Online Tax Calendar - Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Which irs tax dates do i need to remember? 2024 individual tax returns due — most taxpayers have until april 15 to file tax. Access the calendar online from your mobile device or desktop. First quarter 2025 estimated tax payment due; Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. Learn more about income tax dates at h&r block. Use the irs tax calendar to view filing deadlines and actions each month.

Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. Which irs tax dates do i need to remember? Access the calendar online from your mobile device or desktop. 2024 individual tax returns due — most taxpayers have until april 15 to file tax. Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Learn more about income tax dates at h&r block. First quarter 2025 estimated tax payment due; Use the irs tax calendar to view filing deadlines and actions each month.

Learn more about income tax dates at h&r block. Which irs tax dates do i need to remember? Access the calendar online from your mobile device or desktop. First quarter 2025 estimated tax payment due; Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. Use the irs tax calendar to view filing deadlines and actions each month. 2024 individual tax returns due — most taxpayers have until april 15 to file tax.

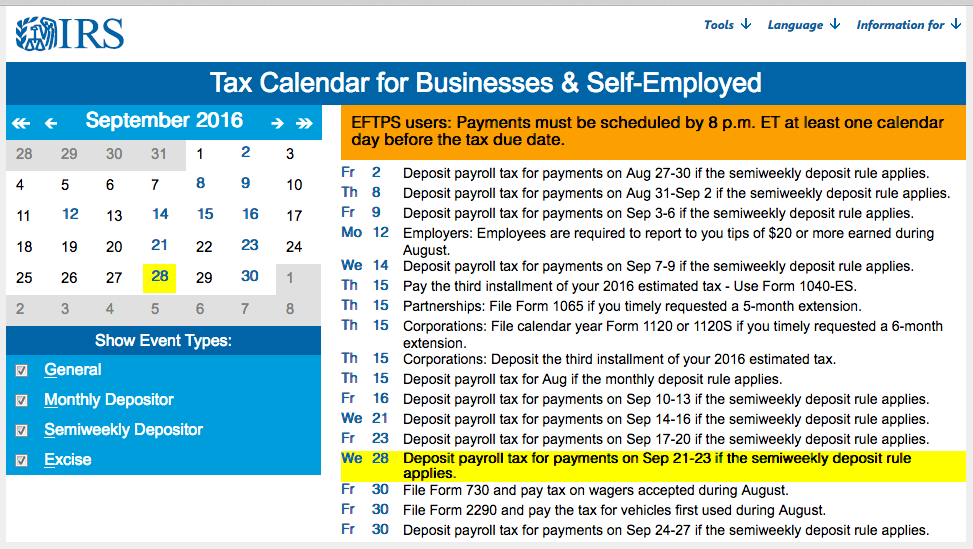

Tax Calendar Accounting Services Tucson

Use the irs tax calendar to view filing deadlines and actions each month. 2024 individual tax returns due — most taxpayers have until april 15 to file tax. Maximize tax savings and minimize fees and penalties with a personalized tax calendar. First quarter 2025 estimated tax payment due; Learn more about income tax dates at h&r block.

