Development Cost In Balance Sheet - The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and.

If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and.

If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational.

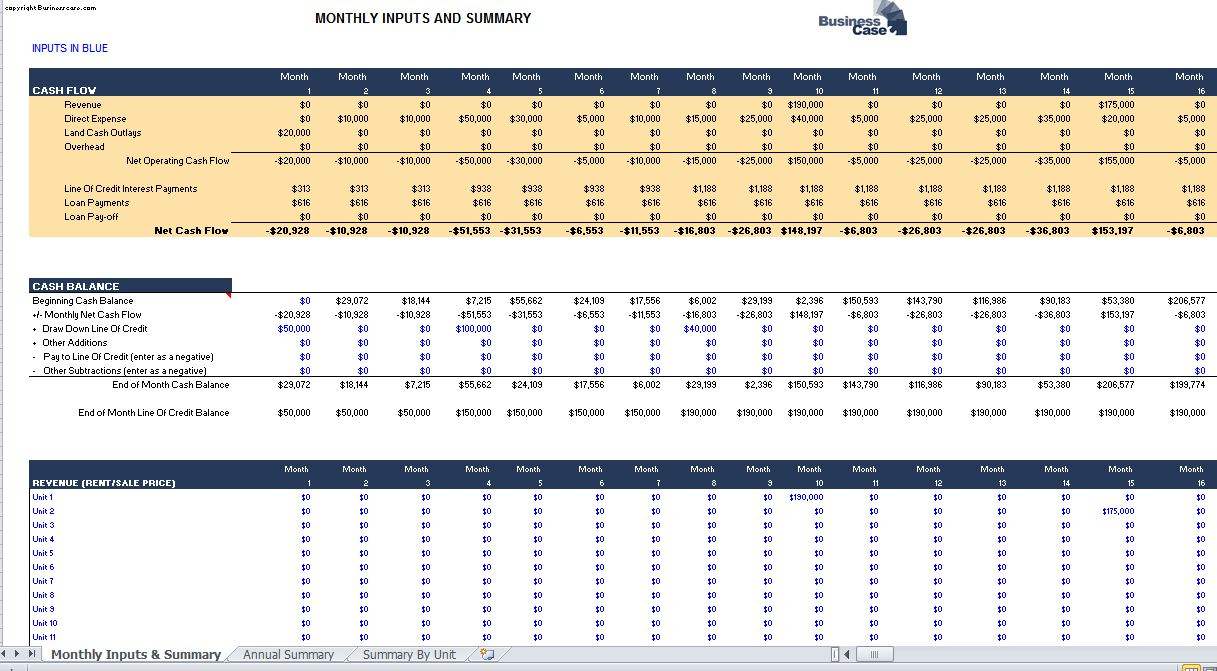

Research and Development Cost Model Plan Projections

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. Capitalized r&d costs.

