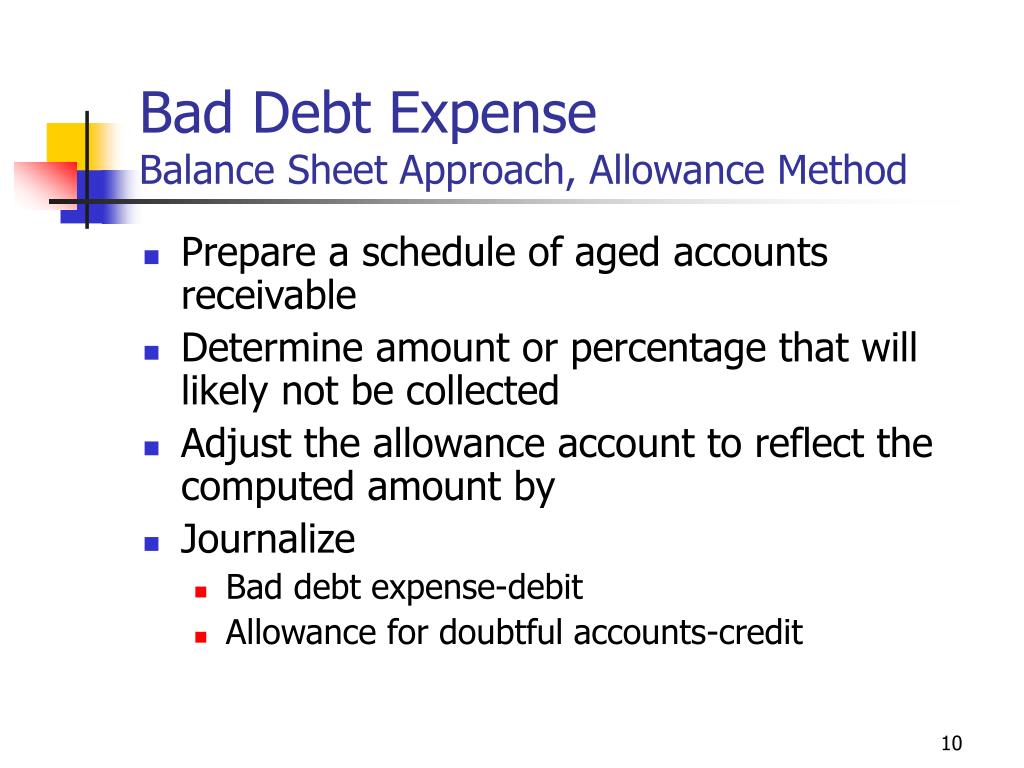

Balance Sheet Allowance For Bad Debt - The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

