Is Unearned Revenue On The Balance Sheet - Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is a key element of this approach, representing income received but not yet earned. However, at the end of the first month, the. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance.

Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. However, at the end of the first month, the. Unearned revenue is a key element of this approach, representing income received but not yet earned.

Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is a key element of this approach, representing income received but not yet earned. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. However, at the end of the first month, the.

What Is Unearned Revenue? A Definition and Examples for Small Businesses

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is a key element of this approach, representing income received but not yet earned. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Unearned revenue is.

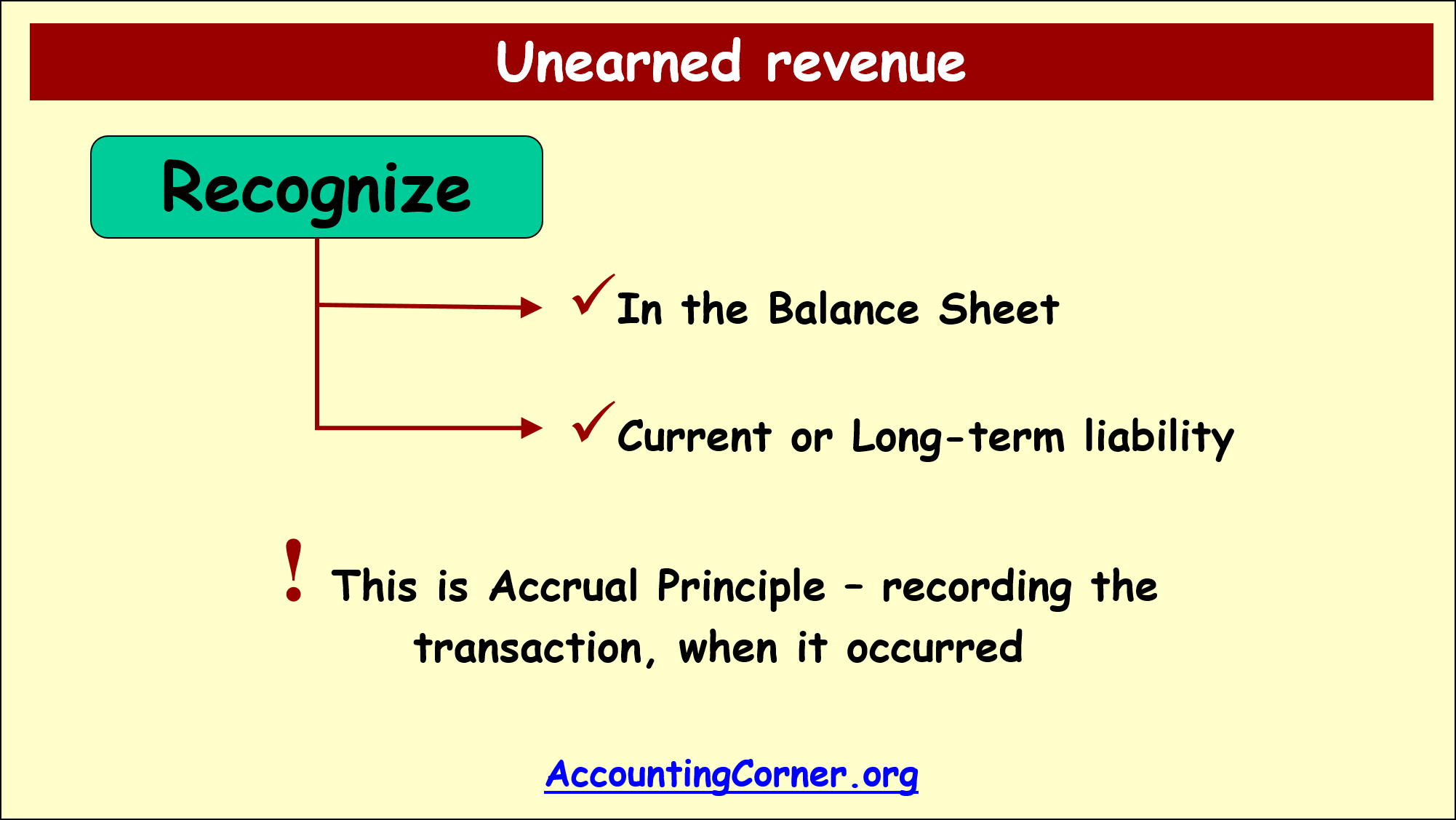

Unearned Revenue Balance Sheet Ppt Powerpoint Presentation Professional

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. However, at the end of the first month, the. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Unearned revenue is the number of advance payments which the.

Unearned revenue examples and journal entries Financial

Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Unearned revenue is a key element of this approach, representing income received but not yet earned. However, at the end of the first month, the. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents.

