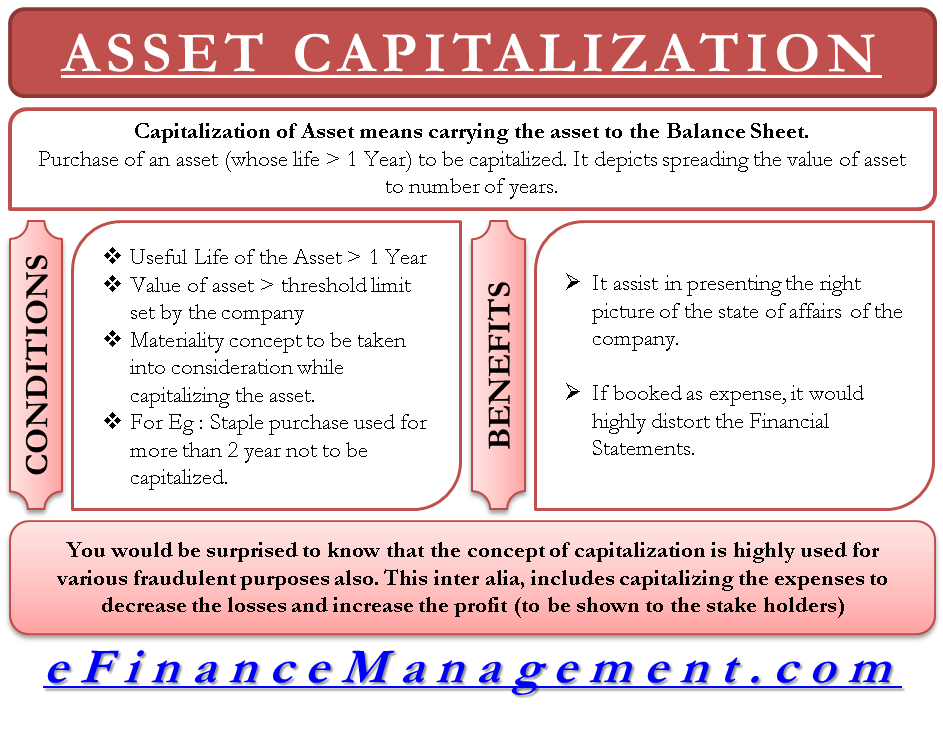

Capitalizing Items Onto The Balance Sheet - In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. An item is capitalized when it is recorded as an asset, rather than an expense. Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. What is capitalize in accounting? Rather than recording it as a one. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense.

In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. Rather than recording it as a one. What is capitalize in accounting? Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. An item is capitalized when it is recorded as an asset, rather than an expense. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense.

Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. Rather than recording it as a one. An item is capitalized when it is recorded as an asset, rather than an expense. What is capitalize in accounting? Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense.

