How To Calculate Share Value From Balance Sheet - As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from. Calculating the share price from a company’s balance sheet is an essential skill. The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating share price from the balance sheet. Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a.

As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from. Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. Calculating share price from the balance sheet. The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. Calculating the share price from a company’s balance sheet is an essential skill. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of.

The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. Calculating share price from the balance sheet. Calculating the share price from a company’s balance sheet is an essential skill. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a.

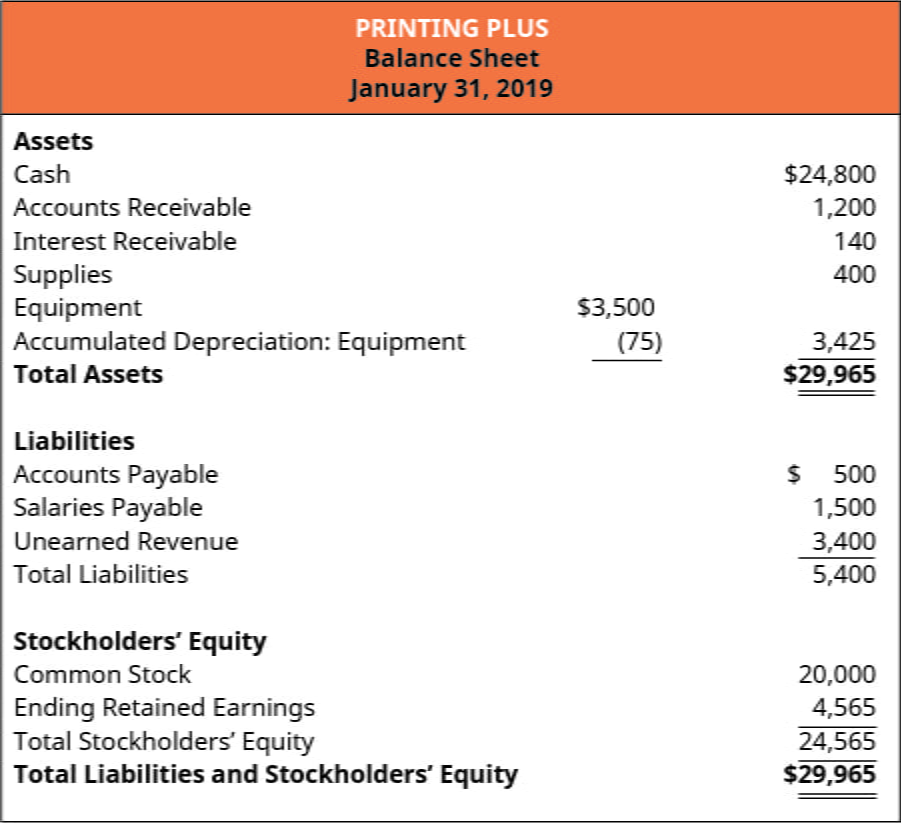

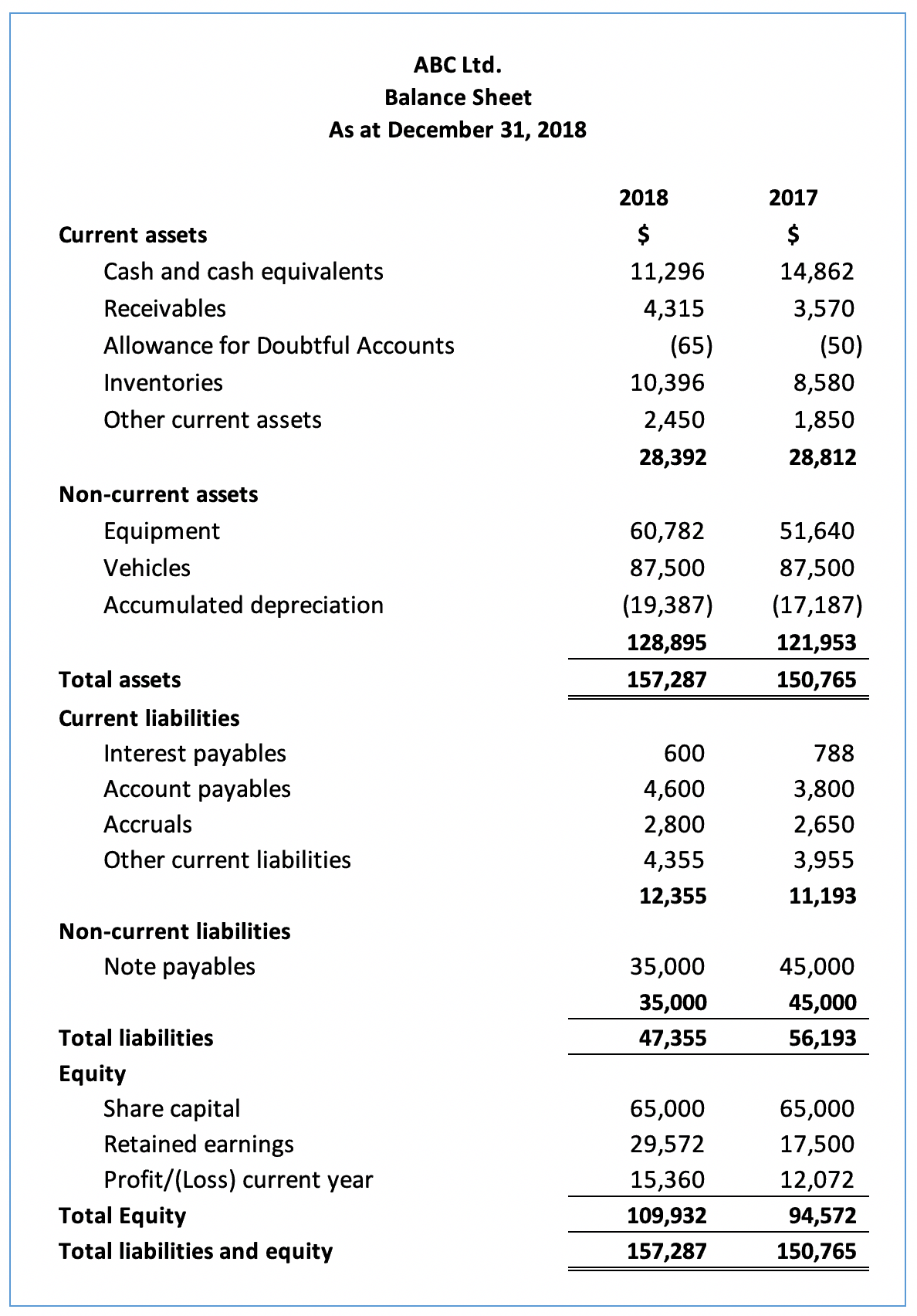

Balance Sheet Formula Assets = Liabilities + Equity

The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating the share price from a company’s balance sheet is an essential skill. Calculating share.