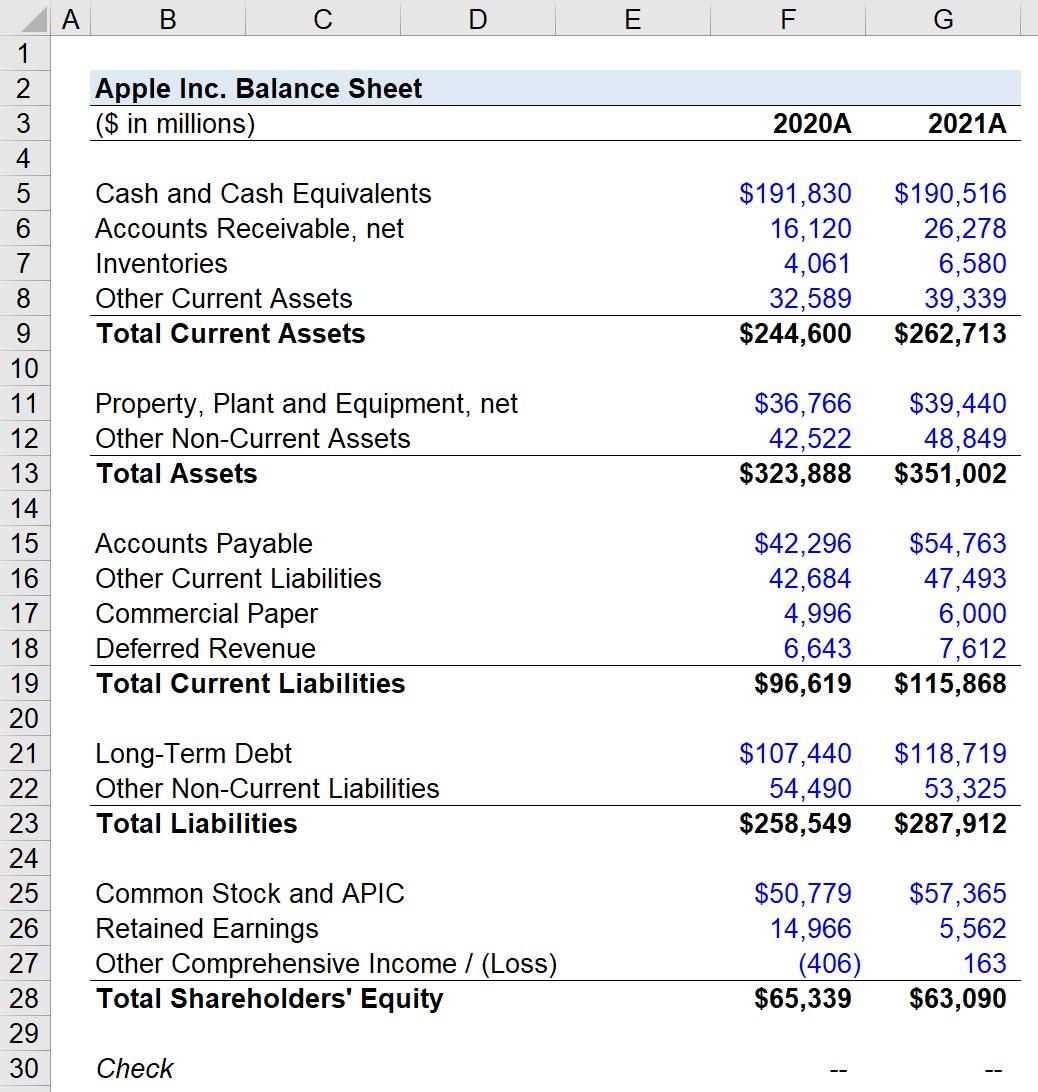

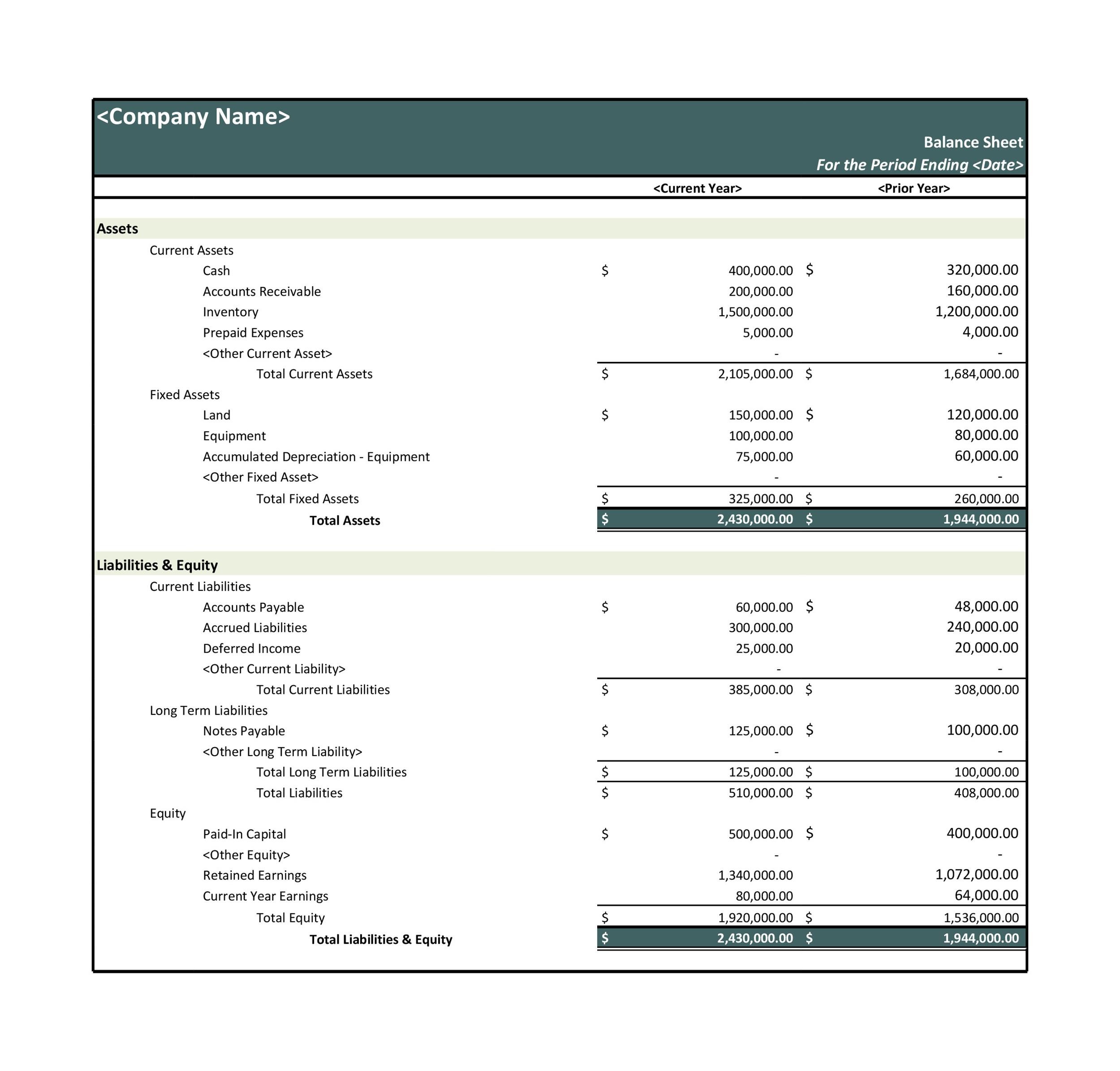

What Are The Two Parts Of A Balance Sheet at Dennis Fleming blog

Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. The.

How to Understand Your Balance Sheet A Beginner's Guide 2025

Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. The decision.