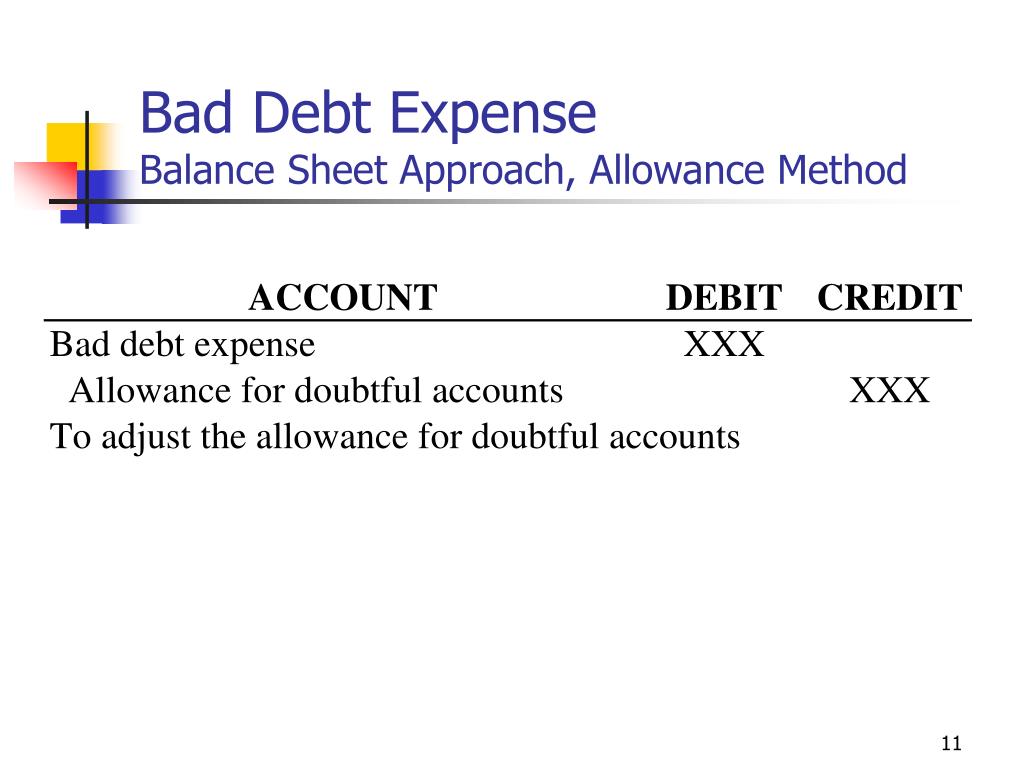

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be. The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts.

How to calculate and record the bad debt expense QuickBooks Australia

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

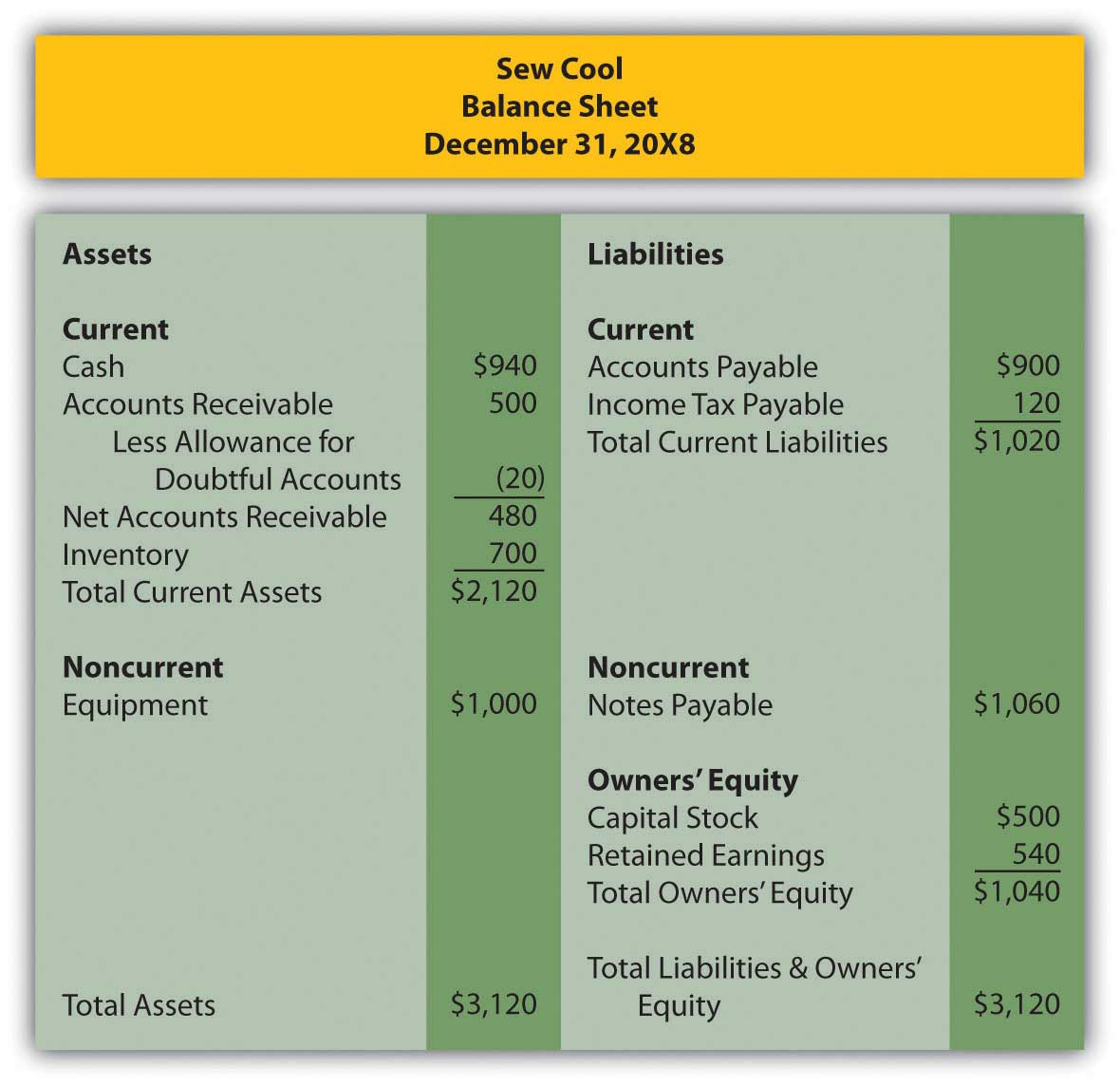

Airfield Align Mechanic bad debts in balance sheet Dictate Postage To adapt

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

Basics of Accounting/165/Where to show the Provision for Bad Debts in

The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be. The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts.