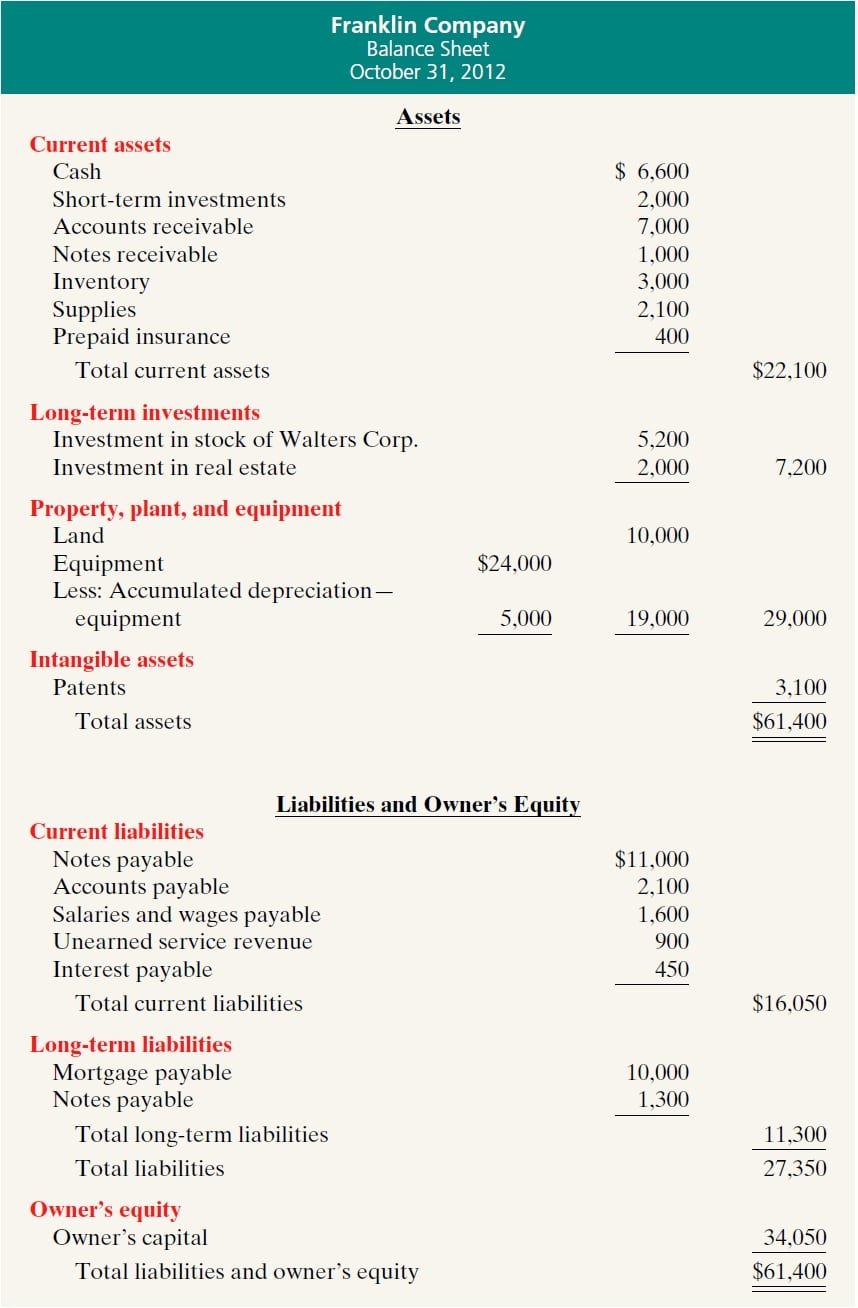

how to calculate share value from balance sheet Solved hartzog

Calculating the share price from a company’s balance sheet is an essential skill. Calculating share price from the balance sheet. The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. Calculating book value per share involves using information from the balance sheet to determine the net worth of a.

How to calculate Earning per share (EPS) from Balance Sheet ? YouTube

Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating the share price from a company’s balance sheet is an essential skill. As.

How to Calculate Common Stock Outstanding From a Balance Sheet The

The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. Calculating share price from the balance sheet. Calculating the share price from a company’s balance sheet is.

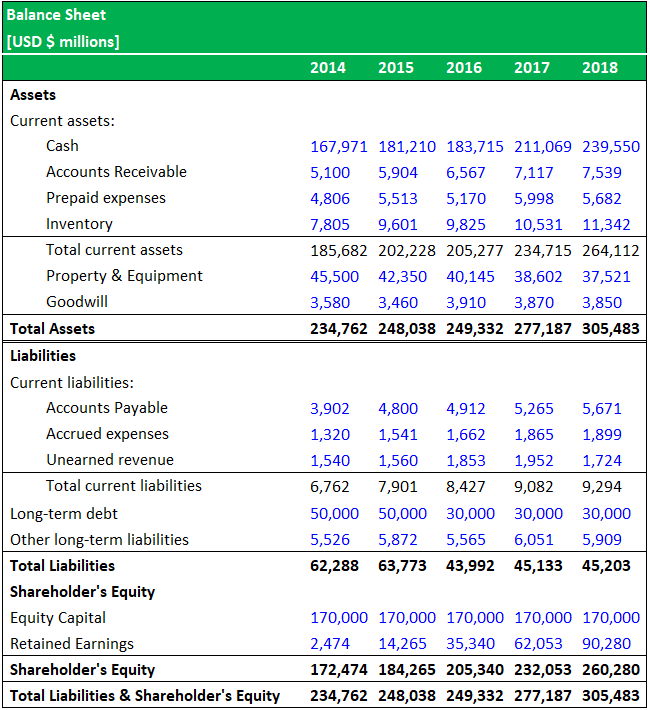

Calculating the Value of Balance Sheets Bizfluent

Calculating share price from the balance sheet. The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from. Calculating the share price from a company’s balance sheet is an essential.