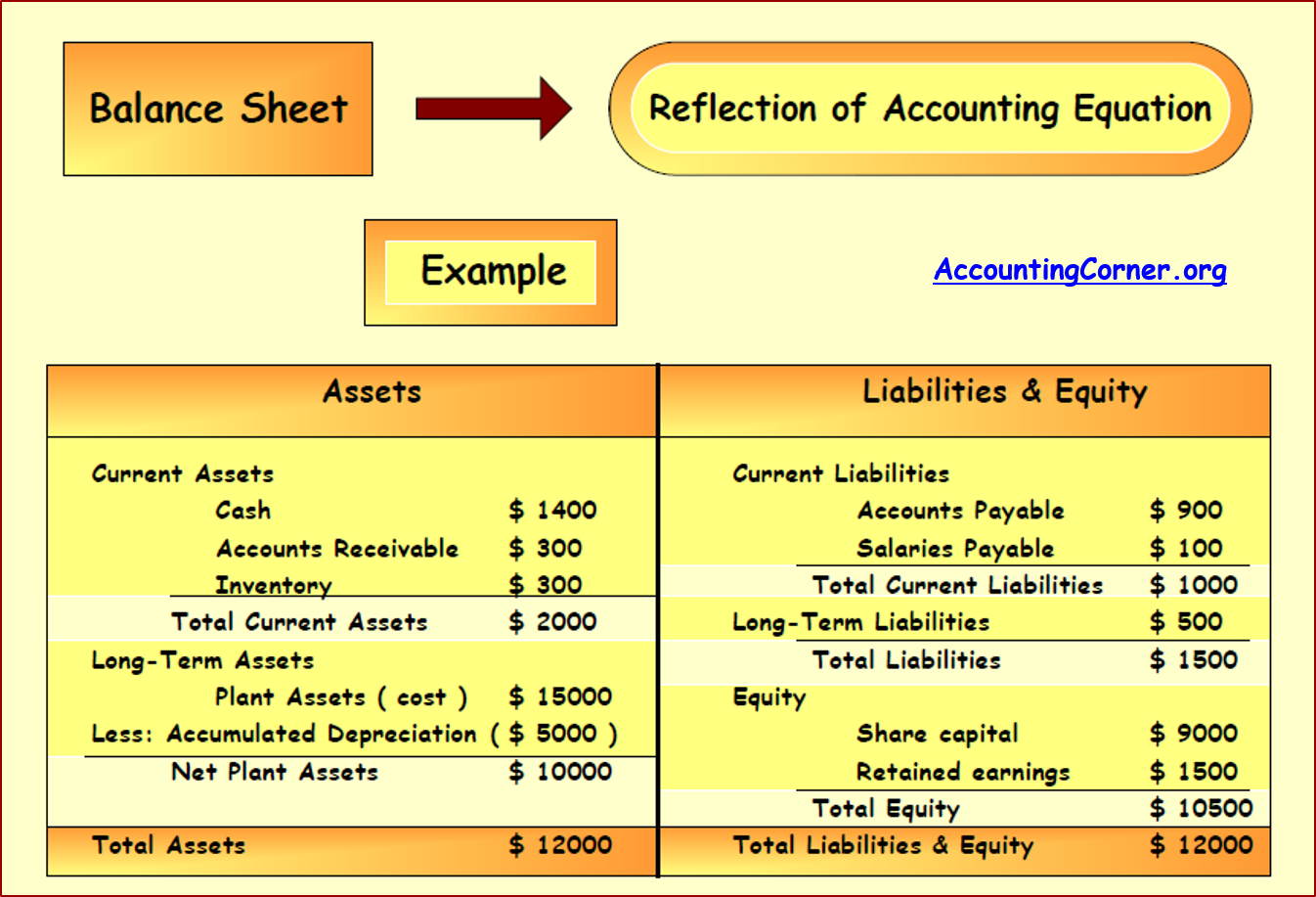

Balance sheet example track assets and liabilities

Rather than recording it as a one. In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. An item is capitalized when it is recorded as an asset, rather than an expense. What.

Balance Sheet Definition Formula & Examples

What is capitalize in accounting? In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. An item is capitalized when it is recorded as an asset, rather than an expense. Rather than recording it as a one. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than.

What Are The Two Parts Of A Balance Sheet at Dennis Fleming blog

An item is capitalized when it is recorded as an asset, rather than an expense. What is capitalize in accounting? Rather than recording it as a one. Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. In accountancy, capitalization means recording a cash outflow as an asset.