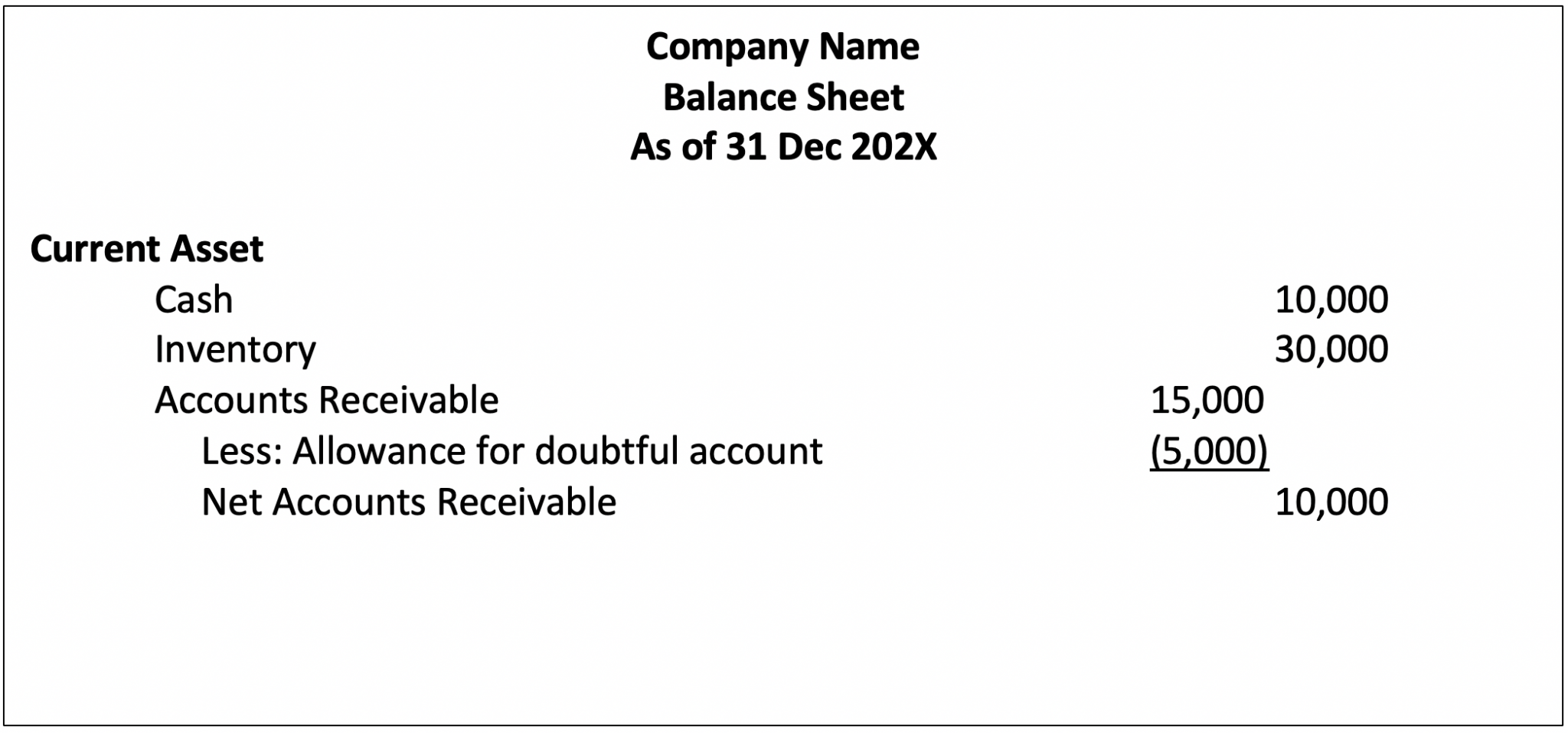

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

Allowance For Bad Debts

The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be. The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

