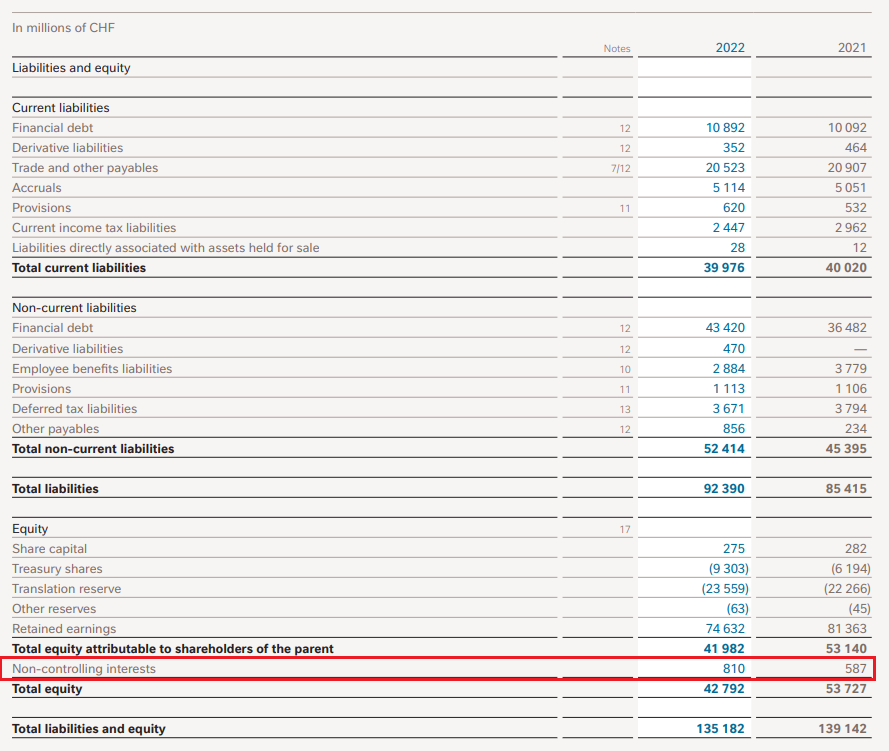

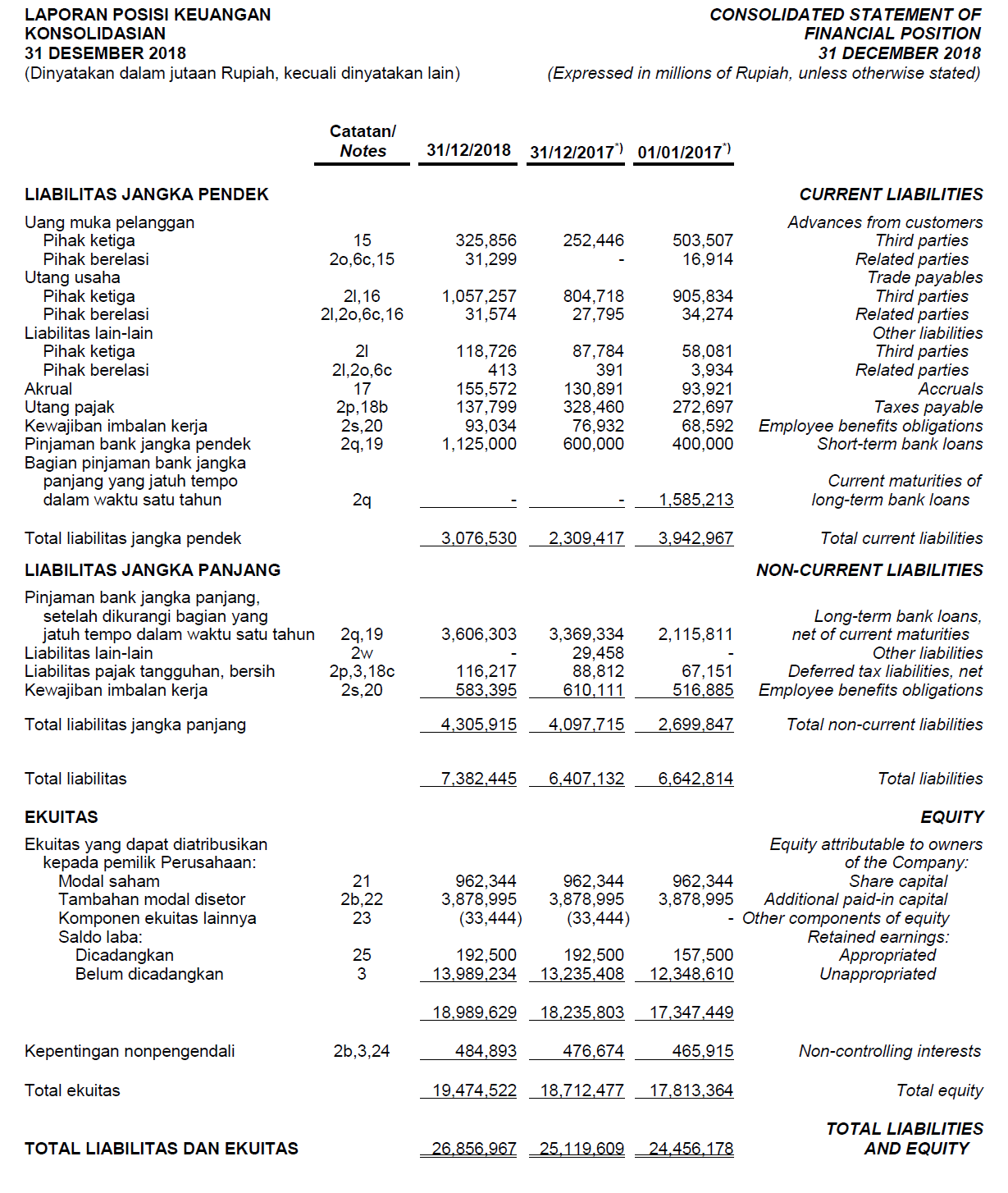

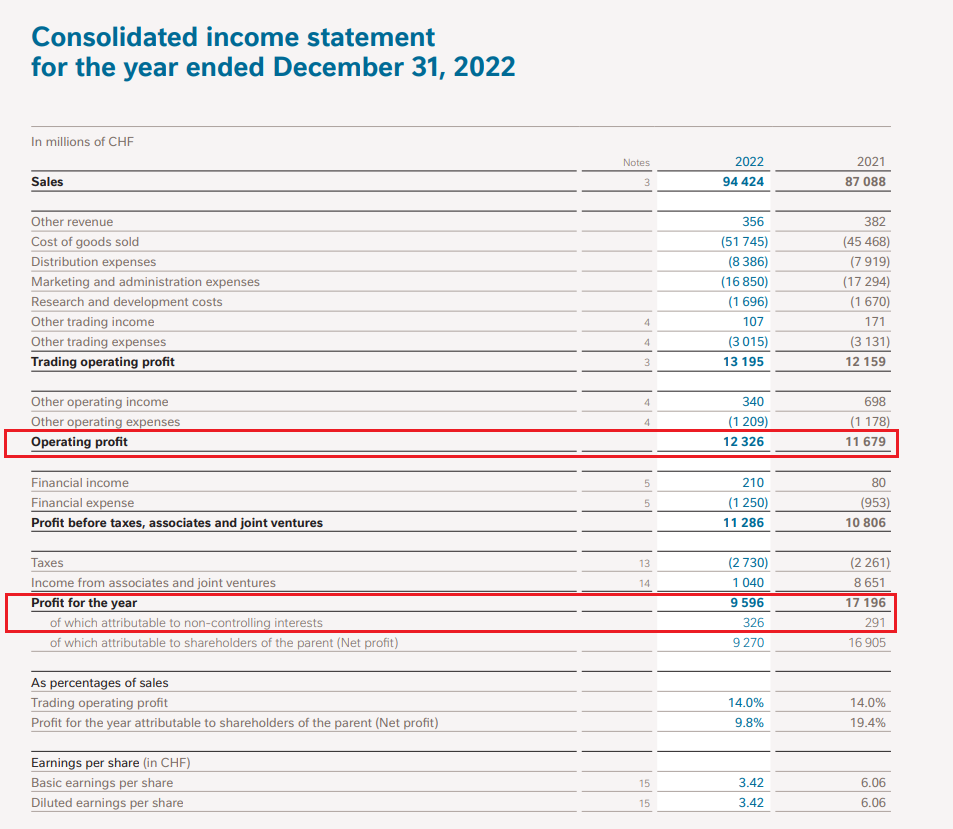

Balance Sheet Minority Interest - As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. How is a minority interest reported? Under international financial reporting standards (ifrs), minority interest is shown at. When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and.

Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. How is a minority interest reported? Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. Under international financial reporting standards (ifrs), minority interest is shown at.

Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. Under international financial reporting standards (ifrs), minority interest is shown at. How is a minority interest reported? When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap.

Minority Interest in Enterprise Value Guide, Example, Formula Wall

How is a minority interest reported? Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. When a company owns more than 50% (but less than 100%) of a subsidiary, the company records.

Minority Interest AwesomeFinTech Blog

How is a minority interest reported? Under international financial reporting standards (ifrs), minority interest is shown at. Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. When a company owns more than 50% (but less.

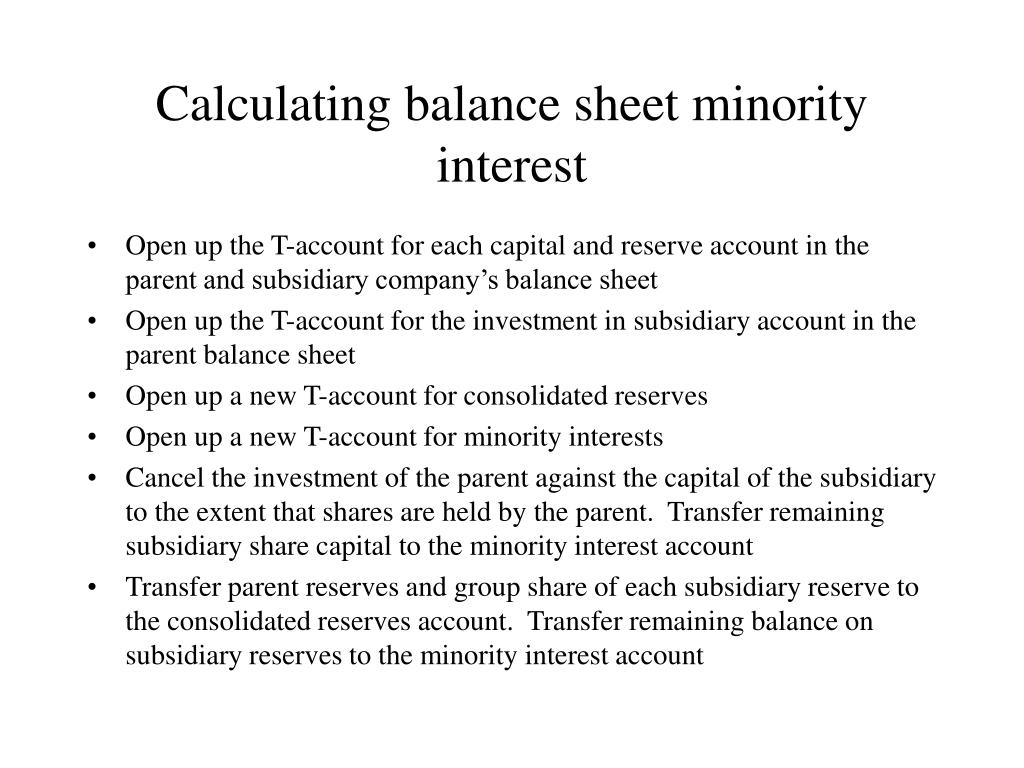

PPT Balance sheet consolidation adjustments PowerPoint Presentation

As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. How is a minority interest reported? When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. Noncontrolling interests, formerly known as minority interests, seem to be.

Minority Interest

Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. Under.

Minority Interest in Enterprise Value Guide, Example, Formula Wall

Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. How is a minority interest reported? As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. When.

Minority Interest Calculation Balance Sheet YouTube

When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. How is a minority interest reported? Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. As per ifrs, minority interest is shown under the equity section.