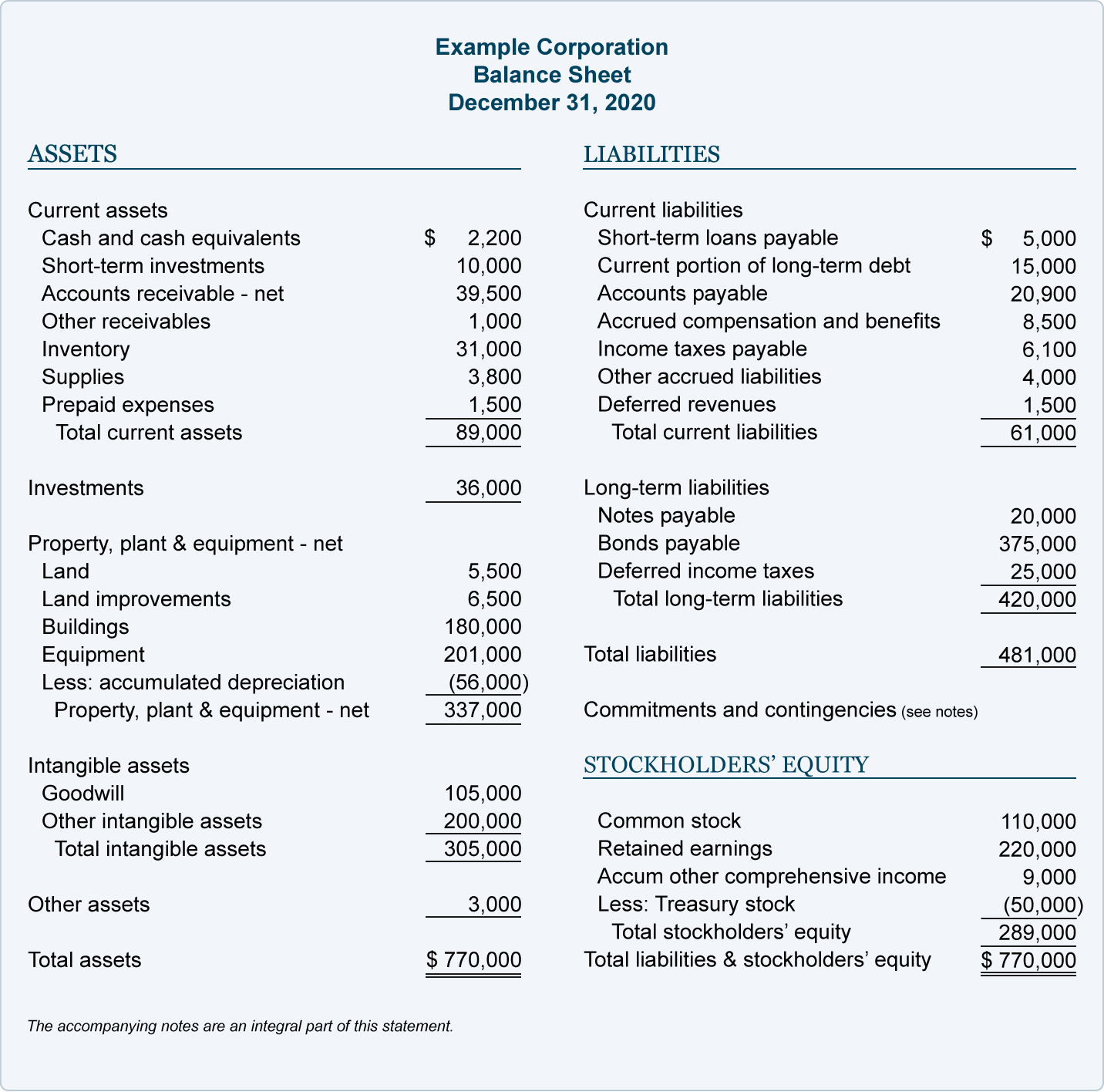

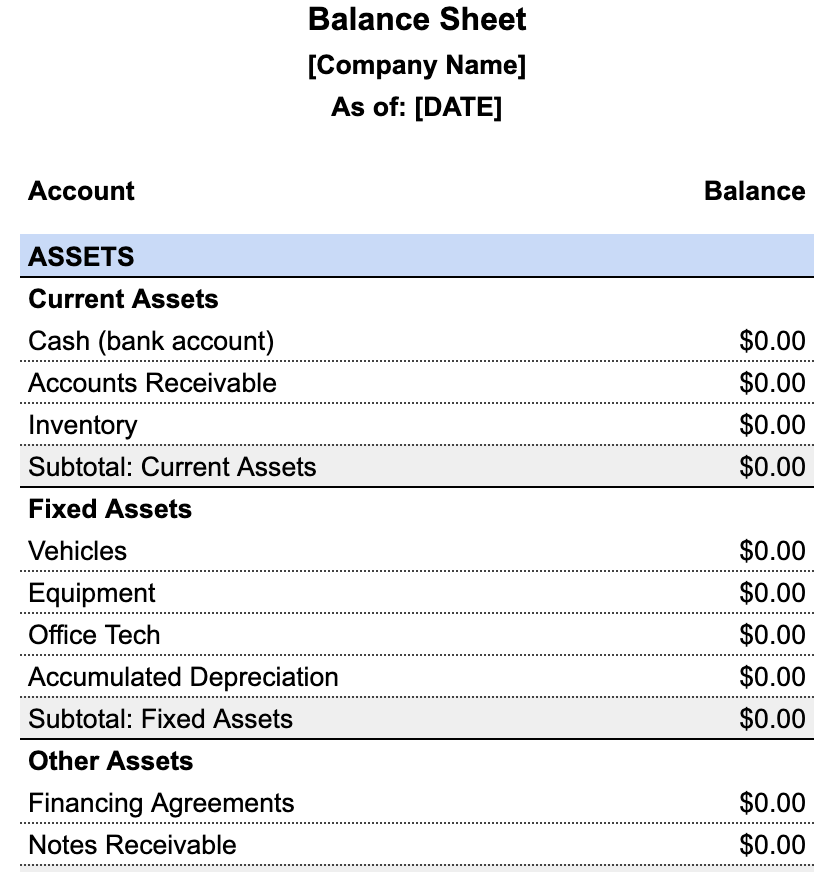

The Balance Sheet A Howto Guide for Businesses

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. If.