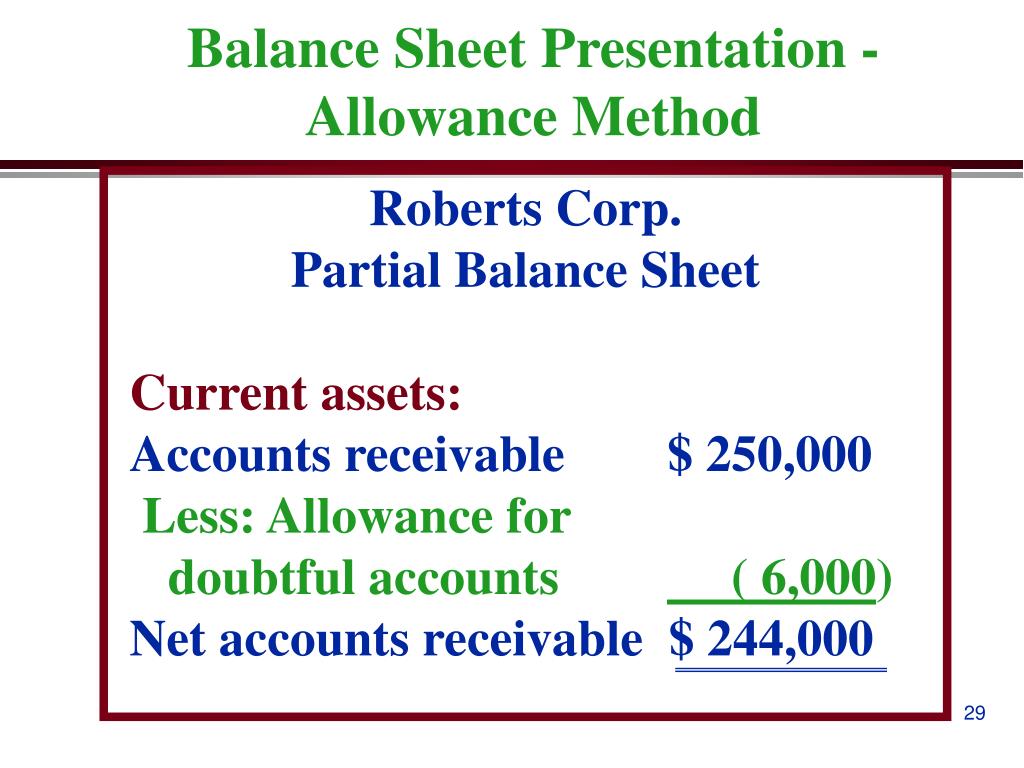

PPT Cash and Receivables PowerPoint Presentation, free download ID

The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be. The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts.

PPT Cash and Receivables PowerPoint Presentation, free download ID

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

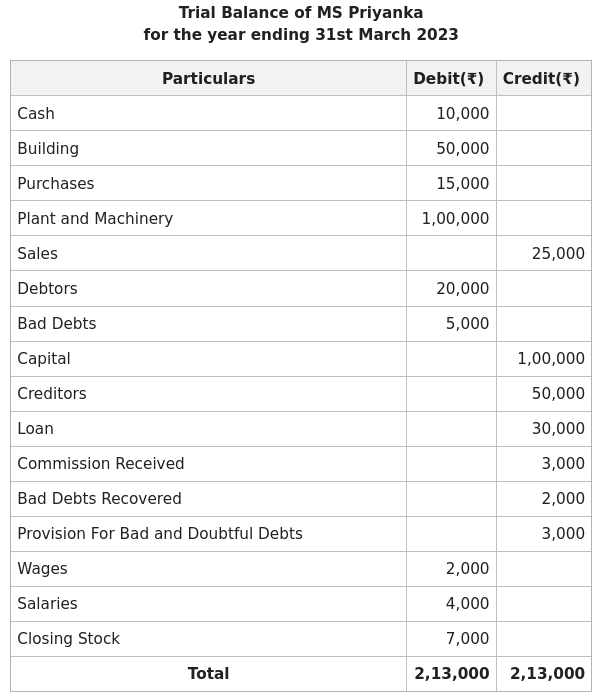

Adjustment of Bad Debts Recovered in Final Accounts (Financial

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts. The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be.

PPT Chapter 6 PowerPoint Presentation, free download ID706391

The allowance, sometimes called a bad debt reserve, represents management’s estimate of the amount of accounts receivable that will not be. The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts.

The Allowance, Sometimes Called A Bad Debt Reserve, Represents Management’s Estimate Of The Amount Of Accounts Receivable That Will Not Be.

The journal entry to record bad debts is a debit to bad debt expense and a credit allowance for doubtful accounts.