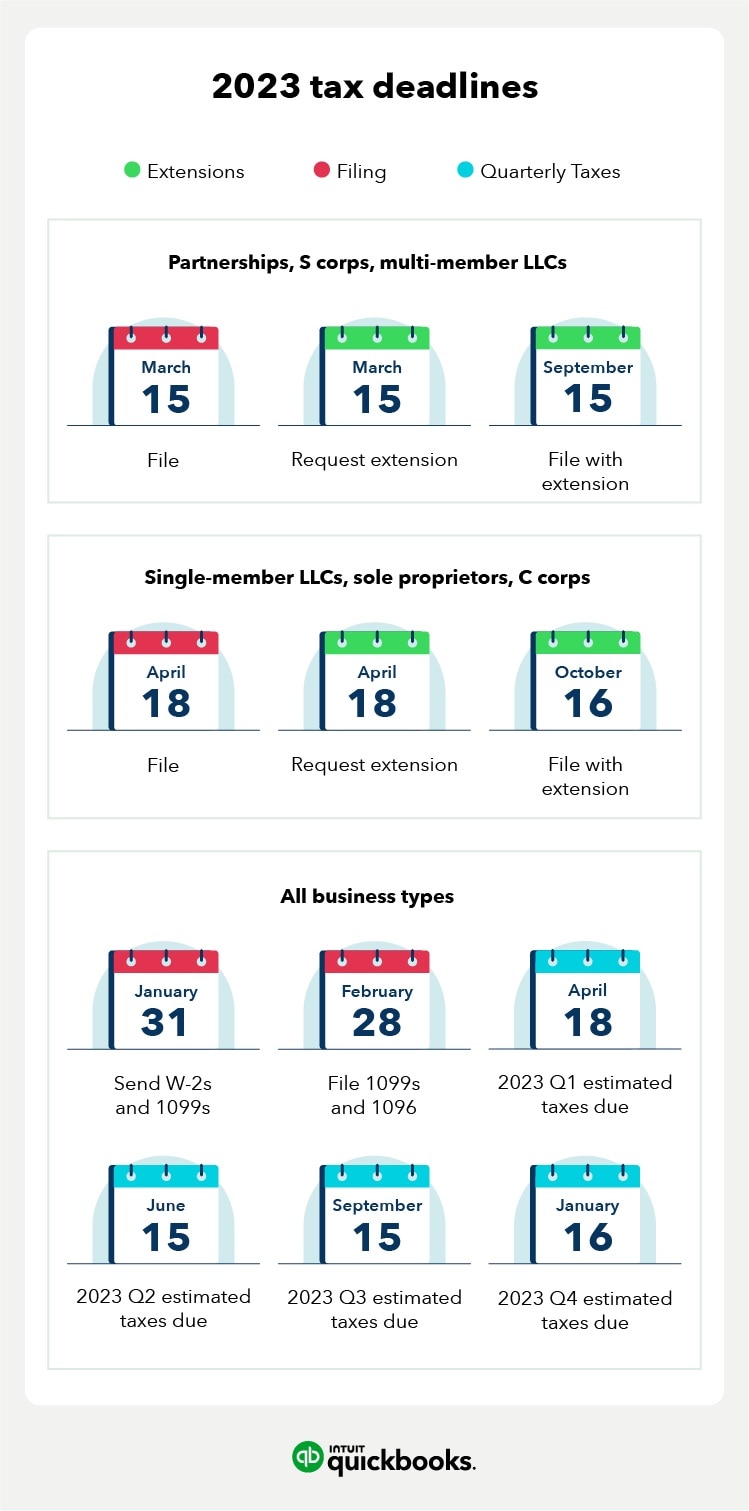

Fillable Online Tax Calendar 2023 Fax Email Print pdfFiller

Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. 2024 individual tax returns due — most taxpayers have until april 15 to file tax. Learn more about income tax dates at h&r block. Use the.

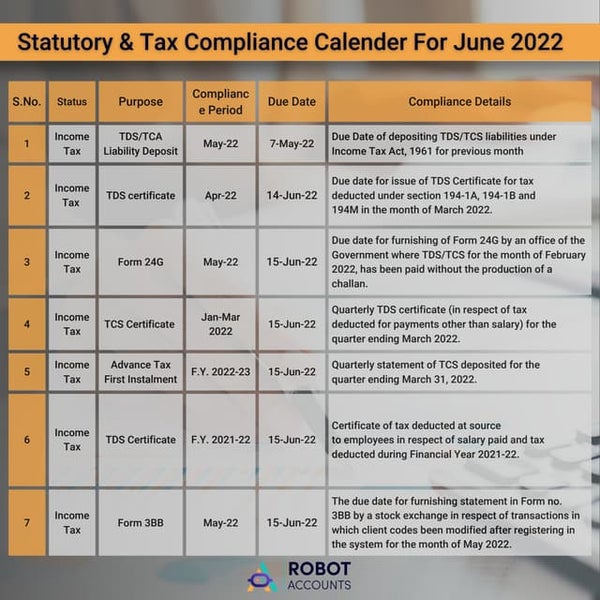

Statutory & Tax Compliance Calendar (1).pdf

Learn more about income tax dates at h&r block. Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Access the calendar online from your mobile device or desktop. 2024 individual tax returns due — most taxpayers have until april 15 to file tax. Use this calendar to help you avoid missing important deadlines, view important due.

2024 Tax Calendar Irs Channa Deloria

Access the calendar online from your mobile device or desktop. Use the irs tax calendar to view filing deadlines and actions each month. Which irs tax dates do i need to remember? Maximize tax savings and minimize fees and penalties with a personalized tax calendar. First quarter 2025 estimated tax payment due;

Tax Calendar pdfFiller

Learn more about income tax dates at h&r block. Which irs tax dates do i need to remember? First quarter 2025 estimated tax payment due; Maximize tax savings and minimize fees and penalties with a personalized tax calendar. 2024 individual tax returns due — most taxpayers have until april 15 to file tax.

IRS Tax Calendar for Businesses and SelfEmployed Irs taxes, Irs, Tax

Learn more about income tax dates at h&r block. Which irs tax dates do i need to remember? Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Access the calendar online from your mobile device.

Tax Calendar 2024Important Due Dates By IRS Markets Today US

2024 individual tax returns due — most taxpayers have until april 15 to file tax. First quarter 2025 estimated tax payment due; Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Access the calendar online from your mobile device or desktop. Which irs tax dates do i need to remember?

Calendars — PacificoTax

Which irs tax dates do i need to remember? 2024 individual tax returns due — most taxpayers have until april 15 to file tax. Learn more about income tax dates at h&r block. Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Access the calendar online from your mobile device or desktop.

Use the IRS tax calendar to view filing deadlines and actions each

Maximize tax savings and minimize fees and penalties with a personalized tax calendar. Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. Learn more about income tax dates at h&r block. Access the calendar online from your mobile device or desktop. 2024 individual tax returns due — most.

Tax Calendar 2023 Full list of due dates and activities to be

Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. First quarter 2025 estimated tax payment due; Access the calendar online from your mobile device or desktop. Which irs tax dates do i need to remember? 2024 individual tax returns due — most taxpayers have until april 15 to.

2024 Individual Tax Returns Due — Most Taxpayers Have Until April 15 To File Tax.

First quarter 2025 estimated tax payment due; Which irs tax dates do i need to remember? Learn more about income tax dates at h&r block. Access the calendar online from your mobile device or desktop.

Use The Irs Tax Calendar To View Filing Deadlines And Actions Each Month.

Use this calendar to help you avoid missing important deadlines, view important due dates and actions for key filing deadlines each. Maximize tax savings and minimize fees and penalties with a personalized tax calendar.