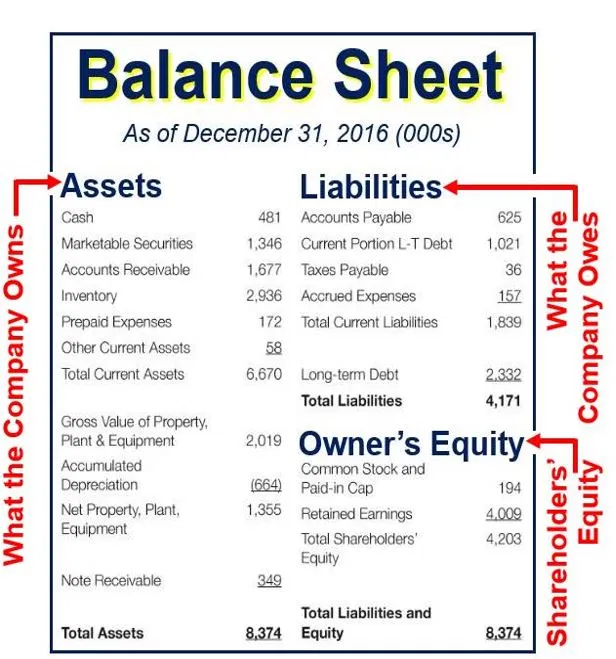

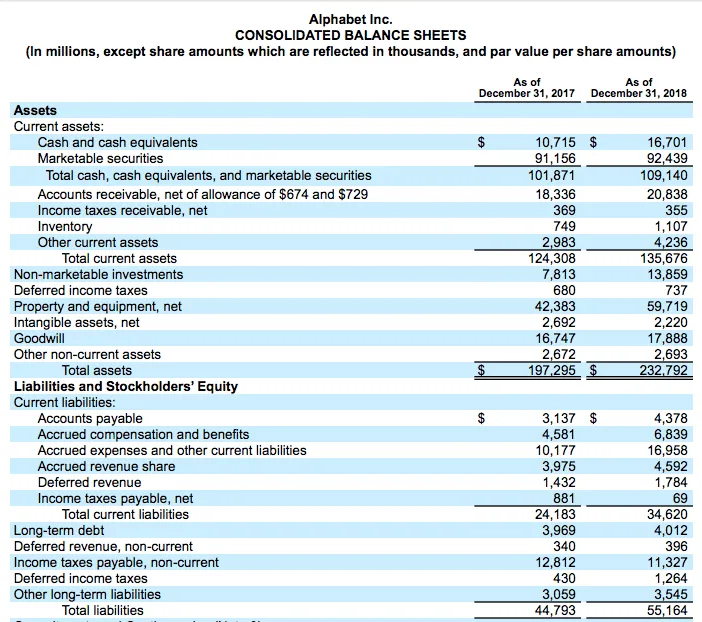

Understanding Liabilities Reading a Balance Sheet

Why is the reconciliation of payroll liabilities so important?. Net pay and withholding liabilities. Payroll withholdings include required and voluntary deductions authorized by each employee. What should you know about your liabilities, specially accrued liabilities? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities.