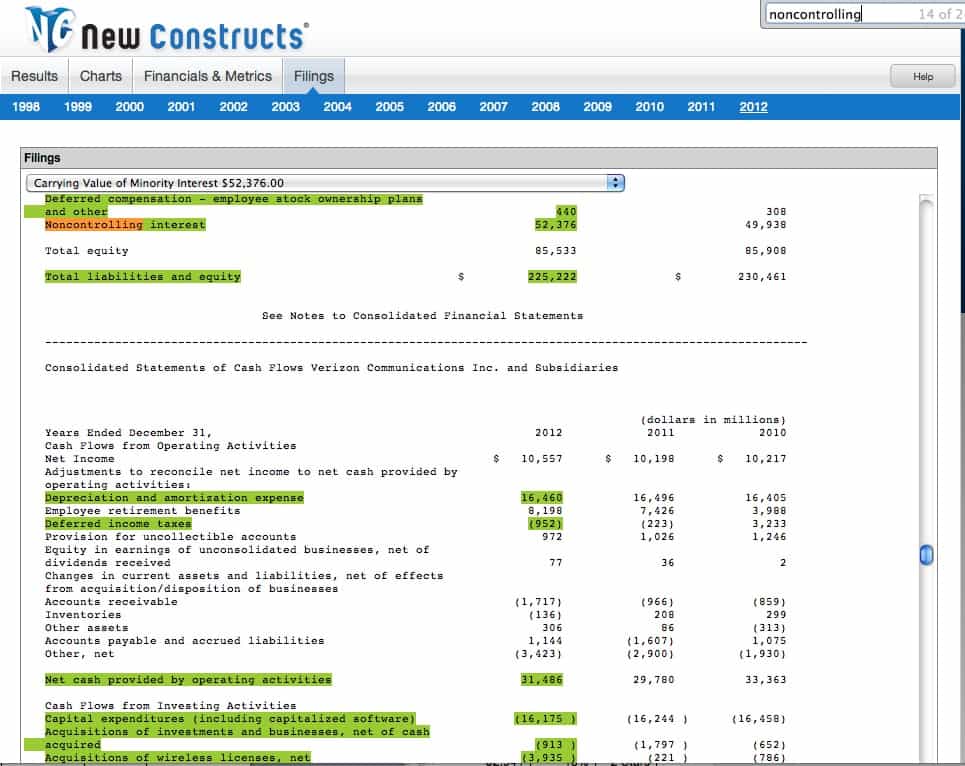

Minority Interests Seeking Alpha

When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. How is a minority interest reported? As per ifrs, minority interest is shown under the equity section.

What is Minority Interest? Definition Meaning Example

Under international financial reporting standards (ifrs), minority interest is shown at. As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. When a company owns more than 50% (but less than 100%) of.

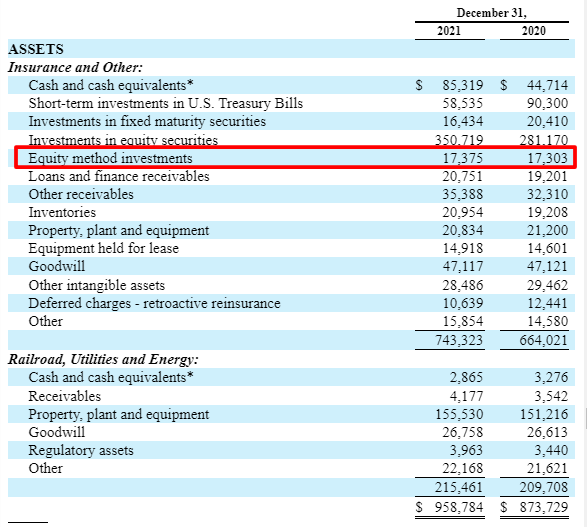

What is Minority Interest and How Do I Find It?

How is a minority interest reported? As per ifrs, minority interest is shown under the equity section of the consolidated balance sheet, whereas us gaap. Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100%.

Minority Interests Definition, Reporting In Financial Statements

Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting. Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. As.

Under International Financial Reporting Standards (Ifrs), Minority Interest Is Shown At.

When a company owns more than 50% (but less than 100%) of a subsidiary, the company records all 100% of the subsidiary’s revenue, costs, and. How is a minority interest reported? Understand the nuances of calculating and reporting minority interest in financial statements, including its role in. Noncontrolling interests, formerly known as minority interests, seem to be one of the most confusing topics in accounting.