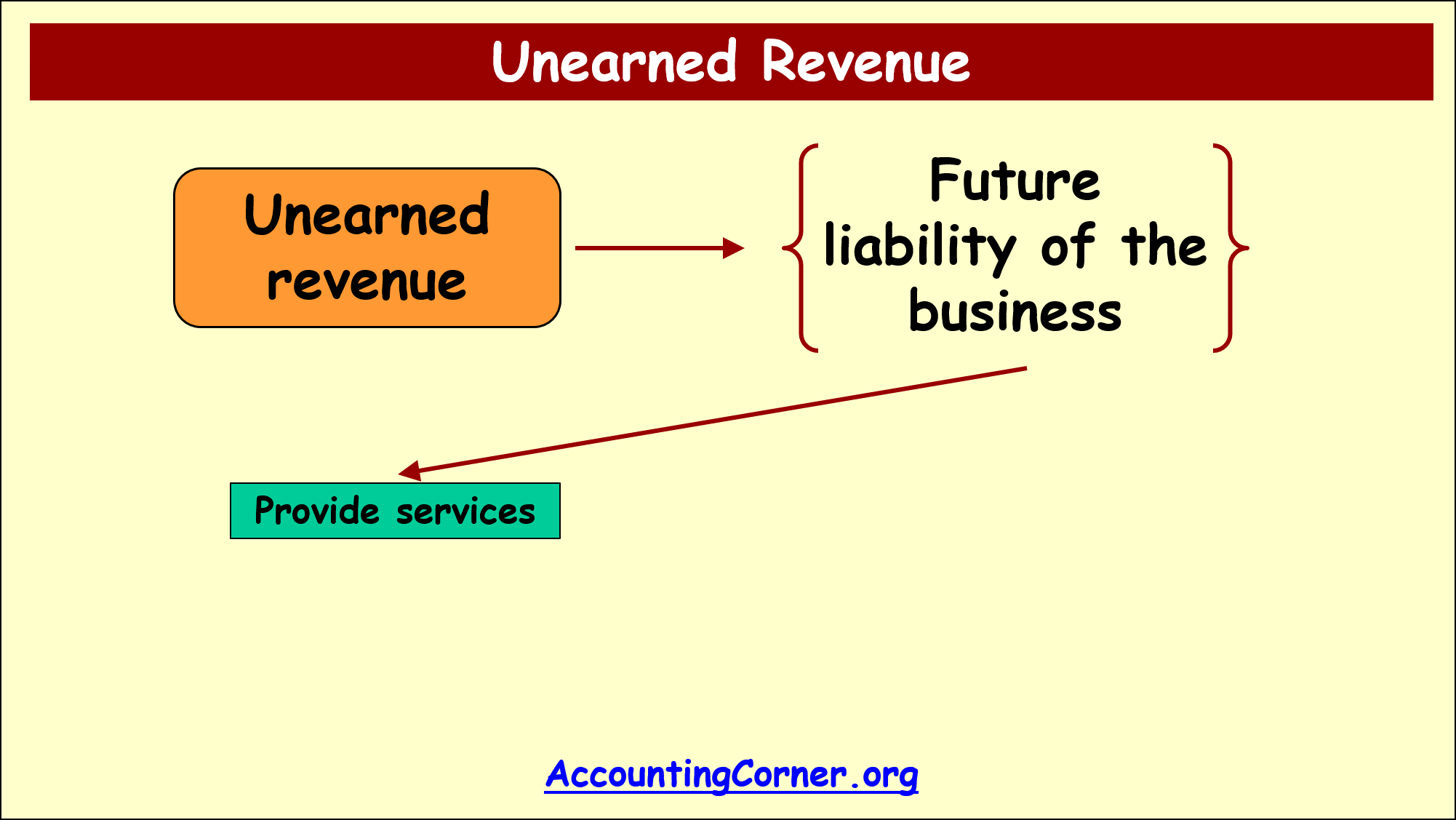

Unearned Revenue Accounting Corner

Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is a key element of this approach, representing income received but not yet earned. Unearned revenue is recorded as a.

Unearned Revenue Balance Sheet Ppt Powerpoint Presentation Gallery

Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is a key element of this approach, representing income received but not yet earned. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. However, at the end of the first month, the. Unearned.

What is Unearned Revenue? QuickBooks Canada Blog

However, at the end of the first month, the. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt.

Unearned Revenue (Sales) on Balance Sheet Example Journal Entries

Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is a key element of this approach, representing income received but not yet earned. Unearned revenue is the number of advance payments which.

Unearned Revenue Accounting Corner

Unearned revenue is a key element of this approach, representing income received but not yet earned. However, at the end of the first month, the. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer. Unearned revenue is recorded as a liability on the balance sheet initially in the.

What is Unearned Revenue? QuickBooks Australia

However, at the end of the first month, the. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Unearned revenue is a key element of this approach, representing income received but not yet earned. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents.

Unearned Revenue Definition

However, at the end of the first month, the. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue is recorded as a liability on the balance sheet initially in the event of receiving payment in advance. Initially, the full amount will be recognized.

However, At The End Of The First Month, The.

Unearned revenue is a key element of this approach, representing income received but not yet earned. Initially, the full amount will be recognized as unearned revenue on amazon’s balance sheet. Unearned revenue is the number of advance payments which the company has received for the goods or services which are still pending for the. Unearned revenue is recorded on a company’s balance sheet as a liability because it represents a debt owed to the customer.

:max_bytes(150000):strip_icc()/Morningstar_-0a37a99b3a0744b6bdf3986e5bdb325b.png)