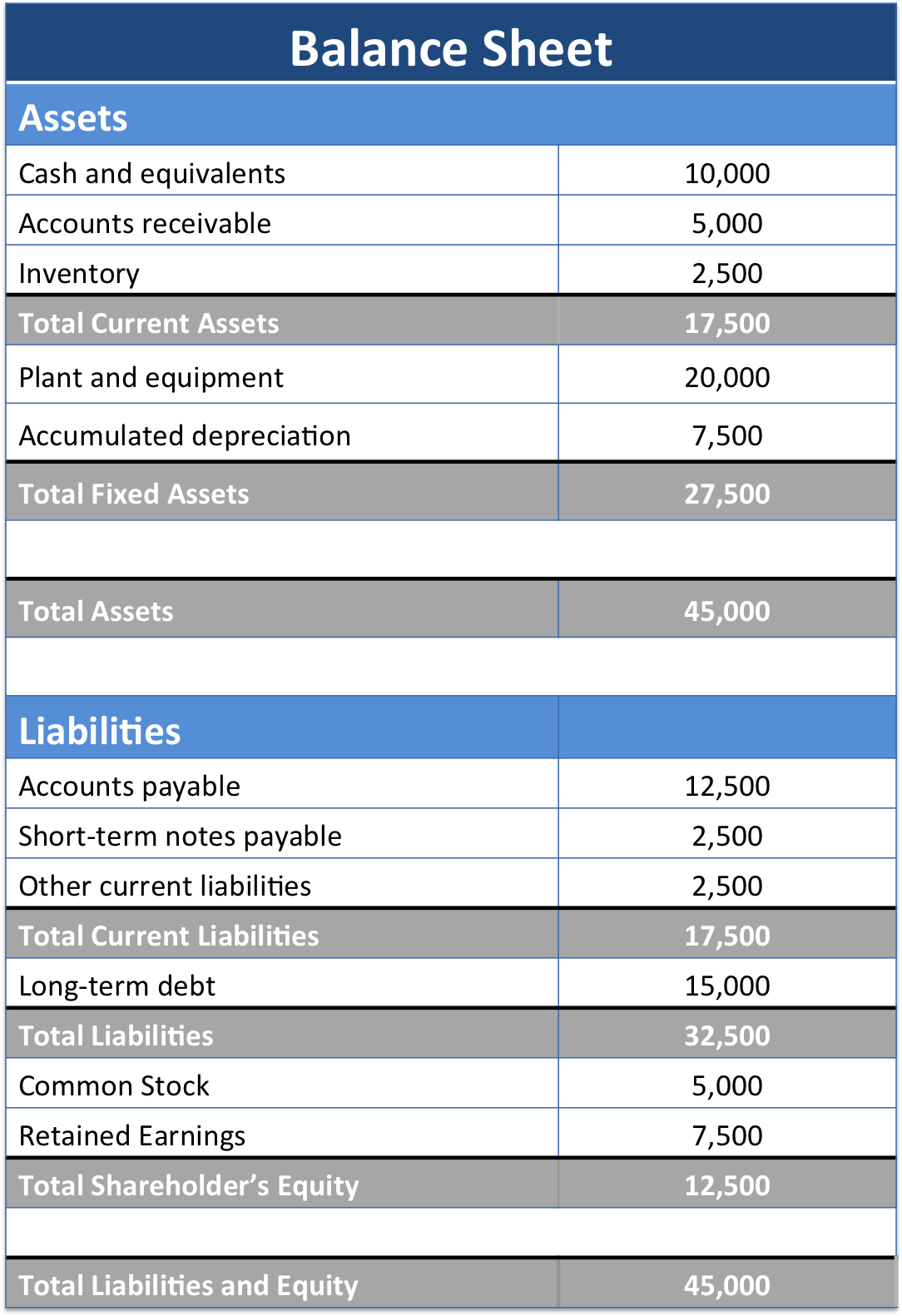

Balance sheet example track assets and liabilities

Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Payroll withholdings include required and voluntary deductions authorized by each employee. Why is the reconciliation of payroll liabilities so important?. What should you know about your liabilities, specially accrued liabilities? If you prepare a balance sheet for your business, you’ll.

How to Read a Balance Sheet (Free Download) Poindexter Blog

Payroll withholdings include required and voluntary deductions authorized by each employee. What should you know about your liabilities, specially accrued liabilities? Net pay and withholding liabilities. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. If you prepare a balance sheet for your business, you’ll record payroll liabilities as.