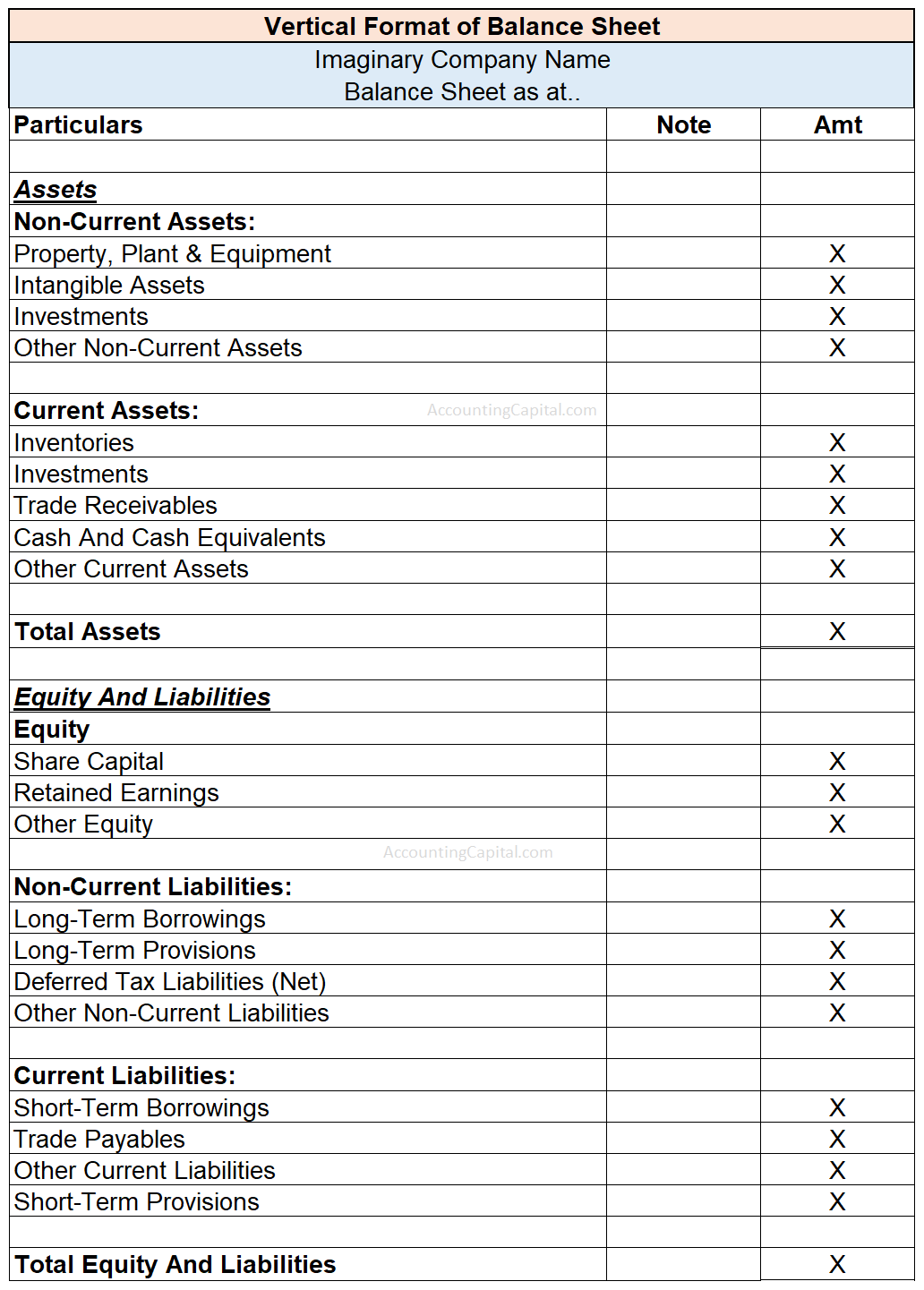

Format of Balance Sheet (explained with pdf) Accounting Capital

Rather than recording it as a one. An item is capitalized when it is recorded as an asset, rather than an expense. In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. What is capitalize in accounting? Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than.

Classified Balance Sheet Accounting Corner

Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. An item is capitalized when it is recorded as an asset, rather than an expense. What is capitalize in accounting? Rather than recording.

Capitalizing R&D Expenses How to Do It and Its Effect on Valuation

An item is capitalized when it is recorded as an asset, rather than an expense. Rather than recording it as a one. What is capitalize in accounting? In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than.

Balance Sheet Items

What is capitalize in accounting? Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense. An item is capitalized when it is recorded as an asset, rather than an expense. Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated.

Financial Accounting Page 4 of 7

In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet. An item is capitalized when it is recorded as an asset, rather than an expense. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense. Capitalization in finance refers to the process of converting an.

Beginner's Guide To Understanding Your Balance Sheet (1) Elements Of

An item is capitalized when it is recorded as an asset, rather than an expense. Rather than recording it as a one. Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. Capitalization in the context of accounting refers to the recording of a cost as an asset,.

38 Free Balance Sheet Templates & Examples Template Lab

Rather than recording it as a one. Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense. What is capitalize in accounting? An item is capitalized when it.

An Item Is Capitalized When It Is Recorded As An Asset, Rather Than An Expense.

Capitalization in finance refers to the process of converting an expense into an asset that will be amortized or depreciated over time. Capitalization in the context of accounting refers to the recording of a cost as an asset, rather than an expense. Rather than recording it as a one. In accountancy, capitalization means recording a cash outflow as an asset in the balance sheet.

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)