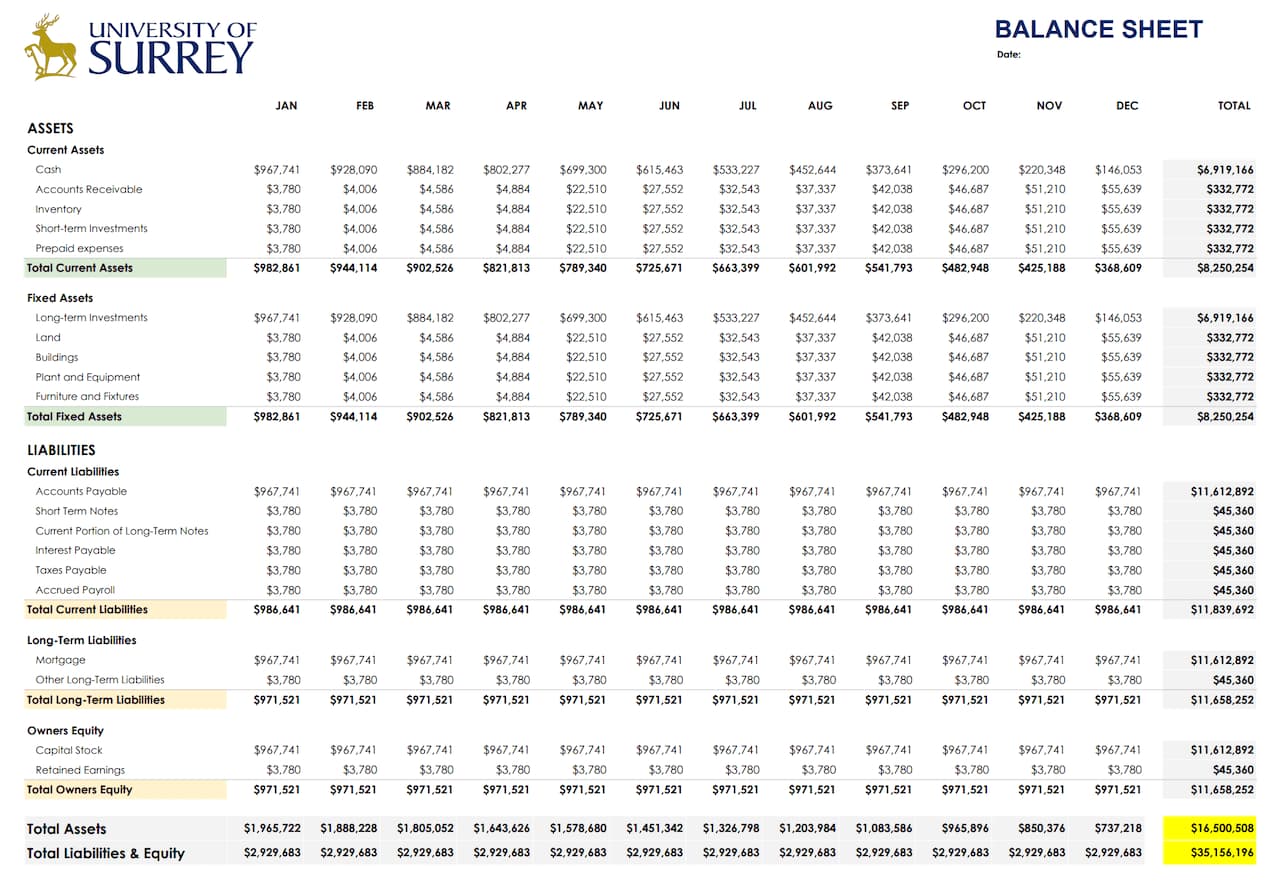

Monthly Balance Sheet Template

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. Development costs.

Property Development Costs Spreadsheet

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and..

balance sheet,balance point 伤感说说吧

Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Research.

The Product Development Process How to Create a New Product

Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If.

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation

The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. Research and.

Balance Sheet Format for Construction Company in Excel

Development costs are considered intangible assets on the balance sheet until the project they are associated with becomes operational. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Capitalized r&d.

Development Costs Are Considered Intangible Assets On The Balance Sheet Until The Project They Are Associated With Becomes Operational.

Research and development (r&d) costs need to be considered to determine whether they should be capitalized or expensed as. The decision to capitalize or expense r&d costs is a significant one, impacting a company’s financial statements and tax. Capitalized r&d costs appear on the balance sheet as intangible assets, boosting asset values and improving metrics such as roa and. If computer software is acquired for use in a research and development project, charge its cost to expense as incurred.