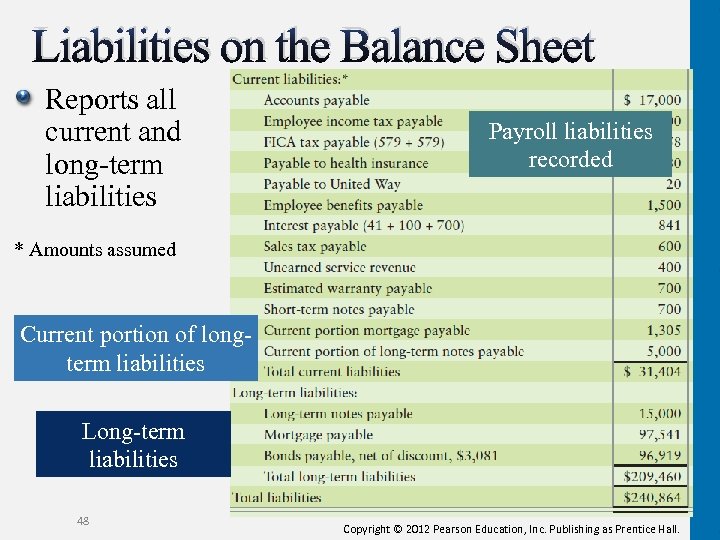

LongTerm Liabilities Bonds Payable and Classification of Liabilities

Payroll liabilities are amounts an employer owes to employees, government agencies, or other. Why is the reconciliation of payroll liabilities so important?. Net pay and withholding liabilities. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. If you prepare a balance sheet for your business, you’ll record payroll liabilities.

Current Liabilities List

What should you know about your liabilities, specially accrued liabilities? Why is the reconciliation of payroll liabilities so important?. Net pay and withholding liabilities. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Salaries and wages payable are classified as current liabilities on the balance sheet, as.

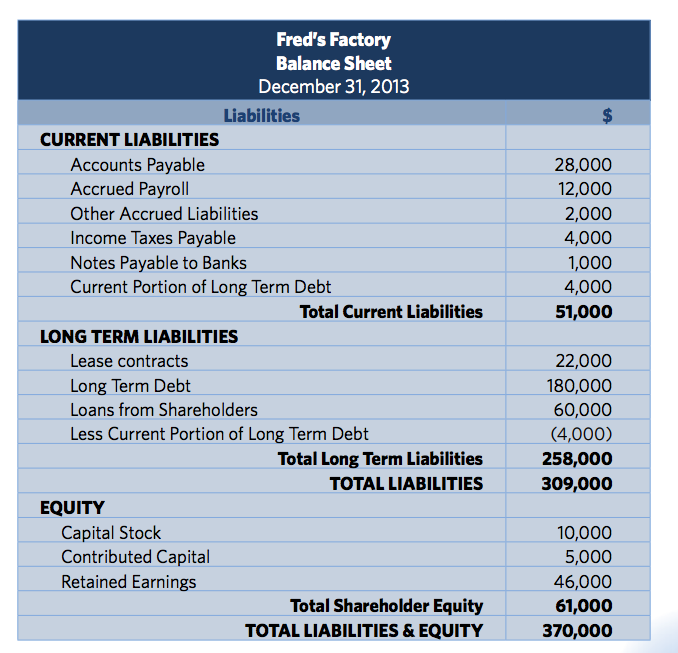

Liabilities Side of Balance Sheet

What should you know about your liabilities, specially accrued liabilities? Why is the reconciliation of payroll liabilities so important?. Payroll liabilities are amounts an employer owes to employees, government agencies, or other. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Payroll withholdings include required and voluntary deductions authorized.

Payroll With Balance Sheet

Net pay and withholding liabilities. What should you know about your liabilities, specially accrued liabilities? If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Why is the reconciliation of payroll liabilities so important?. Payroll liabilities are amounts an employer owes to employees, government agencies, or other.

11 Common Types of Liabilities

Why is the reconciliation of payroll liabilities so important?. What should you know about your liabilities, specially accrued liabilities? Payroll liabilities are amounts an employer owes to employees, government agencies, or other. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. Net pay and withholding liabilities.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

Net pay and withholding liabilities. Payroll withholdings include required and voluntary deductions authorized by each employee. Why is the reconciliation of payroll liabilities so important?. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. What should you know about your liabilities, specially accrued liabilities?

What is the Difference Between Payroll Expenses and Payroll Liabilities

Why is the reconciliation of payroll liabilities so important?. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. Net pay and withholding liabilities. What should you know about your liabilities, specially accrued liabilities? Payroll withholdings include required and voluntary deductions authorized by each employee.

Net Pay And Withholding Liabilities.

Why is the reconciliation of payroll liabilities so important?. Salaries and wages payable are classified as current liabilities on the balance sheet, as they are typically settled within a. If you prepare a balance sheet for your business, you’ll record payroll liabilities as wages payable and taxes payable under current liabilities. What should you know about your liabilities, specially accrued liabilities?

Payroll Withholdings Include Required And Voluntary Deductions Authorized By Each Employee.

Payroll liabilities are amounts an employer owes to employees, government agencies, or other.