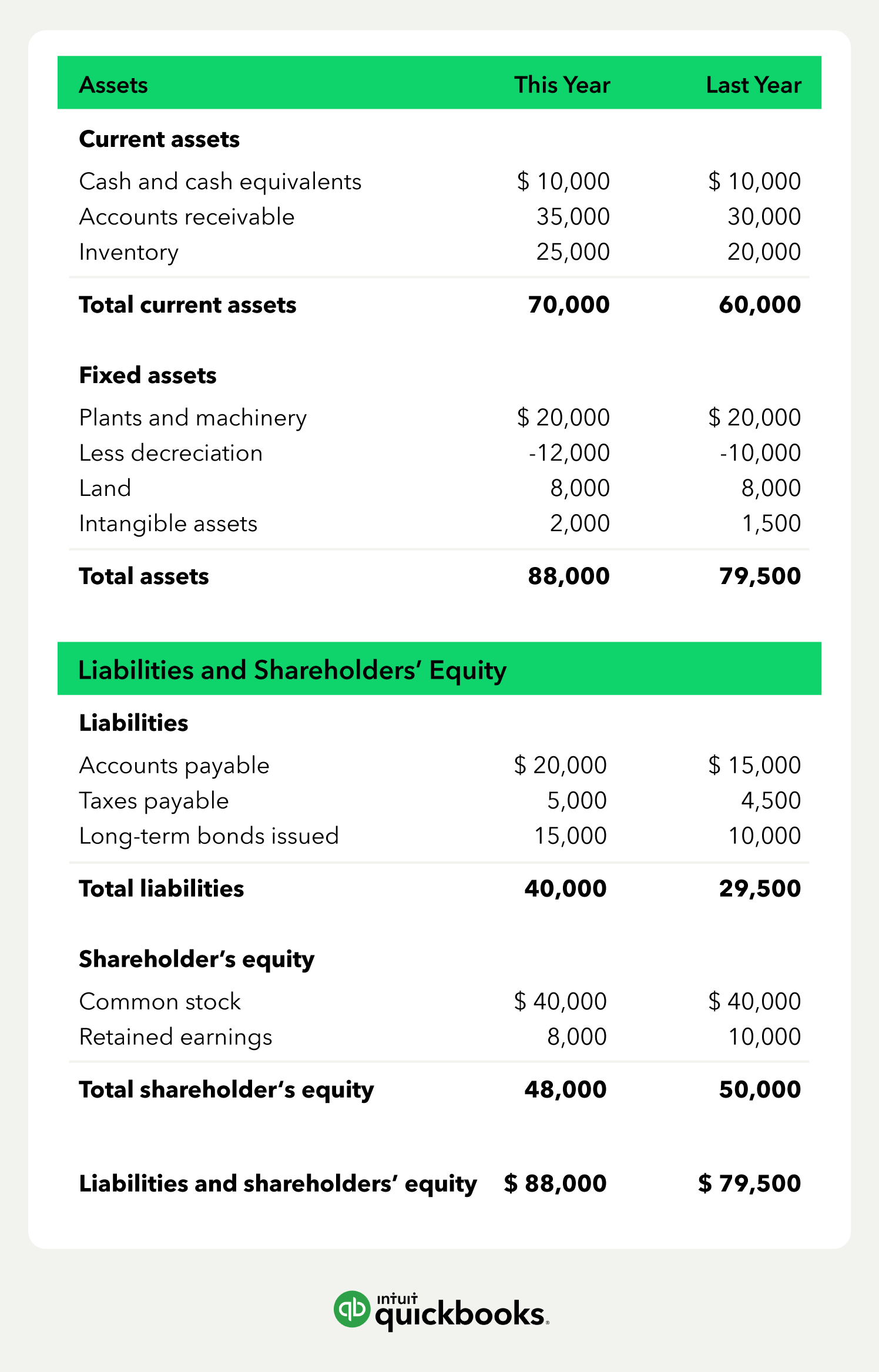

How to Read & Prepare a Balance Sheet QuickBooks

If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from. Calculating share price from the balance sheet. The equity value per share derived from the dcf.

how to calculate share value from balance sheet Solved hartzog

Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating share price from the balance sheet. The equity value per share derived from.

Common Stock in Balance Sheet Financial

Calculating share price from the balance sheet. Calculating the share price from a company’s balance sheet is an essential skill. Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet.

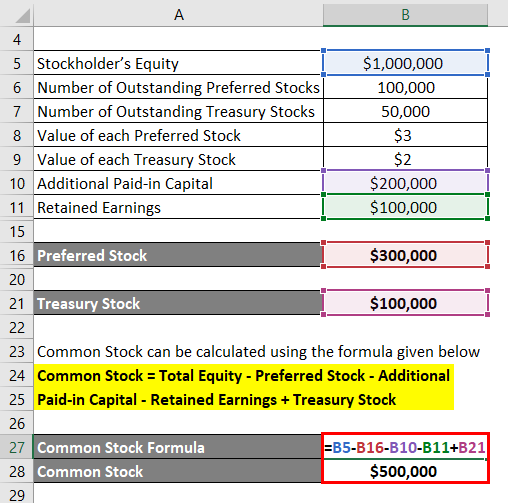

Common Stock Formula Calculator (Examples with Excel Template)

If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating the share price from a company’s balance sheet is an essential skill. Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. As.

Balance Sheet Ratios Types Formula Example Accountinguide

The equity value per share derived from the dcf model is $11.25, which we calculated by dividing the implied equity value. As suggested by the name, the “book” value per share calculation begins with finding the necessary balance sheet data from. Calculating the share price from a company’s balance sheet is an essential skill. Calculating book value per share involves.

As Suggested By The Name, The “Book” Value Per Share Calculation Begins With Finding The Necessary Balance Sheet Data From.

Calculating book value per share involves using information from the balance sheet to determine the net worth of a company on a. Calculating share price from the balance sheet. If you're considering buying a stock, you can refer to the organization's balance sheet to calculate how the current price of a share of. Calculating the share price from a company’s balance sheet is an essential skill.